IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

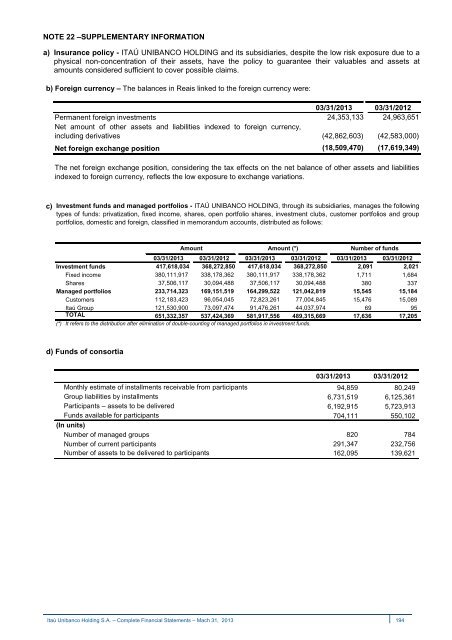

NOTE 22 –SUPPLEMENTARY INFORMATION<br />

a) Insurance policy - ITAÚ UNIBANCO HOLDING and its subsidiaries, despite the low risk exposure due to a<br />

physical non-concentration of their assets, have the policy to guarantee their valuables and assets at<br />

amounts considered sufficient to cover possible claims.<br />

b) Foreign currency – The balances in Reais linked to the foreign currency were:<br />

Permanent foreign investments<br />

Net amount of other assets and liabilities indexed to foreign currency,<br />

including derivatives<br />

Net foreign exchange position<br />

03/31/2013 03/31/2012<br />

24,353,133 24,963,651<br />

(42,862,603) (42,583,000)<br />

(18,509,470) (17,619,349)<br />

The net foreign exchange position, considering the tax effects on the net balance of other assets and liabilities<br />

indexed to foreign currency, reflects the low exposure to exchange variations.<br />

c)<br />

Investment funds and managed portfolios - ITAÚ UNIBANCO HOLDING, through its subsidiaries, manages the following<br />

types of funds: privatization, fixed income, shares, open portfolio shares, investment clubs, customer portfolios and group<br />

portfolios, domestic and foreign, classified in memorandum accounts, distributed as follows:<br />

Amount Amount (*) Number of funds<br />

03/31/2013 03/31/2012 03/31/2013 03/31/2012 03/31/2013 03/31/2012<br />

Investment funds<br />

417,618,034 368,272,850 417,618,034 368,272,850 2,091 2,021<br />

Fixed income 380,111,917 338,178,362 380,111,917 338,178,362 1,711 1,684<br />

Shares 37,506,117 30,094,488 37,506,117 30,094,488 380 337<br />

Managed portfolios<br />

233,714,323 169,151,519 164,299,522 121,042,819 15,545 15,184<br />

Customers 112,183,423 96,054,045 72,823,261 77,004,845 15,476 15,089<br />

<strong>Itaú</strong> Group 121,530,900 73,097,474 91,476,261 44,037,974 69 95<br />

TOTAL 651,332,357 537,424,369 581,917,556 489,315,669 17,636 17,205<br />

(*) It refers to the distribution after elimination of double-counting of managed portfolios in investment funds.<br />

d) Funds of consortia<br />

03/31/2013 03/31/2012<br />

Monthly estimate of installments receivable from participants 94,859 80,249<br />

Group liabilities by installments 6,731,519 6,125,361<br />

Participants – assets to be delivered 6,192,915 5,723,913<br />

Funds available for participants 704,111 550,102<br />

(In units)<br />

Number of managed groups 820 784<br />

Number of current participants 291,347 232,756<br />

Number of assets to be delivered to participants 162,095 139,621<br />

<strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 194