IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Analysis of Segments<br />

Commercial Banking - Retail<br />

The revenues from the Commercial Banking - Retail segment<br />

arise from the offer of banking products and services to a<br />

diversified client base, including individuals and companies.<br />

The segment includes retail, high-income and high-net worth<br />

clients (private banking) and very small and small companies.<br />

In the first quarter of 2013, recurring net income from the<br />

Commercial Banking - Retail segment totaled R$1,349 million, an<br />

increase of 1.0% from the previous quarter. This increase, which<br />

corresponds to R$14 million, is due to the 6.5% lower losses from<br />

loans and retained claims combined with a decrease of 1.8% in<br />

other operating expenses, despite the decrease in the operating<br />

revenues of 2.3%, with a 3.8% increase in service fees and a 6.2%<br />

decrease in financial margin with clients.<br />

The Commercial Banking – Retail segment’s return on allocated<br />

capital reached 26.2% a year and the risk-adjusted efficiency ratio<br />

was 79.5%.<br />

Some additional Commercial Banking - Retail Highlights:<br />

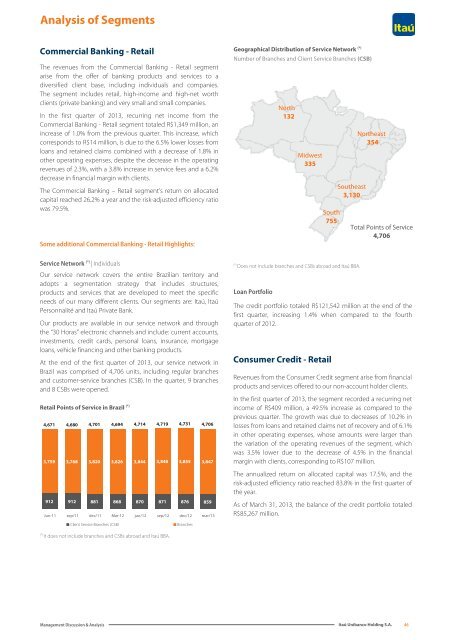

Geographical Distribution of Service Network (*)<br />

Number of Branches and Client Service Branches (CSB)<br />

North<br />

132<br />

Midwest<br />

335<br />

South<br />

755<br />

Southeast<br />

3,130<br />

Northeast<br />

354<br />

Total Points of Service<br />

4,706<br />

Service Network (*) | Individuals<br />

Our service network covers the entire Brazilian territory and<br />

adopts a segmentation strategy that includes structures,<br />

products and services that are developed to meet the specific<br />

needs of our many different clients. Our segments are: <strong>Itaú</strong>, <strong>Itaú</strong><br />

Personnalité and <strong>Itaú</strong> Private Bank.<br />

Our products are available in our service network and through<br />

the “30 Horas” electronic channels and include: current accounts,<br />

investments, credit cards, personal loans, insurance, mortgage<br />

loans, vehicle financing and other banking products.<br />

At the end of the first quarter of 2013, our service network in<br />

Brazil was comprised of 4,706 units, including regular branches<br />

and customer-service branches (CSB). In the quarter, 9 branches<br />

and 8 CSBs were opened.<br />

4,671 4,680 4,701 4,694 4,714 4,719 4,731 4,706<br />

3,759 3,768 3,820 3,826 3,844 3,848 3,855 3,847<br />

912 912 881 868 870 871 876 859<br />

Jun-11 sep/11 dec/11 Mar-12 jun/12 sep/12 dec/12 mar/13<br />

(*)<br />

Does not include branches and CSBs abroad and <strong>Itaú</strong> BBA.<br />

Loan Portfolio<br />

The credit portfolio totaled R$121,542 million at the end of the<br />

first quarter, increasing 1.4% when compared to the fourth<br />

quarter of 2012.<br />

Consumer Credit - Retail<br />

Revenues from the Consumer Credit segment arise from financial<br />

products and services offered to our non-account holder clients.<br />

In the first quarter of 2013, the segment recorded a recurring net<br />

income of R$409 million, a 49.5% increase as compared to the<br />

previous quarter. The growth was due to decreases of 10.2% in<br />

losses from loans and retained claims net of recovery and of 6.1%<br />

in other operating expenses, whose amounts were larger than<br />

the variation of the operating revenues of the segment, which<br />

was 3.5% lower due to the decrease of 4.5% in the financial<br />

margin with clients, corresponding to R$107 million.<br />

The annualized return on allocated capital was 17.5%, and the<br />

risk-adjusted efficiency ratio reached 83.8% in the first quarter of<br />

the year.<br />

As of March 31, 2013, the balance of the credit portfolio totaled<br />

R$85,267 million.<br />

Retail Points of Service in Brazil (*) 46<br />

Client Service Branches (CSB)<br />

Branches<br />

(*)<br />

It does not include branches and CSBs abroad and <strong>Itaú</strong> BBA.<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.