IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

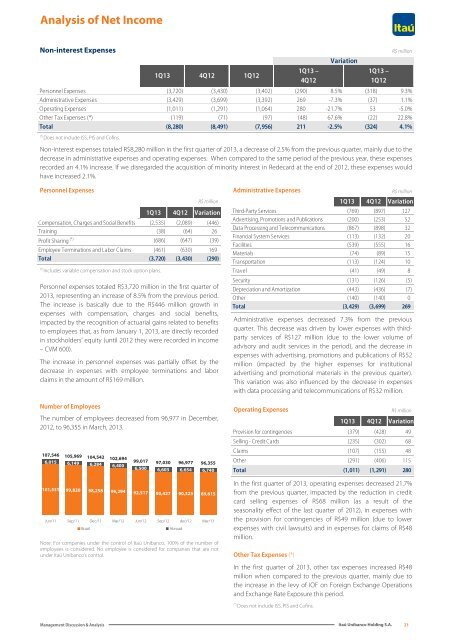

Analysis of Net Income<br />

Non-interest Expenses<br />

(*)<br />

Does not include ISS, PIS and Cofins.<br />

1Q13 4Q12 1Q12<br />

1Q13 –<br />

4Q12<br />

Variation<br />

1Q13 –<br />

1Q12<br />

R$ million<br />

Personnel Expenses (3,720) (3,430) (3,402) (290) 8.5% (318) 9.3%<br />

Administrative Expenses (3,429) (3,699) (3,392) 269 -7.3% (37) 1.1%<br />

Operating Expenses (1,011) (1,291) (1,064) 280 -21.7% 53 -5.0%<br />

Other Tax Expenses (*) (119) (71) (97) (48) 67.6% (22) 22.8%<br />

Total (8,280) (8,491) (7,956) 211 -2.5% (324) 4.1%<br />

Non-interest expenses totaled R$8,280 million in the first quarter of 2013, a decrease of 2.5% from the previous quarter, mainly due to the<br />

decrease in administrative expenses and operating expenses. When compared to the same period of the previous year, these expenses<br />

recorded an 4.1% increase. If we disregarded the acquisition of minority interest in Redecard at the end of 2012, these expenses would<br />

have increased 2.1%.<br />

Personnel Expenses<br />

(*)<br />

Includes variable compensation and stock option plans.<br />

Personnel expenses totaled R$3,720 million in the first quarter of<br />

2013, representing an increase of 8.5% from the previous period.<br />

The increase is basically due to the R$446 million growth in<br />

expenses with compensation, charges and social benefits,<br />

impacted by the recognition of actuarial gains related to benefits<br />

to employees that, as from January 1, 2013, are directly recorded<br />

in stockholders’ equity (until 2012 they were recorded in income<br />

– CVM 600).<br />

The increase in personnel expenses was partially offset by the<br />

decrease in expenses with employee terminations and labor<br />

claims in the amount of R$169 million.<br />

Number of Employees<br />

The number of employees decreased from 96,977 in December,<br />

2012, to 96,355 in March, 2013.<br />

107,546 105,969 104,542 102,694<br />

6,015 6,149<br />

99,017<br />

6,284 97,030 96,977 96,355<br />

6,400<br />

6,500 6,603 6,654 6,740<br />

101,531 99,820 98,258 96,294 92,517 90,427 90,323 89,615<br />

Jun/11 Sep/11 Dec/11 Mar/12 Jun/12 Sep/12 dec/12 Mar/13<br />

Brazil<br />

Abroad<br />

R$ million<br />

1Q13 4Q12 Variation<br />

Compensation, Charges and Social Benefits (2,535) (2,089) (446)<br />

Training (38) (64) 26<br />

Profit Sharing (*) (686) (647) (39)<br />

Employee Terminations and Labor Claims (461) (630) 169<br />

Total (3,720) (3,430) (290)<br />

Note: For companies under the control of <strong>Itaú</strong> Unibanco, 100% of the number of<br />

employees is considered. No employee is considered for companies that are not<br />

under <strong>Itaú</strong> Unibanco’s control.<br />

Administrative Expenses<br />

R$ million<br />

1Q13 4Q12 Variation<br />

Third-Party Services (769) (897) 127<br />

Advertising, Promotions and Publications (200) (253) 52<br />

Data Processing and Telecommunications (867) (898) 32<br />

Financial System Services (113) (132) 20<br />

Facilities (539) (555) 16<br />

Materials (74) (89) 15<br />

Transportation (113) (124) 10<br />

Travel (41) (49) 8<br />

Security (131) (126) (5)<br />

Depreciation and Amortization (443) (436) (7)<br />

Other (140) (140) 0<br />

Total (3,429) (3,699) 269<br />

Administrative expenses decreased 7.3% from the previous<br />

quarter. This decrease was driven by lower expenses with thirdparty<br />

services of R$127 million (due to the lower volume of<br />

advisory and audit services in the period), and the decrease in<br />

expenses with advertising, promotions and publications of R$52<br />

million (impacted by the higher expenses for institutional<br />

advertising and promotional materials in the previous quarter).<br />

This variation was also influenced by the decrease in expenses<br />

with data processing and telecommunications of R$32 million.<br />

Operating Expenses<br />

R$ million<br />

1Q13 4Q12 Variation<br />

Provision for contingencies (379) (428) 49<br />

Selling - Credit Cards (235) (302) 68<br />

Claims (107) (155) 48<br />

Other (291) (406) 115<br />

Total (1,011) (1,291) 280<br />

In the first quarter of 2013, operating expenses decreased 21.7%<br />

from the previous quarter, impacted by the reduction in credit<br />

card selling expenses of R$68 million (as a result of the<br />

seasonality effect of the last quarter of 2012), in expenses with<br />

the provision for contingencies of R$49 million (due to lower<br />

expenses with civil lawsuits) and in expenses for claims of R$48<br />

million.<br />

Other Tax Expenses (*)<br />

In the first quarter of 2013, other tax expenses increased R$48<br />

million when compared to the previous quarter, mainly due to<br />

the increase in the levy of IOF on Foreign Exchange Operations<br />

and Exchange Rate Exposure this period.<br />

(*)<br />

Does not include ISS, PIS and Cofins.<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

23