IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Banking Operations & Insurance Operations<br />

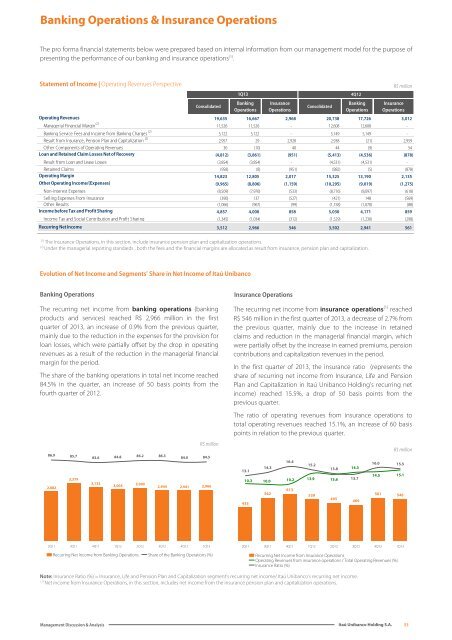

The pro forma financial statements below were prepared based on internal information from our management model for the purpose of<br />

presenting the performance of our banking and insurance operations (1) .<br />

Statement of Income | Operating Revenues Perspective<br />

R$ million<br />

1Q13<br />

4Q12<br />

Consolidated<br />

Banking<br />

Operations<br />

Insurance<br />

Operations<br />

Consolidated<br />

Banking<br />

Operations<br />

Insurance<br />

Operations<br />

Operating Revenues 19,635 16,667 2,968 20,738 17,726 3,012<br />

(2)<br />

Managerial Financial Margin 11,526 11,526 - 12,608 12,608 -<br />

Banking Service Fees and Income from Banking Charges (2) 5,122 5,122 - 5,149 5,149 -<br />

Result from Insurance, Pension Plan and Capitalization (2) 2,957 29 2,928 2,938 (21) 2,959<br />

Other Components of Operating Revenues 30 (10) 40 44 (9) 54<br />

Loan and Retained Claim Losses Net of Recovery (4,812) (3,861) (951) (5,413) (4,536) (878)<br />

Result from Loan and Lease Losses (3,854) (3,854) - (4,531) (4,531) -<br />

Retained Claims (958) (8) (951) (882) (5) (878)<br />

Operating Margin 14,823 12,805 2,017 15,325 13,190 2,135<br />

Other Operating Income/(Expenses) (9,965) (8,806) (1,159) (10,295) (9,019) (1,275)<br />

Non-interest Expenses (8,509) (7,976) (533) (8,716) (8,097) (618)<br />

Selling Expenses From Insurance (390) 137 (527) (421) 148 (569)<br />

Other Results (1,066) (967) (99) (1,158) (1,070) (88)<br />

Income before Tax and Profit Sharing 4,857 4,000 858 5,030 4,171 859<br />

Income Tax and Social Contribution and Profit Sharing (1,345) (1,034) (312) (1,529) (1,230) (298)<br />

Recurring Net Income 3,512 2,966 546 3,502 2,941 561<br />

(1)<br />

The Insurance Operations, in this section, include insurance pension plan and capitalization operations.<br />

(2)<br />

Under the managerial reporting standards , both the fees and the financial margins are allocated as result from insurance, pension plan and capitalization.<br />

Evolution of Net Income and Segments’ Share in Net Income of <strong>Itaú</strong> Unibanco<br />

Banking Operations<br />

The recurring net income from banking operations (banking<br />

products and services) reached R$ 2,966 million in the first<br />

quarter of 2013, an increase of 0.9% from the previous quarter,<br />

mainly due to the reduction in the expenses for the provision for<br />

loan losses, which were partially offset by the drop in operating<br />

revenues as a result of the reduction in the managerial financial<br />

margin for the period.<br />

The share of the banking operations in total net income reached<br />

84.5% in the quarter, an increase of 50 basis points from the<br />

fourth quarter of 2012.<br />

Insurance Operations<br />

The recurring net income from insurance operations (1) reached<br />

R$ 546 million in the first quarter of 2013, a decrease of 2.7% from<br />

the previous quarter, mainly due to the increase in retained<br />

claims and reduction in the managerial financial margin, which<br />

were partially offset by the increase in earned premiums, pension<br />

contributions and capitalization revenues in the period.<br />

In the first quarter of 2013, the insurance ratio (represents the<br />

share of recurring net income from Insurance, Life and Pension<br />

Plan and Capitalization in <strong>Itaú</strong> Unibanco Holding’s recurring net<br />

income) reached 15.5%, a drop of 50 basis points from the<br />

previous quarter.<br />

The ratio of operating revenues from insurance operations to<br />

total operating revenues reached 15.1%, an increase of 60 basis<br />

points in relation to the previous quarter.<br />

86.9 85.7<br />

2,882<br />

3,379<br />

R$ million<br />

83.6 84.8 86.2 86.3<br />

84.0 84.5<br />

3,133<br />

3,004<br />

3,090<br />

2,944 2,941 2,966<br />

13.1<br />

10.3<br />

435<br />

16.4<br />

14.3<br />

15.2<br />

10.0 10.2 13.9<br />

562<br />

613<br />

539<br />

13.8<br />

13.6<br />

495<br />

14.3<br />

13.7<br />

469<br />

R$ million<br />

16.0<br />

15.5<br />

14.5<br />

15.1<br />

561 546<br />

2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13<br />

Recurring Net Income from Banking Operations Share of the Banking Operations (%)<br />

2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13<br />

Recurring Net Income from Insurance Operations<br />

Operating Revenues from insurance operations / Total Operating Revenues (%)<br />

Insurance Ratio (%)<br />

Note: Insurance Ratio (%) = Insurance, Life and Pension Plan and Capitalization segment’s recurring net income/ <strong>Itaú</strong> Unibanco’s recurring net income.<br />

(1)<br />

Net income from Insurance Operations, in this section, includes net income from the insurance pension plan and capitalization operations.<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

53