IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Activities abroad<br />

Main Operations in Latin America<br />

Our main operations in Latin America are mainly focused on<br />

commercial banking and concentrated in Argentina, Chile,<br />

Paraguay and Uruguay.<br />

We are also present in Colombia aiming to be one of the three<br />

main investment and wholesale banks in the next five years,<br />

focusing on companies with annual sales higher than US$100<br />

million or which have significant projects. The segments<br />

evaluated as the most attractive are mining, energy, oil, gas, and<br />

areas related to infrastructure. In Peru, we have a representation<br />

office and are considering increasing our activities in corporate<br />

and investment banking, following the same strategy as in<br />

Colombia, taking advantage of the strong growth of this country.<br />

In Mexico, our focus is in the credit card market through Itaucard<br />

México.<br />

In addition to growing at a rate higher than the world’s average<br />

rate, Latin America is a priority in our international expansion due<br />

to the geographic and cultural proximity to Brazil. Our purpose is<br />

to be recognized as the “Latin American Bank”, becoming a<br />

reference in the region for all financial services provided to<br />

individuals or companies.<br />

We have expanded our business in the region in a sustainable<br />

way over the past years and our priority is to gain economies of<br />

scale, maintain a strong relationship with the local retail market<br />

and strengthen our relationship with local companies. The<br />

growth of Brazilian companies in the region favors our strategy<br />

by setting up a client base for us to start or expand our<br />

operations.<br />

In 2013, we began a new stage of this strategy. Continuing the<br />

efforts made last year, we will keep investing in the<br />

communication and marketing of our brand, in the expansion of<br />

our portfolio of products and services supported by a adequate<br />

risk analysis, in financial education initiatives for clients and in the<br />

consolidation of our corporate culture with our employees.<br />

We are consistently investing in technological infrastructure and<br />

processes so that we can keep growing with quality and security.<br />

Some of the highlights of our regional operations are presented<br />

below:<br />

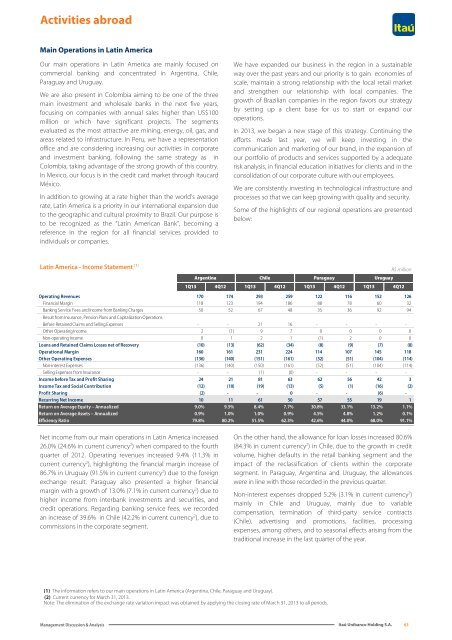

Latin America - Income Statement (1)<br />

Argentina<br />

Paraguay<br />

R$ million<br />

Uruguay<br />

1Q13 4Q12 1Q13 4Q12 1Q13 4Q12 1Q13 4Q12<br />

Operating Revenues 170 174 293 259 122 116 152 126<br />

Financial Margin 118 123 194 186 88 78 60 32<br />

Banking Service Fees and Income from Banking Charges 50 52 67 48 35 36 92 94<br />

Result from Insurance, Pension Plans and Capitalization Operations<br />

Before Retained Claims and Selling Expenses - - 21 16 - - - -<br />

Other Operating Income 2 (1) 9 7 0 0 0 0<br />

Non-operating Income 0 1 2 1 (1) 2 0 0<br />

Loans and Retained Claims Losses net of Recovery (10) (13) (62) (34) (8) (9) (7) (8)<br />

Operational Margin 160 161 231 224 114 107 145 118<br />

Other Operating Expenses (136) (140) (151) (161) (52) (51) (104) (114)<br />

Non-interest Expenses (136) (140) (150) (161) (52) (51) (104) (114)<br />

Selling Expenses from Insurance - - (1) (0) - - - -<br />

Income before Tax and Profit Sharing 24 21 81 63 62 56 42 3<br />

Income Tax and Social Contribution (12) (10) (19) (13) (5) (1) (16) (2)<br />

Profit Sharing (2) - - 0 - - (6) -<br />

Recurring Net Income 10 11 61 50 57 55 19 1<br />

Return on Average Equity – Annualized 9.0% 9.5% 8.4% 7.7% 30.8% 33.1% 13.2% 1.1%<br />

Return on Average Assets – Annualized 0.9% 1.0% 1.0% 0.9% 4.5% 4.8% 1.2% 0.1%<br />

Efficiency Ratio 79.8% 80.2% 51.5% 62.3% 42.6% 44.0% 68.0% 91.1%<br />

Chile<br />

Net income from our main operations in Latin America increased<br />

26.0% (24.6% in current currency 2 ) when compared to the fourth<br />

quarter of 2012. Operating revenues increased 9.4% (11.3% in<br />

current currency 2 ), highlighting the financial margin increase of<br />

86.7% in Uruguay (91.5% in current currency 2 ) due to the foreign<br />

exchange result. Paraguay also presented a higher financial<br />

margin with a growth of 13.0% (7.1% in current currency 2 ) due to<br />

higher income from interbank investments and securities, and<br />

credit operations. Regarding banking service fees, we recorded<br />

an increase of 39.6% in Chile (42.2% in current currency 2 ), due to<br />

commissions in the corporate segment.<br />

On the other hand, the allowance for loan losses increased 80.6%<br />

(84.3% in current currency 2 ) in Chile, due to the growth in credit<br />

volume, higher defaults in the retail banking segment and the<br />

impact of the reclassification of clients within the corporate<br />

segment. In Paraguay, Argentina and Uruguay, the allowances<br />

were in line with those recorded in the previous quarter.<br />

Non-interest expenses dropped 5.2% (3.1% in current currency 2 )<br />

mainly in Chile and Uruguay, mainly due to variable<br />

compensation, termination of third-party service contracts<br />

(Chile), advertising and promotions, facilities, processing<br />

expenses, among others, and to seasonal effects arising from the<br />

traditional increase in the last quarter of the year.<br />

(1) The information refers to our main operations in Latin America (Argentina, Chile, Paraguay and Uruguay).<br />

(2) Current currency for March 31, 2013.<br />

Note: The elimination of the exchange rate variation impact was obtained by applying the closing rate of March 31, 2013 to all periods.<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

63