IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

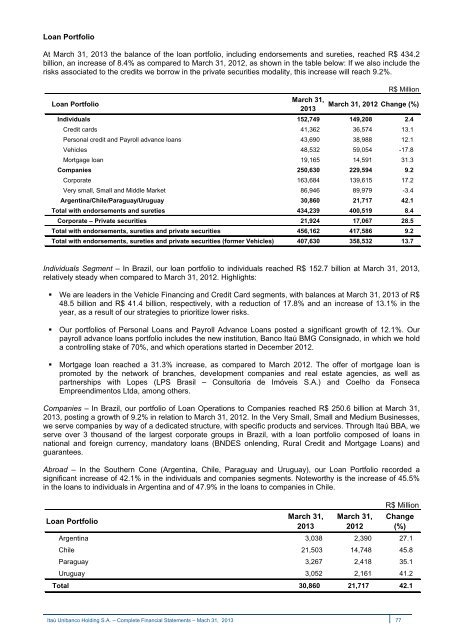

Loan Portfolio<br />

At March 31, 2013 the balance of the loan portfolio, including endorsements and sureties, reached R$ 434.2<br />

billion, an increase of 8.4% as compared to March 31, 2012, as shown in the table below: If we also include the<br />

risks associated to the credits we borrow in the private securities modality, this increase will reach 9.2%.<br />

R$ Million<br />

Loan Portfolio<br />

March 31,<br />

March 31, 2012 Change (%)<br />

2013<br />

Individuals 152,749 149,208 2.4<br />

Credit cards 41,362 36,574 13.1<br />

Personal credit and Payroll advance loans 43,690 38,988 12.1<br />

Vehicles 48,532 59,054 -17.8<br />

Mortgage loan 19,165 14,591 31.3<br />

Companies 250,630 229,594 9.2<br />

Corporate 163,684 139,615 17.2<br />

Very small, Small and Middle Market 86,946 89,979 -3.4<br />

Argentina/Chile/Paraguay/Uruguay 30,860 21,717 42.1<br />

Total with endorsements and sureties 434,239 400,519 8.4<br />

Corporate – Private securities 21,924 17,067 28.5<br />

Total with endorsements, sureties and private securities 456,162 417,586 9.2<br />

Total with endorsements, sureties and private securities (former Vehicles) 407,630 358,532 13.7<br />

Individuals Segment – In Brazil, our loan portfolio to individuals reached R$ 152.7 billion at March 31, 2013,<br />

relatively steady when compared to March 31, 2012. Highlights:<br />

• We are leaders in the Vehicle Financing and Credit Card segments, with balances at March 31, 2013 of R$<br />

48.5 billion and R$ 41.4 billion, respectively, with a reduction of 17.8% and an increase of 13.1% in the<br />

year, as a result of our strategies to prioritize lower risks.<br />

• Our portfolios of Personal Loans and Payroll Advance Loans posted a significant growth of 12.1%. Our<br />

payroll advance loans portfolio includes the new institution, <strong>Banco</strong> <strong>Itaú</strong> BMG Consignado, in which we hold<br />

a controlling stake of 70%, and which operations started in December 2012.<br />

• Mortgage loan reached a 31.3% increase, as compared to March 2012. The offer of mortgage loan is<br />

promoted by the network of branches, development companies and real estate agencies, as well as<br />

partnerships with Lopes (LPS Brasil – Consultoria de Imóveis S.A.) and Coelho da Fonseca<br />

Empreendimentos Ltda, among others.<br />

Companies – In Brazil, our portfolio of Loan Operations to Companies reached R$ 250.6 billion at March 31,<br />

2013, posting a growth of 9.2% in relation to March 31, 2012. In the Very Small, Small and Medium Businesses,<br />

we serve companies by way of a dedicated structure, with specific products and services. Through <strong>Itaú</strong> BBA, we<br />

serve over 3 thousand of the largest corporate groups in Brazil, with a loan portfolio composed of loans in<br />

national and foreign currency, mandatory loans (BNDES onlending, Rural Credit and Mortgage Loans) and<br />

guarantees.<br />

Abroad – In the Southern Cone (Argentina, Chile, Paraguay and Uruguay), our Loan Portfolio recorded a<br />

significant increase of 42.1% in the individuals and companies segments. Noteworthy is the increase of 45.5%<br />

in the loans to individuals in Argentina and of 47.9% in the loans to companies in Chile.<br />

R$ Million<br />

Loan Portfolio<br />

March 31, March 31, Change<br />

2013 2012 (%)<br />

Argentina 3,038 2,390 27.1<br />

Chile 21,503 14,748 45.8<br />

Paraguay 3,267 2,418 35.1<br />

Uruguay 3,052 2,161 41.2<br />

Total 30,860 21,717 42.1<br />

<strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 77