IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

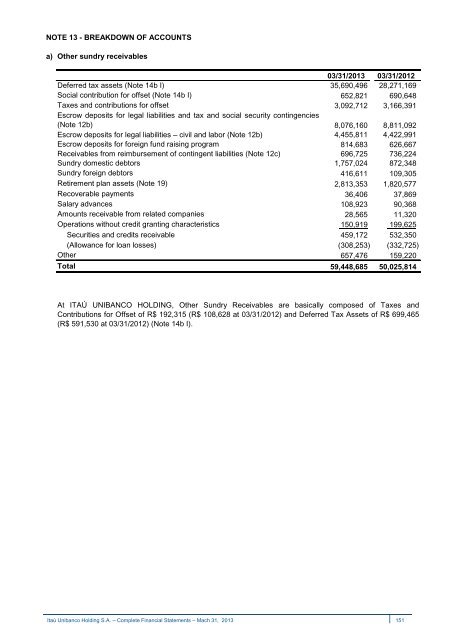

NOTE 13 - BREAKDOWN OF ACCOUNTS<br />

a)<br />

Other sundry receivables<br />

Deferred tax assets (Note 14b I)<br />

Social contribution for offset (Note 14b I)<br />

03/31/2013 03/31/2012<br />

35,690,496 28,271,169<br />

652,821 690,648<br />

3,092,712 3,166,391<br />

Taxes and contributions for offset<br />

Escrow deposits for legal liabilities and tax and social security contingencies<br />

(Note 12b)<br />

8,076,160 8,811,092<br />

Escrow deposits for legal liabilities – civil and labor (Note 12b) 4,455,811 4,422,991<br />

Escrow deposits for foreign fund raising program<br />

814,683 626,667<br />

Receivables from reimbursement of contingent liabilities (Note 12c)<br />

696,725 736,224<br />

Sundry domestic debtors<br />

1,757,024 872,348<br />

Sundry foreign debtors<br />

416,611 109,305<br />

Retirement plan assets (Note 19)<br />

2,813,353 1,820,577<br />

Recoverable payments<br />

36,406 37,869<br />

Salary advances<br />

108,923 90,368<br />

Amounts receivable from related companies<br />

28,565 11,320<br />

Operations without credit granting characteristics<br />

150,919 199,625<br />

Securities and credits receivable 459,172 532,350<br />

(Allowance for loan losses) (308,253) (332,725)<br />

Other<br />

Total<br />

657,476 159,220<br />

59,448,685 50,025,814<br />

At ITAÚ UNIBANCO HOLDING, Other Sundry Receivables are basically composed of Taxes and<br />

Contributions for Offset of R$ 192,315 (R$ 108,628 at 03/31/2012) and Deferred Tax Assets of R$ 699,465<br />

(R$ 591,530 at 03/31/2012) (Note 14b I).<br />

<strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 151