IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

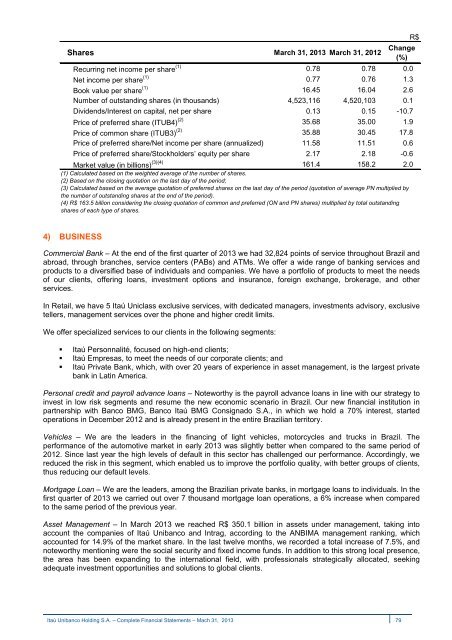

R$<br />

Shares March 31, 2013 March 31, 2012 Change<br />

(%)<br />

Recurring net income per share (1) 0.78 0.78 0.0<br />

Net income per share (1) 0.77 0.76 1.3<br />

Book value per share (1) 16.45 16.04 2.6<br />

Number of outstanding shares (in thousands) 4,523,116 4,520,103 0.1<br />

Dividends/Interest on capital, net per share 0.13 0.15 -10.7<br />

Price of preferred share (ITUB4) (2) 35.68 35.00 1.9<br />

Price of common share (ITUB3) (2) 35.88 30.45 17.8<br />

Price of preferred share/Net income per share (annualized) 11.58 11.51 0.6<br />

Price of preferred share/Stockholders’ equity per share 2.17 2.18 -0.6<br />

Market value (in billions) (3)(4) 161.4 158.2 2.0<br />

(1) Calculated based on the weighted average of the number of shares.<br />

(2) Based on the closing quotation on the last day of the period;<br />

(3) Calculated based on the average quotation of preferred shares on the last day of the period (quotation of average PN multiplied by<br />

the number of outstanding shares at the end of the period).<br />

(4) R$ 163.5 billion considering the closing quotation of common and preferred (ON and PN shares) multiplied by total outstanding<br />

shares of each type of shares.<br />

4) BUSINESS<br />

Commercial Bank – At the end of the first quarter of 2013 we had 32,824 points of service throughout Brazil and<br />

abroad, through branches, service centers (PABs) and ATMs. We offer a wide range of banking services and<br />

products to a diversified base of individuals and companies. We have a portfolio of products to meet the needs<br />

of our clients, offering loans, investment options and insurance, foreign exchange, brokerage, and other<br />

services.<br />

In Retail, we have 5 <strong>Itaú</strong> Uniclass exclusive services, with dedicated managers, investments advisory, exclusive<br />

tellers, management services over the phone and higher credit limits.<br />

We offer specialized services to our clients in the following segments:<br />

• <strong>Itaú</strong> Personnalité, focused on high-end clients;<br />

• <strong>Itaú</strong> Empresas, to meet the needs of our corporate clients; and<br />

• <strong>Itaú</strong> Private Bank, which, with over 20 years of experience in asset management, is the largest private<br />

bank in Latin America.<br />

Personal credit and payroll advance loans – Noteworthy is the payroll advance loans in line with our strategy to<br />

invest in low risk segments and resume the new economic scenario in Brazil. Our new financial institution in<br />

partnership with <strong>Banco</strong> BMG, <strong>Banco</strong> <strong>Itaú</strong> BMG Consignado S.A., in which we hold a 70% interest, started<br />

operations in December 2012 and is already present in the entire Brazilian territory.<br />

Vehicles – We are the leaders in the financing of light vehicles, motorcycles and trucks in Brazil. The<br />

performance of the automotive market in early 2013 was slightly better when compared to the same period of<br />

2012. Since last year the high levels of default in this sector has challenged our performance. Accordingly, we<br />

reduced the risk in this segment, which enabled us to improve the portfolio quality, with better groups of clients,<br />

thus reducing our default levels.<br />

Mortgage Loan – We are the leaders, among the Brazilian private banks, in mortgage loans to individuals. In the<br />

first quarter of 2013 we carried out over 7 thousand mortgage loan operations, a 6% increase when compared<br />

to the same period of the previous year.<br />

Asset Management – In March 2013 we reached R$ 350.1 billion in assets under management, taking into<br />

account the companies of <strong>Itaú</strong> Unibanco and Intrag, according to the ANBIMA management ranking, which<br />

accounted for 14.9% of the market share. In the last twelve months, we recorded a total increase of 7.5%, and<br />

noteworthy mentioning were the social security and fixed income funds. In addition to this strong local presence,<br />

the area has been expanding to the international field, with professionals strategically allocated, seeking<br />

adequate investment opportunities and solutions to global clients.<br />

<strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 79