e) Borrowings and onlending BORROWINGS Domestic Foreign (*) ONLENDING Domestic – official institutions 03/31/2013 03/31/2012 0-30 31-180 181-365 Over 365 days Total % Total % 2,740,610 10,062,133 7,354,940 3,907,194 24,064,877 38.3 17,141,960 32.9 127,297 118,603 51,520 144,604 442,024 0.7 534,483 1.0 2,613,313 9,943,530 7,303,420 3,762,590 23,622,853 37.6 16,607,477 31.9 1,984,515 5,422,806 5,125,619 26,292,599 38,825,539 61.7 34,931,555 67.1 1,567,666 5,409,052 5,121,306 26,142,281 38,240,305 60.8 34,374,964 66.0 BNDES 271,615 1,045,345 1,334,412 8,748,886 11,400,258 18.1 9,874,417 19.0 FINAME 1,256,517 4,285,089 3,637,941 17,251,247 26,430,794 42.0 24,137,819 46.4 Other 39,534 78,618 148,953 142,148 409,253 0.7 362,728 0.7 Foreign TOTAL % per maturity term TOTAL- 03/31/2012 % per maturity term (*) Foreign borrowings are basically represented by foreign exchange transactions related to export pre-financing and import financing. 416,849 13,754 4,313 150,318 585,234 0.9 556,591 1.1 4,725,125 15,484,939 12,480,559 30,199,793 62,890,416 52,073,515 7.5 24.6 19.8 48.1 2,745,001 13,398,249 9,926,166 26,004,099 52,073,515 5.3 25.7 19.1 49.9 <strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 138

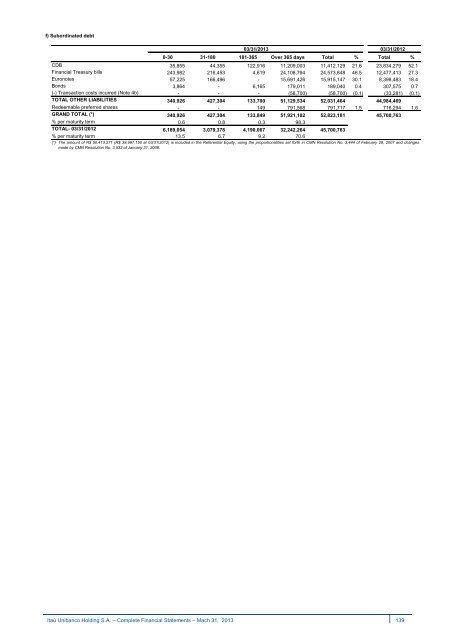

f) Subordinated debt 03/31/2013 03/31/2012 0-30 31-180 181-365 Over 365 days Total % Total % CDB 35,855 44,355 122,916 11,209,003 11,412,129 21.6 23,834,279 52.1 Financial Treasury bills 243,982 216,453 4,619 24,108,794 24,573,848 46.5 12,477,413 27.3 Euronotes 57,225 166,496 - 15,691,426 15,915,147 30.1 8,398,483 18.4 Bonds 3,864 - 6,165 179,011 189,040 0.4 307,575 0.7 (-) Transaction costs incurred (Note 4b) - - - (58,700) (58,700) (0.1) (33,281) (0.1) TOTAL OTHER LIABILITIES 340,926 427,304 133,700 51,129,534 52,031,464 44,984,469 Redeemable preferred shares - - 149 791,568 791,717 1.5 716,294 1.6 GRAND TOTAL (*) 340,926 427,304 133,849 51,921,102 52,823,181 45,700,763 % per maturity term 0.6 0.8 0.3 98.3 TOTAL- 03/31/2012 6,189,054 3,079,378 4,190,067 32,242,264 45,700,763 % per maturity term 13.5 6.7 9.2 70.6 (*) The amount of R$ 50,413,271 (R$ 39,997,150 at 03/31/2012) is included in the Referential Equity, using the proportionalities set forth in CMN Resolution No. 3,444 of February 28, 2007 and changes made by CMN Resolution No. 3,532 of January 31, 2008. <strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 139

- Page 1 and 2:

financial report March 31, 2013 Ita

- Page 3 and 4:

management discussion analysis Ita

- Page 5 and 6:

Executive Summary Information and f

- Page 7 and 8:

Executive Summary Effects of the Re

- Page 9 and 10:

Executive Summary We present below

- Page 11 and 12:

Executive Summary Banking Services

- Page 13 and 14:

Executive Summary Credit Portfolio

- Page 15 and 16:

analysis of net income Itaú Uniban

- Page 17 and 18:

Analysis of Net Income Managerial F

- Page 19 and 20:

Analysis of Net Income Banking Serv

- Page 21 and 22:

Analysis of Net Income Result from

- Page 23 and 24:

Analysis of Net Income Non-interest

- Page 25 and 26:

Analysis of Net Income Points of Se

- Page 27 and 28:

alance sheet, balance sheet by curr

- Page 29 and 30:

Balance Sheet Short-term Interbank

- Page 31 and 32:

Balance Sheet Funding Mar 31, 13 De

- Page 33 and 34:

Balance Sheet by Currency We adopt

- Page 35 and 36:

Capital Ratios (BIS) Solvency Ratio

- Page 37 and 38:

Ownership Structure The management

- Page 39 and 40:

Annual and Extraordinary Stockholde

- Page 41 and 42:

analysis of segments, products and

- Page 43 and 44:

Analysis of Segments Pro Forma Adju

- Page 45 and 46:

Analysis of Segments The pro forma

- Page 47 and 48:

Analysis of Segments Wholesale Bank

- Page 49 and 50:

Products and Services Cards Through

- Page 51 and 52:

anking operations & insurance opera

- Page 53 and 54:

Banking Operations & Insurance Oper

- Page 55 and 56:

Insurance, Life and Pension Plan &

- Page 57 and 58:

Insurance The figures presented in

- Page 59 and 60:

Life and Pension Plan Pro Forma Rec

- Page 61 and 62:

activities abroad Itaú Unibanco Ho

- Page 63 and 64:

Activities abroad Main Operations i

- Page 65 and 66:

Activities abroad Latin America - B

- Page 67 and 68:

Activities abroad Itaú BBA Interna

- Page 70 and 71:

(This page was left in blank intent

- Page 72 and 73:

Itaú Unibanco Holding S.A. - Compl

- Page 74 and 75:

Banco Itaú BMG Consignado S.A. - i

- Page 76 and 77:

3.2) Income R$ billion Statement of

- Page 78 and 79:

Default At March 31, 2013, total de

- Page 80 and 81:

Custody Services - In the custody m

- Page 82 and 83:

In the January-March 2013 period, t

- Page 84 and 85:

ITAÚ UNIBANCO S.A. Chief Executive

- Page 86 and 87:

ITAÚ UNIBANCO HOLDING S.A. Consoli

- Page 88 and 89: ITAÚ UNIBANCO HOLDING S.A. Consoli

- Page 90 and 91: ITAÚ UNIBANCO HOLDING S.A. Consoli

- Page 92 and 93: ITAÚ UNIBANCO HOLDING S.A. Stateme

- Page 94 and 95: Itaú Unibanco Holding S.A. Stateme

- Page 96 and 97: ITAÚ UNIBANCO HOLDING S.A. NOTES T

- Page 98 and 99: In ITAÚ UNIBANCO HOLDING CONSOLIDA

- Page 100 and 101: NOTE 3 - REQUIREMENTS OF CAPITAL AN

- Page 102 and 103: During this period, the effects of

- Page 104 and 105: Cash Flow Hedge - the effective amo

- Page 106 and 107: Mathematical provisions for benefit

- Page 108 and 109: NOTE 5 - CASH AND CASH EQUIVALENTS

- Page 110 and 111: NOTE 7 - SECURITIES AND DERIVATIVE

- Page 112 and 113: c) Trading securities See below the

- Page 114 and 115: e) Held-to-maturity securities See

- Page 116 and 117: I - Derivatives by index Memorandum

- Page 118 and 119: II - Derivatives by counterparty Se

- Page 120 and 121: III - Derivatives by notional amoun

- Page 122 and 123: V - Accounting hedge a) The effecti

- Page 124 and 125: VI - Realized and unrealized gain o

- Page 126 and 127: j) Sensitivity analysis (TRADING AN

- Page 128 and 129: II - By maturity and risk level 03/

- Page 130 and 131: ) Credit concentration Loan, lease

- Page 132 and 133: e) Restricted operations on assets

- Page 134 and 135: NOTE 9 - FOREIGN EXCHANGE PORTFOLIO

- Page 136 and 137: c) Deposits received under securiti

- Page 140 and 141: Description Name of security / Curr

- Page 142 and 143: ) Assets Guaranteeing Technical Pro

- Page 144 and 145: NOTE 12 - CONTINGENT ASSETS AND LIA

- Page 146 and 147: - Tax and social security lawsuits

- Page 148 and 149: The main discussions related to Leg

- Page 150 and 151: c) Receivables - Reimbursement of c

- Page 152 and 153: ) Prepaid expenses Commissions 03/3

- Page 154 and 155: d) Banking service fees 01/01 to 03

- Page 156 and 157: f) Personnel expenses Compensation

- Page 158 and 159: NOTE 14 - TAXES a) Composition of e

- Page 160 and 161: ) Deferred taxes I - The deferred t

- Page 162 and 163: III - The estimate of realization a

- Page 164 and 165: d) Taxes paid or provided for and w

- Page 166 and 167: II - Composition of investments 03/

- Page 168 and 169: II) Goodwill CHANGES Amortization p

- Page 170 and 171: NOTE 16 - STOCKHOLDERS’ EQUITY a)

- Page 172 and 173: c) Capital and revenue reserves 03/

- Page 174 and 175: f) Stock Option Plan I - Purpose an

- Page 176 and 177: Summary of Changes in the Share-Bas

- Page 178 and 179: NOTE 17 - RELATED PARTIES a) Transa

- Page 180 and 181: ) Compensation of Management Key Pe

- Page 182 and 183: To obtain the market values for the

- Page 184 and 185: c) Defined benefit plan I - Main as

- Page 186 and 187: V- Change in the net amount recogni

- Page 188 and 189:

NOTE 20 - INFORMATION ON FOREIGN SU

- Page 190 and 191:

I - Market Risk Market risk is the

- Page 192 and 193:

II - Credit Risk Credit risk is the

- Page 194 and 195:

NOTE 22 -SUPPLEMENTARY INFORMATION

- Page 196 and 197:

Report on Review To the Directors a

- Page 198:

ITAÚ UNIBANCO HOLDING S.A. CNPJ. 6