IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Capital Ratios (BIS)<br />

Solvency Ratios | Economic-Financial Consolidated<br />

On March 31, 2013, the stockholders' equity of the parent<br />

company totaled R$74,416 million, an increase of R$196 million in<br />

relation to December 31, 2012.<br />

The BIS ratio reached 17.7%, a 100 basis point increase from<br />

December 31, 2012, mainly due to the decrease of R$31,325<br />

million in the total exposure weighted by risk and to the increase<br />

in the Referential Equity Tier I.<br />

This ratio exceeds the minimum of 11% required by the Central<br />

Bank of Brazil and indicates an excess of capital of R$42.0 billion,<br />

allowing for the increase of up to R$382.2 billion in credit assets<br />

based on an 100% risk-weighting. If the remaining values of<br />

assets realization and the complementary allowance for loan<br />

losses in the reference equity were taken into consideration, our<br />

BIS Ration would have been 18.7%.<br />

Mar 31, 13 Dec 31, 12 Mar 31, 12<br />

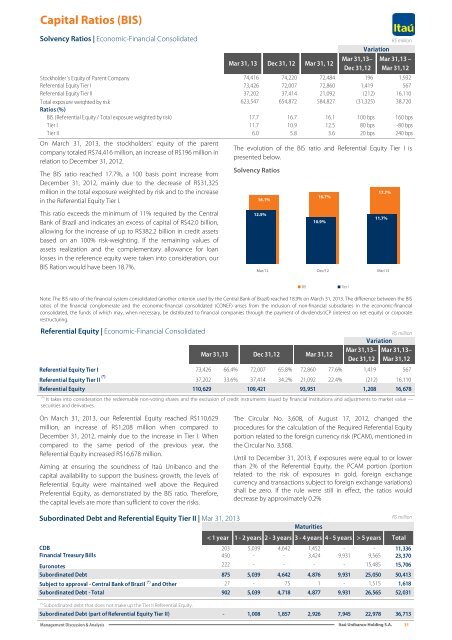

Solvency Ratios<br />

16.1%<br />

12.5%<br />

Mar/12<br />

16.7%<br />

10.9%<br />

Dec/12<br />

Mar 31,13–<br />

Dec 31,12<br />

R$ million<br />

Variation<br />

Mar 31,13 –<br />

Mar 31,12<br />

Stockholder´s Equity of Parent Company 74,416 74,220 72,484 196 1,932<br />

Referential Equity Tier I 73,426 72,007 72,860 1,419 567<br />

Referential Equity Tier II 37,202 37,414 21,092 (212) 16,110<br />

Total exposure weighted by risk 623,547 654,872 584,827 (31,325) 38,720<br />

Ratios (%)<br />

BIS (Referential Equity / Total exposure weighted by risk) 17.7 16.7 16.1 100 bps 160 bps<br />

Tier I 11.7 10.9 12.5 80 bps -80 bps<br />

Tier II 6.0 5.8 3.6 20 bps 240 bps<br />

The evolution of the BIS ratio and Referential Equity Tier I is<br />

presented below.<br />

17.7%<br />

11.7%<br />

Mar/13<br />

BIS<br />

Tier I<br />

Note: The BIS ratio of the financial system consolidated (another criterion used by the Central Bank of Brazil) reached 18.9% on March 31, 2013. The difference between the BIS<br />

ratios of the financial conglomerate and the economic-financial consolidated (CONEF) arises from the inclusion of non-financial subsidiaries in the economic-financial<br />

consolidated, the funds of which may, when necessary, be distributed to financial companies through the payment of dividends/JCP (interest on net equity) or corporate<br />

restructuring.<br />

Referential Equity | Economic-Financial Consolidated<br />

R$ million<br />

Variation<br />

Mar 31,13 Dec 31,12 Mar 31,12<br />

Mar 31,13– Mar 31,13–<br />

Dec 31,12 Mar 31,12<br />

Referential Equity Tier I 73,426 66.4% 72,007 65.8% 72,860 77.6% 1,419 567<br />

Referential Equity Tier II (*) 37,202 33.6% 37,414 34.2% 21,092 22.4% (212) 16,110<br />

Referential Equity 110,629 109,421 93,951 1,208 16,678<br />

(*)<br />

It takes into consideration the redeemable non-voting shares and the exclusion of credit instruments issued by financial institutions and adjustments to market value —<br />

securities and derivatives.<br />

On March 31, 2013, our Referential Equity reached R$110,629<br />

million, an increase of R$1,208 million when compared to<br />

December 31, 2012, mainly due to the increase in Tier I. When<br />

compared to the same period of the previous year, the<br />

Referential Equity increased R$16,678 million.<br />

Aiming at ensuring the soundness of <strong>Itaú</strong> Unibanco and the<br />

capital availability to support the business growth, the levels of<br />

Referential Equity were maintained well above the Required<br />

Preferential Equity, as demonstrated by the BIS ratio. Therefore,<br />

the capital levels are more than sufficient to cover the risks.<br />

The Circular No. 3,608, of August 17, 2012, changed the<br />

procedures for the calculation of the Required Referential Equity<br />

portion related to the foreign currency risk (PCAM), mentioned in<br />

the Circular No. 3,568.<br />

Until to December 31, 2013, if exposures were equal to or lower<br />

than 2% of the Referential Equity, the PCAM portion (portion<br />

related to the risk of exposures in gold, foreign exchange<br />

currency and transactions subject to foreign exchange variations)<br />

shall be zero. If the rule were still in effect, the ratios would<br />

decrease by approximately 0.2%<br />

Subordinated Debt and Referential Equity Tier II | Mar 31, 2013<br />

Maturities<br />

< 1 year 1 - 2 years 2 - 3 years 3 - 4 years 4 - 5 years > 5 years Total<br />

CDB 203 5,039 4,642 1,452 - - 11,336<br />

Financial Treasury Bills 450 - - 3,424 9,931 9,565 23,370<br />

Euronotes 222 - - - - 15,485 15,706<br />

Subordinated Debt 875 5,039 4,642 4,876 9,931 25,050 50,413<br />

Subject to approval - Central Bank of Brazil (*) and Other 27 - 75 1 - 1,515 1,618<br />

Subordinated Debt - Total 902 5,039 4,718 4,877 9,931 26,565 52,031<br />

(*)<br />

Subordinated debt that does not make up the Tier II Referential Equity.<br />

R$ million<br />

Subordinated Debt (part of Referential Equity Tier II) - 1,008 1,857 2,926 7,945 22,978 36,713<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

35