IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Products and Services<br />

The results of each product and service are classified in the<br />

segments according to the characteristics of the operations.<br />

Accordingly, some of the products and services listed below may<br />

be included in more than one segment.<br />

Mortgage Loans<br />

At the end of the first quarter of 2013, including securitized loans,<br />

the mortgage loan portfolio amounted to R$27,649 million, with<br />

a growth of 5.4% and 27.4%, in the quarter, as compared to the<br />

previous quarter and to March 2012, respectively. The individuals<br />

portfolio, totaling R$19,518 million at the end of the first quarter,<br />

increased 5.9% when compared to the previous quarter and<br />

29.4% in relation to March 2012, thus keeping the pace of<br />

expansion that characterized the real estate market in the past<br />

quarters. At the end of March 2013, the companies portfolio<br />

totaled R$8,131 million.<br />

In the first quarter of 2013, the volume of new mortgage loan<br />

financing contracts for individuals was R$2,020 million, whereas<br />

financing to companies amounted to R$527 million, totaling<br />

R$2,547 million.<br />

Volume of Originations<br />

R$ million<br />

The mentioned growths made the payroll loan portfolio reach<br />

R$16,261 million in March 2013, an increase of 20.0% compared<br />

to December 2012.<br />

Year-on-year, the payroll loan portfolio increased 47.1% (R$ 5,207<br />

million).<br />

Vehicle Financing<br />

The vehicle financing portfolio to individuals amounted to<br />

R$48,532 million at the end of the first quarter of the year. New<br />

vehicle financing and leasing transactions totaled R$4,655<br />

million, an increase of 17.7% from the previous quarter.<br />

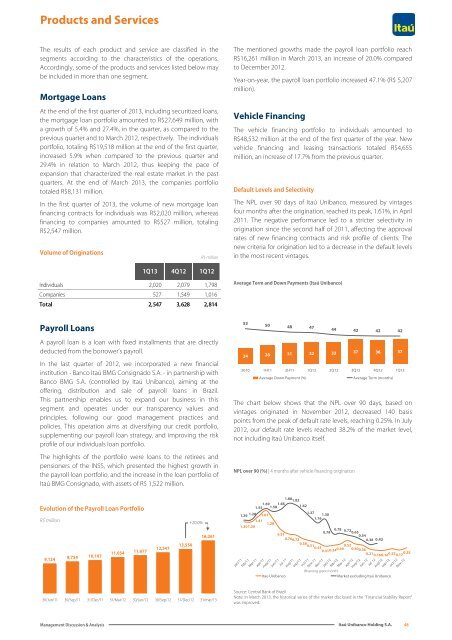

Default Levels and Selectivity<br />

The NPL over 90 days of <strong>Itaú</strong> Unibanco, measured by vintages<br />

four months after the origination, reached its peak, 1.61%, in April<br />

2011. The negative performance led to a stricter selectivity in<br />

origination since the second half of 2011, affecting the approval<br />

rates of new financing contracts and risk profile of clients. The<br />

new criteria for origination led to a decrease in the default levels<br />

in the most recent vintages.<br />

1Q13 4Q12 1Q12<br />

Individuals 2,020 2,079 1,798<br />

Companies 527 1,549 1,016<br />

Total 2,547 3,628 2,814<br />

Average Term and Down Payments (<strong>Itaú</strong> Unibanco)<br />

Payroll Loans<br />

A payroll loan is a loan with fixed installments that are directly<br />

deducted from the borrower’s payroll.<br />

In the last quarter of 2012, we incorporated a new financial<br />

institution - <strong>Banco</strong> <strong>Itaú</strong> BMG Consignado S.A. - in partnership with<br />

<strong>Banco</strong> BMG S.A. (controlled by <strong>Itaú</strong> Unibanco), aiming at the<br />

offering, distribution and sale of payroll loans in Brazil.<br />

This partnership enables us to expand our business in this<br />

segment and operates under our transparency values and<br />

principles, following our good management practices and<br />

policies. This operation aims at diversifying our credit portfolio,<br />

supplementing our payroll loan strategy, and improving the risk<br />

profile of our individuals loan portfolio.<br />

The highlights of the portfolio were loans to the retirees and<br />

pensioners of the INSS, which presented the highest growth in<br />

the payroll loan portfolio, and the increase in the loan portfolio of<br />

<strong>Itaú</strong> BMG Consignado, with assets of R$ 1,522 million.<br />

53<br />

50<br />

48<br />

47<br />

24 28 31 32 33 37 36 37<br />

2010 1H11 2H11 1Q12 2Q12 3Q12 4Q12 1Q13<br />

Average Down Payment (%)<br />

44<br />

42<br />

42<br />

Average Term (months)<br />

The chart below shows that the NPL over 90 days, based on<br />

vintages originated in November 2012, decreased 140 basis<br />

points from the peak of default rate levels, reaching 0.25%. In July<br />

2012, our default rate levels reached 38.2% of the market level,<br />

not including <strong>Itaú</strong> Unibanco itself.<br />

NPL over 90 (%) | 4 months after vehicle financing origination<br />

42<br />

Evolution of the Payroll Loan Portfolio<br />

R$ million<br />

11,054 11,677<br />

9,124<br />

9,754 10,107<br />

12,547<br />

13,550<br />

+20.0%<br />

16,261<br />

1.88 1.82<br />

1.69<br />

1.55 1.58 1.66 1.62<br />

1.26 1.28 1.37<br />

1.61<br />

1.30<br />

1.16<br />

1.41<br />

1.28<br />

1.20 1.20<br />

0.78<br />

0.78 0.720.650.54<br />

0.91<br />

0.760.72<br />

0.38 0.42<br />

0.58<br />

0.51<br />

0.43 0.39 0.52 0.40 0.310.34 0.36<br />

0.210.160.16 0.22 0.17 0.25<br />

jan/11<br />

feb/11<br />

Mar-11<br />

apr/11<br />

may/11<br />

<strong>Itaú</strong> Unibanco<br />

jun/11<br />

Jul-11<br />

aug/11<br />

sep/11<br />

oct/11<br />

Nov-11<br />

dec/11<br />

jan/12<br />

feb/12<br />

Mar-12<br />

apr/12<br />

may/12<br />

Jun-12<br />

(financing grant month)<br />

Market excluding <strong>Itaú</strong> Unibanco<br />

Jul-12<br />

aug/12<br />

sep/12<br />

oct/12<br />

Nov-12<br />

30/Jun/11 30/Sep/11 31/Dec/11 31/Mar/12 30/Jun/12 30/Sep/12 31/Dec/12 31/mar/13<br />

Source: Central Bank of Brazil.<br />

Note: In March 2013, the historical series of the market disclosed in the “Financial Stability Report”<br />

was improved.<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

48