IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Executive Summary<br />

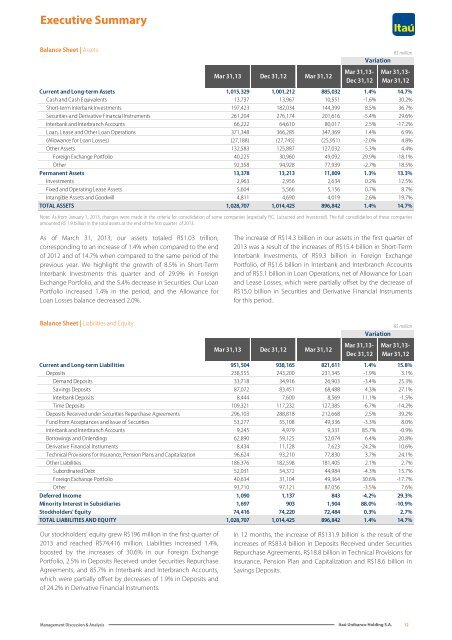

Balance Sheet | Assets<br />

Mar 31,13 Dec 31,12 Mar 31,12<br />

Mar 31,13-<br />

Dec 31,12<br />

R$ million<br />

Variation<br />

Mar 31,13-<br />

Mar 31,12<br />

Current and Long-term Assets 1,015,329 1,001,212 885,032 1.4% 14.7%<br />

Cash and Cash Equivalents 13,737 13,967 10,551 -1.6% 30.2%<br />

Short-term Interbank Investments 197,423 182,034 144,399 8.5% 36.7%<br />

Securities and Derivative Financial Instruments 261,204 276,174 201,616 -5.4% 29.6%<br />

Interbank and Interbranch Accounts 66,222 64,610 80,017 2.5% -17.2%<br />

Loan, Lease and Other Loan Operations 371,348 366,285 347,369 1.4% 6.9%<br />

(Allowance for Loan Losses) (27,188) (27,745) (25,951) -2.0% 4.8%<br />

Other Assets 132,583 125,887 127,032 5.3% 4.4%<br />

Foreign Exchange Portfolio 40,225 30,960 49,092 29.9% -18.1%<br />

Other 92,358 94,928 77,939 -2.7% 18.5%<br />

Permanent Assets 13,378 13,213 11,809 1.3% 13.3%<br />

Investments 2,963 2,956 2,634 0.2% 12.5%<br />

Fixed and Operating Lease Assets 5,604 5,566 5,156 0.7% 8.7%<br />

Intangible Assets and Goodwill 4,811 4,690 4,019 2.6% 19.7%<br />

TOTAL ASSETS 1,028,707 1,014,425 896,842 1.4% 14.7%<br />

Note: As from January 1, 2013, changes were made in the criteria for consolidation of some companies (especially FIC, Luizacred and Investcred). The full consolidation of these companies<br />

amounted R$ 1.9 billion in the total assets at the end of the first quarter of 2013.<br />

As of March 31, 2013, our assets totaled R$1.03 trillion,<br />

corresponding to an increase of 1.4% when compared to the end<br />

of 2012 and of 14.7% when compared to the same period of the<br />

previous year. We highlight the growth of 8.5% in Short-Term<br />

Interbank Investments this quarter and of 29.9% in Foreign<br />

Exchange Portfolio, and the 5.4% decrease in Securities. Our Loan<br />

Portfolio increased 1.4% in the period, and the Allowance for<br />

Loan Losses balance decreased 2.0%.<br />

The increase of R$14.3 billion in our assets in the first quarter of<br />

2013 was a result of the increases of R$15.4 billion in Short-Term<br />

Interbank Investments, of R$9.3 billion in Foreign Exchange<br />

Portfolio, of R$1.6 billion in Interbank and Interbranch Accounts<br />

and of R$5.1 billion in Loan Operations, net of Allowance for Loan<br />

and Lease Losses, which were partially offset by the decrease of<br />

R$15.0 billion in Securities and Derivative Financial Instruments<br />

for this period.<br />

Balance Sheet | Liabilities and Equity<br />

Mar 31,13 Dec 31,12 Mar 31,12<br />

Mar 31,13-<br />

Dec 31,12<br />

R$ million<br />

Variation<br />

Mar 31,13-<br />

Mar 31,12<br />

Current and Long-term Liabilities 951,504 938,165 821,611 1.4% 15.8%<br />

Deposits 238,555 243,200 231,345 -1.9% 3.1%<br />

Demand Deposits 33,718 34,916 26,903 -3.4% 25.3%<br />

Savings Deposits 87,072 83,451 68,488 4.3% 27.1%<br />

Interbank Deposits 8,444 7,600 8,569 11.1% -1.5%<br />

Time Deposits 109,321 117,232 127,385 -6.7% -14.2%<br />

Deposits Received under Securities Repurchase Agreements 296,103 288,818 212,668 2.5% 39.2%<br />

Fund from Acceptances and Issue of Securities 53,277 55,108 49,336 -3.3% 8.0%<br />

Interbank and Interbranch Accounts 9,245 4,979 9,331 85.7% -0.9%<br />

Borrowings and Onlendings 62,890 59,125 52,074 6.4% 20.8%<br />

Derivative Financial Instruments 8,434 11,128 7,623 -24.2% 10.6%<br />

Technical Provisions for Insurance, Pension Plans and Capitalization 96,624 93,210 77,830 3.7% 24.1%<br />

Other Liabilities 186,376 182,598 181,405 2.1% 2.7%<br />

Subordinated Debt 52,031 54,372 44,984 -4.3% 15.7%<br />

Foreign Exchange Portfolio 40,634 31,104 49,364 30.6% -17.7%<br />

Other 93,710 97,121 87,056 -3.5% 7.6%<br />

Deferred Income 1,090 1,137 843 -4.2% 29.3%<br />

Minority Interest in Subsidiaries 1,697 903 1,904 88.0% -10.9%<br />

Stockholders' Equity 74,416 74,220 72,484 0.3% 2.7%<br />

TOTAL LIABILITIES AND EQUITY 1,028,707 1,014,425 896,842 1.4% 14.7%<br />

Our stockholders’ equity grew R$196 million in the first quarter of<br />

2013 and reached R$74,416 million. Liabilities increased 1.4%,<br />

boosted by the increases of 30.6% in our Foreign Exchange<br />

Portfolio, 2.5% in Deposits Received under Securities Repurchase<br />

Agreements, and 85.7% in Interbank and Interbranch Accounts,<br />

which were partially offset by decreases of 1.9% in Deposits and<br />

of 24.2% in Derivative Financial Instruments.<br />

In 12 months, the increase of R$131.9 billion is the result of the<br />

increases of R$83.4 billion in Deposits Received under Securities<br />

Repurchase Agreements, R$18.8 billion in Technical Provisions for<br />

Insurance, Pension Plan and Capitalization and R$18.6 billion in<br />

Savings Deposits.<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

12