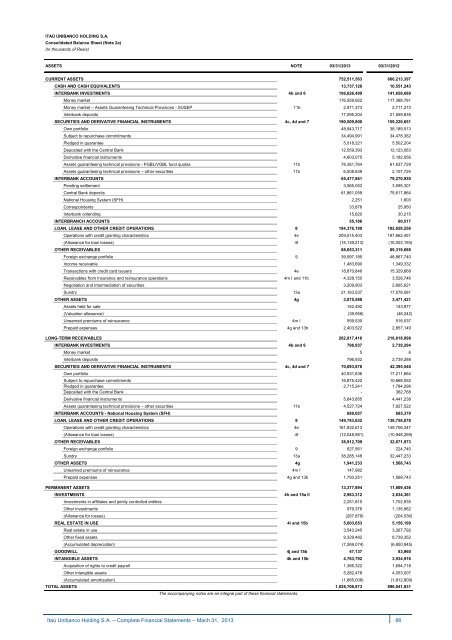

ITAÚ UNIBANCO HOLDING S.A. Consolidated Balance Sheet (Note 2a) (In thousands of Reais) ASSETS NOTE 03/31/2013 03/31/2012 CURRENT ASSETS CASH AND CASH EQUIVALENTS INTERBANK INVESTMENTS 752,511,563 666,213,397 0 13,737,128 10,551,243 4b and 6 196,626,499 141,659,689 Money market 0 176,559,922 117,388,781 Money market – Assets Guaranteeing Technical Provisions - SUSEP 11b 2,971,373 2,711,273 Interbank deposits 0 17,095,204 21,559,635 SECURITIES AND DERIVATIVE FINANCIAL INSTRUMENTS 4c, 4d and 7 190,509,800 159,220,651 Own portfolio 0 48,943,717 38,189,513 Subject to repurchase commitments 0 34,494,991 34,478,362 Pledged in guarantee 0 5,018,221 5,502,204 Deposited with the Central Bank 0 12,559,393 12,123,063 Derivative financial instruments 0 4,603,075 5,182,056 Assets guaranteeing technical provisions - PGBL/VGBL fund quotas 11b 78,381,764 61,637,729 Assets guaranteeing technical provisions – other securities 11b 6,508,639 2,107,724 INTERBANK ACCOUNTS 0 65,477,861 79,270,930 Pending settlement 0 3,565,053 3,595,301 Central Bank deposits 0 61,861,059 75,617,864 National Housing System (SFH) 0 2,251 1,600 Correspondents 0 33,878 25,950 Interbank onlending 0 15,620 30,215 INTERBRANCH ACCOUNTS LOAN, LEASE AND OTHER CREDIT OPERATIONS 0 55,186 60,517 8 194,376,190 182,659,258 Operations with credit granting characteristics 4e 209,515,403 197,662,451 (Allowance for loan losses) 4f (15,139,213) (15,003,193) OTHER RECEIVABLES 0 88,653,311 89,319,688 Foreign exchange portfolio 9 39,597,185 48,867,740 Income receivable 0 1,483,690 1,349,332 Transactions with credit card issuers 4e 18,870,846 15,329,668 Receivables from insurance and reinsurance operations 4m I and 11b 4,328,150 3,528,746 Negotiation and intermediation of securities 0 3,209,903 2,665,621 Sundry 13a 21,163,537 17,578,581 OTHER ASSETS 4g 3,075,588 3,471,421 Assets held for sale 0 152,492 143,977 (Valuation allowance) 0 (39,956) (46,242) Unearned premiums of reinsurance 4m I 559,530 516,537 Prepaid expenses 4g and 13b 2,403,522 2,857,149 LONG-TERM RECEIVABLES INTERBANK INVESTMENTS 0 262,817,416 218,818,998 4b and 6 796,937 2,739,294 Money market 0 5 6 Interbank deposits 0 796,932 2,739,288 SECURITIES AND DERIVATIVE FINANCIAL INSTRUMENTS 4c, 4d and 7 70,693,878 42,395,540 Own portfolio 0 40,931,636 17,211,664 Subject to repurchase commitments 0 16,875,422 10,668,052 Pledged in guarantee 0 2,715,241 1,784,296 Deposited with the Central Bank - 362,768 Derivative financial instruments 0 5,643,855 4,441,238 Assets guaranteeing technical provisions – other securities 11b 4,527,724 7,927,522 INTERBANK ACCOUNTS - National Housing System (SFH) LOAN, LEASE AND OTHER CREDIT OPERATIONS 0 689,027 685,370 8 149,783,632 138,758,078 Operations with credit granting characteristics 4e 161,832,613 149,706,347 (Allowance for loan losses) 4f (12,048,981) (10,948,269) OTHER RECEIVABLES 0 38,912,709 32,671,973 Foreign exchange portfolio 9 627,561 224,740 Sundry 13a 38,285,148 32,447,233 OTHER ASSETS 4g 1,941,233 1,568,743 Unearned premiums of reinsurance 4m I 147,982 - Prepaid expenses 4g and 13b 1,793,251 1,568,743 PERMANENT ASSETS INVESTMENTS 0 13,377,894 11,809,436 4h and 15a Il 2,963,312 2,634,361 Investments in affiliates and jointly controlled entities 0 2,251,815 1,702,935 Other investments 0 979,376 1,135,962 (Allowance for losses) 0 (267,879) (204,536) REAL ESTATE IN USE 4i and 15b 5,603,653 5,156,199 Real estate in use 0 3,543,245 3,267,792 Other fixed assets 0 9,329,482 8,739,352 (Accumulated depreciation) 0 (7,269,074) (6,850,945) GOODWILL 4j and 15b 47,137 83,960 INTANGIBLE ASSETS TOTAL ASSETS 4k and 15b 4,763,792 3,934,916 Acquisition of rights to credit payroll 0 1,366,322 1,694,718 Other intangible assets 0 5,282,478 4,053,007 (Accumulated amortization) 0 (1,885,008) (1,812,809) The accompanying notes are an integral part of these financial statements. 1,028,706,873 896,841,831 <strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 86

ITAÚ UNIBANCO HOLDING S.A. Consolidated Balance Sheet (Note 2a) (In thousands of Reais) LIABILITIES NOTE 03/31/2013 03/31/2012 CURRENT LIABILITIES 562,898,403 460,946,226 DEPOSITS 4b and 10b 178,574,229 151,291,988 Demand deposits - 33,717,703 26,902,686 Savings deposits - 87,071,786 68,488,274 Interbank deposits - 8,132,346 8,056,059 Time deposits - 49,652,394 47,844,969 DEPOSITS RECEIVED UNDER SECURITIES REPURCHASE AGREEMENTS 4b and 10c 188,950,579 107,268,659 Own portfolio - 83,825,632 65,461,874 Third-party portfolio - 103,067,623 40,839,214 Free portfolio - 2,057,324 967,571 FUNDS FROM ACCEPTANCES AND ISSUANCE OF SECURITIES 4b and 10d 29,362,517 25,323,197 Real estate, mortgage, credit and similar notes - 21,728,195 20,180,627 Debentures - 1,056,720 1,065,185 Foreign borrowings through securities - 6,577,602 4,077,385 INTERBANK ACCOUNTS - 5,114,604 5,390,056 Pending settlement - 3,945,226 4,242,713 Correspondents - 1,169,378 1,147,343 INTERBRANCH ACCOUNTS - 4,130,323 3,941,218 Third-party funds in transit - 4,112,209 3,930,368 Internal transfer of funds - 18,114 10,850 BORROWINGS AND ONLENDING 4b and 10e 32,690,623 26,069,416 Borrowings - 20,157,683 14,773,776 Onlending - 12,532,940 11,295,640 DERIVATIVE FINANCIAL INSTRUMENTS 4d and 7h 3,306,411 3,897,484 TECHNICAL PROVISION FOR INSURANCE, PENSION PLAN AND CAPITALIZATION 4m II and 11a 10,897,156 10,565,412 OTHER LIABILITIES - 109,871,961 127,198,796 Collection and payment of taxes and contributions - 4,896,299 5,836,557 Foreign exchange portfolio 9 40,056,107 49,320,980 Social and statutory 16b II 1,367,876 1,405,507 Tax and social security contributions 4n 4o and 14c 4,815,264 5,846,432 Negotiation and intermediation of securities - 4,734,417 5,439,299 Credit card operations 4e 41,736,120 36,323,091 Subordinated debt 10f 901,930 13,458,421 Sundry 13c 11,363,948 9,568,509 LONG-TERM LIABILITIES - 388,605,488 360,664,349 DEPOSITS 4b and 10b 59,980,395 80,052,797 Interbank deposits - 311,337 513,026 Time deposits - 59,669,058 79,539,771 DEPOSITS RECEIVED UNDER SECURITIES REPURCHASE AGREEMENTS 4b and 10c 107,152,265 105,398,937 Own portfolio - 89,211,611 88,902,886 Free portfolio - 17,940,654 16,496,051 FUNDS FROM ACCEPTANCES AND ISSUANCE OF SECURITIES 4b and 10d 23,914,636 24,012,686 Real estate, mortgage, credit and similar notes - 14,422,750 17,137,304 Foreign borrowings through securities - 9,491,886 6,875,382 BORROWINGS AND ONLENDING 4b and 10e 30,199,793 26,004,099 Borrowings - 3,907,194 2,368,184 Onlending - 26,292,599 23,635,915 DERIVATIVE FINANCIAL INSTRUMENTS 4d and 7h 5,127,526 3,725,493 TECHNICAL PROVISION FOR INSURANCE, PENSION PLAN AND CAPITALIZATION 4m II and 11a 85,726,761 67,264,321 OTHER LIABILITIES - 76,504,112 54,206,016 Foreign exchange portfolio 9 578,279 43,058 Tax and social security contributions 4n, 4o and 14c 13,385,150 12,746,958 Subordinated debt 10f 51,129,534 31,526,048 Sundry 13c 11,411,149 9,889,952 DEFERRED INCOME 4p 1,089,997 842,684 MINORITY INTEREST IN SUBSIDIARIES 16e 1,697,028 1,904,321 STOCKHOLDERS’ EQUITY 16 74,415,957 72,484,251 Capital - 45,000,000 45,000,000 Capital reserves - 870,524 745,346 Revenue reserves - 29,332,893 28,262,569 Asset valuation adjustment 4c, 4d and 7d 598,757 (47,753) (Treasury shares) - (1,386,217) (1,475,911) TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY The accompanying notes are an integral part of these financial statements. 1,028,706,873 896,841,831 <strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 87

- Page 1 and 2:

financial report March 31, 2013 Ita

- Page 3 and 4:

management discussion analysis Ita

- Page 5 and 6:

Executive Summary Information and f

- Page 7 and 8:

Executive Summary Effects of the Re

- Page 9 and 10:

Executive Summary We present below

- Page 11 and 12:

Executive Summary Banking Services

- Page 13 and 14:

Executive Summary Credit Portfolio

- Page 15 and 16:

analysis of net income Itaú Uniban

- Page 17 and 18:

Analysis of Net Income Managerial F

- Page 19 and 20:

Analysis of Net Income Banking Serv

- Page 21 and 22:

Analysis of Net Income Result from

- Page 23 and 24:

Analysis of Net Income Non-interest

- Page 25 and 26:

Analysis of Net Income Points of Se

- Page 27 and 28:

alance sheet, balance sheet by curr

- Page 29 and 30:

Balance Sheet Short-term Interbank

- Page 31 and 32:

Balance Sheet Funding Mar 31, 13 De

- Page 33 and 34:

Balance Sheet by Currency We adopt

- Page 35 and 36: Capital Ratios (BIS) Solvency Ratio

- Page 37 and 38: Ownership Structure The management

- Page 39 and 40: Annual and Extraordinary Stockholde

- Page 41 and 42: analysis of segments, products and

- Page 43 and 44: Analysis of Segments Pro Forma Adju

- Page 45 and 46: Analysis of Segments The pro forma

- Page 47 and 48: Analysis of Segments Wholesale Bank

- Page 49 and 50: Products and Services Cards Through

- Page 51 and 52: anking operations & insurance opera

- Page 53 and 54: Banking Operations & Insurance Oper

- Page 55 and 56: Insurance, Life and Pension Plan &

- Page 57 and 58: Insurance The figures presented in

- Page 59 and 60: Life and Pension Plan Pro Forma Rec

- Page 61 and 62: activities abroad Itaú Unibanco Ho

- Page 63 and 64: Activities abroad Main Operations i

- Page 65 and 66: Activities abroad Latin America - B

- Page 67 and 68: Activities abroad Itaú BBA Interna

- Page 70 and 71: (This page was left in blank intent

- Page 72 and 73: Itaú Unibanco Holding S.A. - Compl

- Page 74 and 75: Banco Itaú BMG Consignado S.A. - i

- Page 76 and 77: 3.2) Income R$ billion Statement of

- Page 78 and 79: Default At March 31, 2013, total de

- Page 80 and 81: Custody Services - In the custody m

- Page 82 and 83: In the January-March 2013 period, t

- Page 84 and 85: ITAÚ UNIBANCO S.A. Chief Executive

- Page 88 and 89: ITAÚ UNIBANCO HOLDING S.A. Consoli

- Page 90 and 91: ITAÚ UNIBANCO HOLDING S.A. Consoli

- Page 92 and 93: ITAÚ UNIBANCO HOLDING S.A. Stateme

- Page 94 and 95: Itaú Unibanco Holding S.A. Stateme

- Page 96 and 97: ITAÚ UNIBANCO HOLDING S.A. NOTES T

- Page 98 and 99: In ITAÚ UNIBANCO HOLDING CONSOLIDA

- Page 100 and 101: NOTE 3 - REQUIREMENTS OF CAPITAL AN

- Page 102 and 103: During this period, the effects of

- Page 104 and 105: Cash Flow Hedge - the effective amo

- Page 106 and 107: Mathematical provisions for benefit

- Page 108 and 109: NOTE 5 - CASH AND CASH EQUIVALENTS

- Page 110 and 111: NOTE 7 - SECURITIES AND DERIVATIVE

- Page 112 and 113: c) Trading securities See below the

- Page 114 and 115: e) Held-to-maturity securities See

- Page 116 and 117: I - Derivatives by index Memorandum

- Page 118 and 119: II - Derivatives by counterparty Se

- Page 120 and 121: III - Derivatives by notional amoun

- Page 122 and 123: V - Accounting hedge a) The effecti

- Page 124 and 125: VI - Realized and unrealized gain o

- Page 126 and 127: j) Sensitivity analysis (TRADING AN

- Page 128 and 129: II - By maturity and risk level 03/

- Page 130 and 131: ) Credit concentration Loan, lease

- Page 132 and 133: e) Restricted operations on assets

- Page 134 and 135: NOTE 9 - FOREIGN EXCHANGE PORTFOLIO

- Page 136 and 137:

c) Deposits received under securiti

- Page 138 and 139:

e) Borrowings and onlending BORROWI

- Page 140 and 141:

Description Name of security / Curr

- Page 142 and 143:

) Assets Guaranteeing Technical Pro

- Page 144 and 145:

NOTE 12 - CONTINGENT ASSETS AND LIA

- Page 146 and 147:

- Tax and social security lawsuits

- Page 148 and 149:

The main discussions related to Leg

- Page 150 and 151:

c) Receivables - Reimbursement of c

- Page 152 and 153:

) Prepaid expenses Commissions 03/3

- Page 154 and 155:

d) Banking service fees 01/01 to 03

- Page 156 and 157:

f) Personnel expenses Compensation

- Page 158 and 159:

NOTE 14 - TAXES a) Composition of e

- Page 160 and 161:

) Deferred taxes I - The deferred t

- Page 162 and 163:

III - The estimate of realization a

- Page 164 and 165:

d) Taxes paid or provided for and w

- Page 166 and 167:

II - Composition of investments 03/

- Page 168 and 169:

II) Goodwill CHANGES Amortization p

- Page 170 and 171:

NOTE 16 - STOCKHOLDERS’ EQUITY a)

- Page 172 and 173:

c) Capital and revenue reserves 03/

- Page 174 and 175:

f) Stock Option Plan I - Purpose an

- Page 176 and 177:

Summary of Changes in the Share-Bas

- Page 178 and 179:

NOTE 17 - RELATED PARTIES a) Transa

- Page 180 and 181:

) Compensation of Management Key Pe

- Page 182 and 183:

To obtain the market values for the

- Page 184 and 185:

c) Defined benefit plan I - Main as

- Page 186 and 187:

V- Change in the net amount recogni

- Page 188 and 189:

NOTE 20 - INFORMATION ON FOREIGN SU

- Page 190 and 191:

I - Market Risk Market risk is the

- Page 192 and 193:

II - Credit Risk Credit risk is the

- Page 194 and 195:

NOTE 22 -SUPPLEMENTARY INFORMATION

- Page 196 and 197:

Report on Review To the Directors a

- Page 198:

ITAÚ UNIBANCO HOLDING S.A. CNPJ. 6