IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

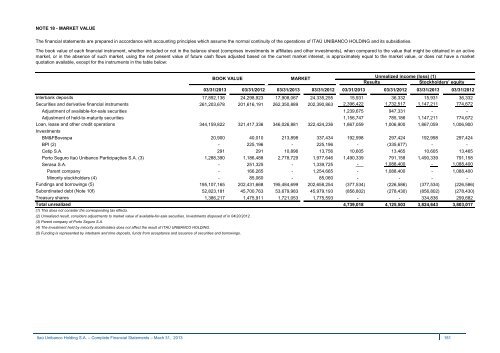

NOTE 18 - MARKET VALUE<br />

The financial statements are prepared in accordance with accounting principles which assume the normal continuity of the operations of ITAÚ UNIBANCO HOLDING and its subsidiaries.<br />

The book value of each financial instrument, whether included or not in the balance sheet (comprises investments in affiliates and other investments), when compared to the value that might be obtained in an active<br />

market, or in the absence of such market, using the net present value of future cash flows adjusted based on the current market interest, is approximately equal to the market value, or does not have a market<br />

quotation available, except for the instruments in the table below:<br />

BOOK VALUE<br />

03/31/2013 03/31/2012 03/31/2013 03/31/2012 03/31/2013 03/31/2012 03/31/2013 03/31/2012<br />

Interbank deposits<br />

17,892,136 24,298,923 17,908,067 24,335,255 15,931 36,332 15,931 36,332<br />

Securities and derivative financial instruments<br />

261,203,678 201,616,191 262,350,889 202,390,863 2,396,422 1,732,517 1,147,211 774,672<br />

Adjustment of available-for-sale securities 1,239,675 947,331 - -<br />

Adjustment of held-to-maturity securities 1,156,747 785,186 1,147,211 774,672<br />

Loan, lease and other credit operations<br />

344,159,822 321,417,336 346,026,881 322,424,236 1,867,059 1,006,900 1,867,059 1,006,900<br />

Investments<br />

BM&FBovespa 20,900 40,010 213,898 337,434 192,998 297,424 192,998 297,424<br />

BPI (2) - 225,196 - 225,196 - (335,677) - -<br />

Cetip S.A. 291 291 10,896 13,756 10,605 13,465 10,605 13,465<br />

Porto Seguro <strong>Itaú</strong> Unibanco Participações S.A. (3) 1,288,390 1,186,488 2,778,729 1,977,646 1,490,339 791,158 1,490,339 791,158<br />

Serasa S.A. - 251,325 - 1,339,725 - 1,088,400 - 1,088,400<br />

Parent company - 166,265 - 1,254,665 - 1,088,400 - 1,088,400<br />

Minority stockholders (4) - 85,060 - 85,060 - - - -<br />

Fundings and borrowings (5)<br />

195,107,165 202,431,668 195,484,699 202,658,254 (377,534) (226,586) (377,534) (226,586)<br />

Subordinated debt (Note 10f)<br />

52,823,181 45,700,763 53,679,983 45,979,193 (856,802) (278,430) (856,802) (278,430)<br />

Treasury shares<br />

1,386,217 1,475,911 1,721,053 1,775,593 - - 334,836 299,682<br />

Total unrealized<br />

4,739,018 4,125,503 3,824,643 3,803,017<br />

(1) This does not consider the corresponding tax effects.<br />

(2) Unrealized result, considers adjustments to market value of available-for-sale securities. Investments disposed of in 04/20/2012.<br />

(3) Parent company of Porto Seguro S.A.<br />

(4) The investment held by minority stockholders does not affect the result of ITAÚ UNIBANCO HOLDING.<br />

(5) Funding is represented by interbank and time deposits, funds from acceptance and issuance of securities and borrowings.<br />

MARKET<br />

Unrealized income (loss) (1)<br />

Results<br />

Stockholders’ equity<br />

<strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 181