IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

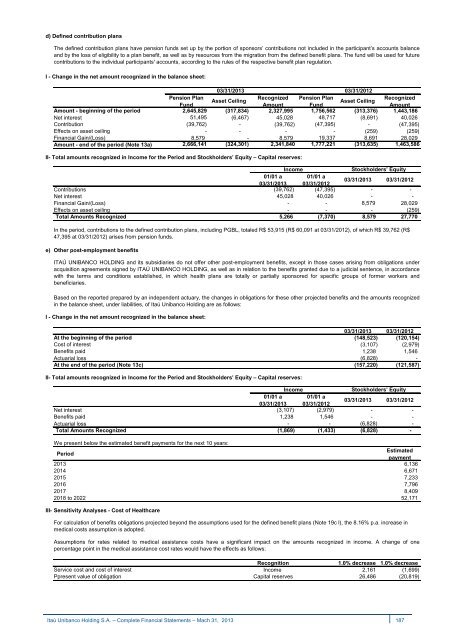

d) Defined contribution plans<br />

The defined contribution plans have pension funds set up by the portion of sponsors’ contributions not included in the participant’s accounts balance<br />

and by the loss of eligibility to a plan benefit, as well as by resources from the migration from the defined benefit plans. The fund will be used for future<br />

contributions to the individual participants' accounts, according to the rules of the respective benefit plan regulation.<br />

I - Change in the net amount recognized in the balance sheet:<br />

03/31/2013 03/31/2012<br />

Pension Plan<br />

Recognized Pension Plan<br />

Recognized<br />

Asset Ceiling<br />

Asset Ceiling<br />

Fund<br />

Amount Fund<br />

Amount<br />

Amount - beginning of the period 2,645,829 (317,834) 2,327,995 1,756,562 (313,376) 1,443,186<br />

Net interest 51,495 (6,467) 45,028 48,717 (8,691) 40,026<br />

Contribution (39,762) - (39,762) (47,395) - (47,395)<br />

Effects on asset ceiling - - - - (259) (259)<br />

Financial Gain/(Loss) 8,579 - 8,579 19,337 8,691 28,029<br />

Amount - end of the period (Note 13a) 2,666,141 (324,301) 2,341,840 1,777,221 (313,635) 1,463,586<br />

II- Total amounts recognized in Income for the Period and Stockholders’ Equity – Capital reserves:<br />

Income<br />

Stockholders’ Equity<br />

01/01 a 01/01 a<br />

03/31/2013 03/31/2012<br />

03/31/2013 03/31/2012<br />

Contributions<br />

(39,762) (47,395) - -<br />

Net interest<br />

45,028 40,026 - -<br />

Financial Gain/(Loss)<br />

- - 8,579 28,029<br />

Effects on asset ceiling<br />

- - - (259)<br />

Total Amounts Recognized 5,266 (7,370) 8,579 27,770<br />

In the period, contributions to the defined contribution plans, including PGBL, totaled R$ 53,915 (R$ 60,091 at 03/31/2012), of which R$ 39,762 (R$<br />

47,395 at 03/31/2012) arises from pension funds.<br />

e)<br />

Other post-employment benefits<br />

ITAÚ UNIBANCO HOLDING and its subsidiaries do not offer other post-employment benefits, except in those cases arising from obligations under<br />

acquisition agreements signed by ITAÚ UNIBANCO HOLDING, as well as in relation to the benefits granted due to a judicial sentence, in accordance<br />

with the terms and conditions established, in which health plans are totally or partially sponsored for specific groups of former workers and<br />

beneficiaries.<br />

Based on the reported prepared by an independent actuary, the changes in obligations for these other projected benefits and the amounts recognized<br />

in the balance sheet, under liabilities, of <strong>Itaú</strong> Unibanco Holding are as follows:<br />

I - Change in the net amount recognized in the balance sheet:<br />

03/31/2013 03/31/2012<br />

At the beginning of the period (148,523) (120,154)<br />

Cost of interest (3,107) (2,979)<br />

Benefits paid 1,238 1,546<br />

Actuarial loss (6,828) -<br />

At the end of the period (Note 13c) (157,220) (121,587)<br />

II- Total amounts recognized in Income for the Period and Stockholders’ Equity – Capital reserves:<br />

Income<br />

Stockholders’ Equity<br />

01/01 a 01/01 a<br />

03/31/2013 03/31/2012<br />

03/31/2013 03/31/2012<br />

Net interest<br />

(3,107) (2,979) - -<br />

Benefits paid 1,238 1,546 - -<br />

Actuarial loss - - (6,828) -<br />

Total Amounts Recognized (1,869) (1,433) (6,828) -<br />

We present below the estimated benefit payments for the next 10 years:<br />

Period<br />

Estimated<br />

payment<br />

2013 6,136<br />

2014 6,671<br />

2015 7,233<br />

2016 7,796<br />

2017 8,409<br />

2018 to 2022 52,171<br />

III- Sensitivity Analyses - Cost of Healthcare<br />

For calculation of benefits obligations projected beyond the assumptions used for the defined benefit plans (Note 19c l), the 8.16% p.a. increase in<br />

medical costs assumption is adopted.<br />

Assumptions for rates related to medical assistance costs have a significant impact on the amounts recognized in income. A change of one<br />

percentage point in the medical assistance cost rates would have the effects as follows:<br />

Recognition<br />

1.0% decrease 1.0% decrease<br />

Service cost and cost of interest Income 2,161 (1,699)<br />

Ppresent value of obligation Capital reserves 26,486 (20,819)<br />

<strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 187