IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Insurance, Life and Pension Plan & Capitalization<br />

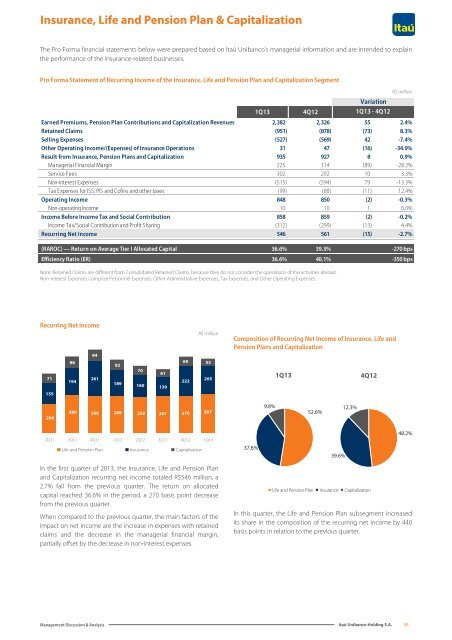

The Pro Forma financial statements below were prepared based on <strong>Itaú</strong> Unibanco’s managerial information and are intended to explain<br />

the performance of the insurance-related businesses.<br />

Pro Forma Statement of Recurring Income of the Insurance, Life and Pension Plan and Capitalization Segment<br />

R$ million<br />

Variation<br />

1Q13<br />

4Q12<br />

1Q13 - 4Q12<br />

Earned Premiums, Pension Plan Contributions and Capitalization Revenues 2,382 2,326 55 2.4%<br />

Retained Claims (951) (878) (73) 8.3%<br />

Selling Expenses (527) (569) 42 -7.4%<br />

Other Operating Income/(Expenses) of Insurance Operations 31 47 (16) -34.9%<br />

Result from Insurance, Pension Plans and Capitalization 935 927 8 0.9%<br />

Managerial Financial Margin 225 314 (89) -28.2%<br />

Service Fees 302 292 10 3.3%<br />

Non-interest Expenses (515) (594) 79 -13.3%<br />

Tax Expenses for ISS, PIS and Cofins and other taxes (99) (88) (11) 12.4%<br />

Operating Income 848 850 (2) -0.3%<br />

Non-operating Income 10 10 1 6.0%<br />

Income Before Income Tax and Social Contribution 858 859 (2) -0.2%<br />

Income Tax/Social Contribution and Profit Sharing (312) (299) (13) 4.4%<br />

Recurring Net Income 546 561 (15) -2.7%<br />

(RAROC) — Return on Average Tier I Allocated Capital 36.6% 39.3% -270 bps<br />

Efficiency Ratio (ER) 36.6% 40.1% -350 bps<br />

Note: Retained Claims are different from Consolidated Retained Claims, because they do not consider the operations of the activities abroad.<br />

Non-interest Expenses comprise Personnel Expenses, Other Administrative Expenses, Tax Expenses, and Other Operating Expenses.<br />

Recurring Net Income<br />

84<br />

88<br />

71<br />

194<br />

261<br />

155<br />

82<br />

189<br />

70<br />

160<br />

61<br />

139<br />

R$ million<br />

69 53<br />

222<br />

205<br />

Composition of Recurring Net Income of Insurance, Life and<br />

Pension Plans and Capitalization<br />

1Q13<br />

4Q12<br />

208<br />

280<br />

268<br />

268<br />

263<br />

267<br />

270<br />

287<br />

9.8%<br />

52.6%<br />

12.3%<br />

2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13<br />

Life and Pension Plan Insurance Capitalization<br />

37.6%<br />

39.6%<br />

48.2%<br />

In the first quarter of 2013, the Insurance, Life and Pension Plan<br />

and Capitalization recurring net income totaled R$546 million, a<br />

2.7% fall from the previous quarter. The return on allocated<br />

capital reached 36.6% in the period, a 270 basis point decrease<br />

from the previous quarter.<br />

When compared to the previous quarter, the main factors of the<br />

impact on net income are the increase in expenses with retained<br />

claims and the decrease in the managerial financial margin,<br />

partially offset by the decrease in non-interest expenses.<br />

Life and Pension Plan Insurance Capitalization<br />

In this quarter, the Life and Pension Plan subsegment increased<br />

its share in the composition of the recurring net income by 440<br />

basis points in relation to the previous quarter.<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

55