) Credit concentration Loan, lease and other credit operations (*) 03/31/2013 03/31/2012 Largest debtor 4,697,755 1.1 3,296,014 0.8 10 largest debtors 28,319,581 6.5 22,555,838 5.6 20 largest debtors 44,465,922 10.2 37,410,715 9.3 50 largest debtors 69,782,999 16.1 59,058,435 14.7 100 largest debtors 92,118,012 21.2 77,650,668 19.4 Risk % of Total Risk % of Total Loan, lease and other credit operations and securities of companies and financial institutions (*) 03/31/2013 03/31/2012 Largest debtor 5,303,903 1.1 3,920,695 0.9 10 largest debtors 37,004,915 7.5 30,946,097 7.0 20 largest debtors 58,664,810 11.9 50,464,328 11.3 50 largest debtors 95,699,289 19.4 80,910,874 18.2 100 largest debtors 124,362,506 25.3 105,467,529 23.7 (*) The amounts include endorsements and sureties. Risk % of Total Risk % of Total c) Changes in allowance for loan losses Opening balance (27,744,938) (25,771,727) Effect of change in consolidation criteria (Note 2b) (483,210) - Net increase for the period (4,945,194) (6,031,366) Required by Resolution No. 2,682/99 (4,945,194) (6,031,366) Additional allowance - - Write-Off 5,985,148 5,851,631 Closing balance (1) (27,188,194) (25,951,462) Required by Resolution No. 2,682/99 (22,129,779) (20,893,047) (1) (2) (3) (4) 01/01 to 03/31/2013 01/01 to 03/31/2012 Specific allowance (2) (15,557,518) (15,114,870) Generic allowance (3) (6,572,261) (5,778,177) Additional allowance (4) (5,058,415) (5,058,415) The allowance for loan losses related to the lease portfolio amounts to: R$ (1,291,820) (R$ (1,793,057) at March 31, 2012). Operations with overdue installments for more than 14 days or under responsibility of bankruptcy or in process of bankruptcy companies. For operations not covered in the previous item due to the classification of the client or operation. Refers to the provision in excess of the minimum required percentage by CMN Resolution No. 2,682 of December 21, 1999, based on the expected loss methodology adopted in the institution’s credit risk management, which also considers the potential losses in revolving credit. At March 31, 2013, the balance of the allowance in relation to the loan portfolio is equivalent to 7.3% (7.5% at 03/31/2012). <strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 130

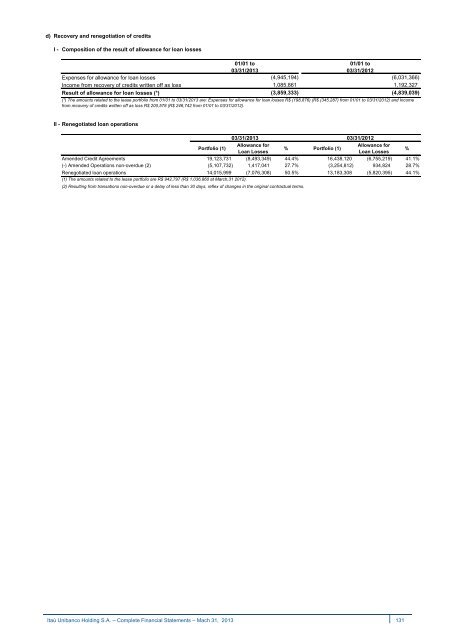

d) Recovery and renegotiation of credits I - Composition of the result of allowance for loan losses Expenses for allowance for loan losses Income from recovery of credits written off as loss Result of allowance for loan losses (*) 01/01 to 03/31/2013 (4,945,194) 1,085,861 (3,859,333) 01/01 to 03/31/2012 (6,031,366) 1,192,327 (4,839,039) (*) The amounts related to the lease portfolio from 01/01 to 03/31/2013 are: Expenses for allowance for loan losses R$ (198,876) (R$ (345,287) from 01/01 to 03/31/2012) and Income from recovery of credits written off as loss R$ 200,578 (R$ 246,742 from 01/01 to 03/31/2012). II - Renegotiated loan operations Portfolio (1) 03/31/2013 03/31/2012 Allowance for Loan Losses % Portfolio (1) Allowance for Loan Losses Amended Credit Agreements 19,123,731 (8,493,349) 44.4% 16,438,120 (6,755,219) 41.1% (-) Amended Operations non-overdue (2) (5,107,732) 1,417,041 27.7% (3,254,812) 934,824 28.7% Renegotiated loan operations 14,015,999 (7,076,308) 50.5% 13,183,308 (5,820,395) 44.1% (1) The amounts related to the lease portfolio are R$ 942,797 (R$ 1,036,860 at March,31 2012). (2) Resulting from transations non-overdue or a delay of less than 30 days, reflex of changes in the original contractual terms. % <strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 131