IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Activities abroad<br />

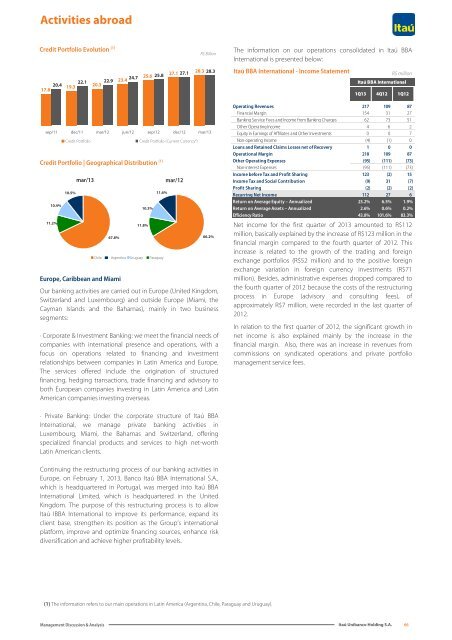

Credit Portfolio Evolution (1)<br />

R$ Billion<br />

The information on our operations consolidated in <strong>Itaú</strong> BBA<br />

International is presented below:<br />

23.4<br />

24.7<br />

22.1 22.9<br />

20.4 19.3<br />

20.3<br />

17.8<br />

25.6 25.8<br />

27.1 27.1<br />

28.3 28.3<br />

<strong>Itaú</strong> BBA International - Income Statement<br />

R$ million<br />

<strong>Itaú</strong> BBA International<br />

1Q13 4Q12 1Q12<br />

sep/11 dec/11 mar/12 jun/12 sep/12 dec/12 mar/13<br />

Credit Portfolio<br />

Credit Portfolio | Geographical Distribution (1)<br />

10.4%<br />

11.2%<br />

10.5%<br />

mar/13<br />

Chile<br />

67.8%<br />

Argentina<br />

Uruguay<br />

Credit Portfolio (Current Currency²)<br />

10.3%<br />

11.8%<br />

11.6%<br />

Paraguay<br />

mar/12<br />

66.2%<br />

Europe, Caribbean and Miami<br />

Our banking activities are carried out in Europe (United Kingdom,<br />

Switzerland and Luxembourg) and outside Europe (Miami, the<br />

Cayman Islands and the Bahamas), mainly in two business<br />

segments:<br />

· Corporate & Investment Banking: we meet the financial needs of<br />

companies with international presence and operations, with a<br />

focus on operations related to financing and investment<br />

relationships between companies in Latin America and Europe.<br />

The services offered include the origination of structured<br />

financing, hedging transactions, trade financing and advisory to<br />

both European companies investing in Latin America and Latin<br />

American companies investing overseas.<br />

Operating Revenues 217 109 87<br />

Financial Margin 154 31 27<br />

Banking Service Fees and Income from Banking Charges 62 73 51<br />

Other Operating Income 4 6 2<br />

Equity in Earnings of Affiliates and Other Investments 0 0 7<br />

Non-operating Income (4) (1) 0<br />

Loans and Retained Claims Losses net of Recovery 1 0 0<br />

Operational Margin 218 109 87<br />

Other Operating Expenses (95) (111) (73)<br />

Non-interest Expenses (95) (111) (73)<br />

Income before Tax and Profit Sharing 123 (2) 15<br />

Income Tax and Social Contribution (9) 31 (7)<br />

Profit Sharing (2) (2) (2)<br />

Recurring Net Income 112 27 6<br />

Return on Average Equity – Annualized 23.2% 6.5% 1.9%<br />

Return on Average Assets – Annualized 2.6% 0.6% 0.2%<br />

Efficiency Ratio 43.8% 101.6% 83.3%<br />

Net income for the first quarter of 2013 amounted to R$112<br />

million, basically explained by the increase of R$123 million in the<br />

financial margin compared to the fourth quarter of 2012. This<br />

increase is related to the growth of the trading and foreign<br />

exchange portfolios (R$52 million) and to the positive foreign<br />

exchange variation in foreign currency investments (R$71<br />

million). Besides, administrative expenses dropped compared to<br />

the fourth quarter of 2012 because the costs of the restructuring<br />

process in Europe (advisory and consulting fees), of<br />

approximately R$7 million, were recorded in the last quarter of<br />

2012.<br />

In relation to the first quarter of 2012, the significant growth in<br />

net income is also explained mainly by the increase in the<br />

financial margin. Also, there was an increase in revenues from<br />

commissions on syndicated operations and private portfolio<br />

management service fees.<br />

· Private Banking: Under the corporate structure of <strong>Itaú</strong> BBA<br />

International, we manage private banking activities in<br />

Luxembourg, Miami, the Bahamas and Switzerland, offering<br />

specialized financial products and services to high net-worth<br />

Latin American clients.<br />

Continuing the restructuring process of our banking activities in<br />

Europe, on February 1, 2013, <strong>Banco</strong> <strong>Itaú</strong> BBA International S.A.,<br />

which is headquartered in Portugal, was merged into <strong>Itaú</strong> BBA<br />

International Limited, which is headquartered in the United<br />

Kingdom. The purpose of this restructuring process is to allow<br />

<strong>Itaú</strong> IBBA International to improve its performance, expand its<br />

client base, strengthen its position as the Group’s international<br />

platform, improve and optimize financing sources, enhance risk<br />

diversification and achieve higher profitability levels.<br />

(1) The information refers to our main operations in Latin America (Argentina, Chile, Paraguay and Uruguay).<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

66