IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

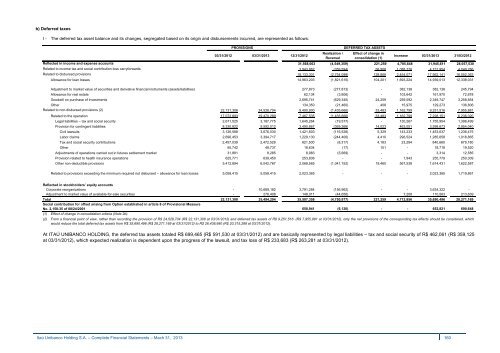

) Deferred taxes<br />

I -<br />

The deferred tax asset balance and its changes, segregated based on its origin and disbursements incurred, are represented as follows:<br />

Reflected in income and expense accounts<br />

Related to income tax and social contribution loss carryforwards<br />

Related to disbursed provisions<br />

Allowance for loan losses<br />

PROVISIONS<br />

03/31/2012 03/31/2013 12/31/2012<br />

Realization /<br />

Reversal<br />

DEFERRED TAX ASSETS<br />

Effect of change in<br />

consolidation (1)<br />

Increase<br />

03/31/2013<br />

31/03/2012<br />

31,568,063 (4,549,359) 221,259 4,705,648 31,945,611 28,057,530<br />

3,943,862 (359,594) 58,908 1,088,778 4,731,954 4,049,286<br />

18,133,301 (2,754,099) 128,868 2,454,071 17,962,141 16,052,363<br />

14,963,203 (1,821,615) 104,201 1,693,224 14,939,013 12,338,031<br />

Adjustment to market value of securities and derivative financial instruments (assets/liabilities)<br />

277,873 (277,873) - 382,138 382,138 245,794<br />

Allowance for real estate<br />

62,134 (3,806) - 103,642 161,970 72,878<br />

Goodwill on purchase of investments<br />

2,695,741 (629,345) 24,259 259,092 2,349,747 3,258,854<br />

Other<br />

134,350 (21,460) 408 15,975 129,273 136,806<br />

Related to non-disbursed provisions (2)<br />

22,131,308 24,528,704 9,490,900 (1,435,666) 33,483 1,162,799 9,251,516 7,955,881<br />

Related to the operation<br />

17,072,893 19,470,289 7,467,535 (1,435,666) 33,483 1,162,799 7,228,151 6,236,020<br />

Legal liabilities – tax and social security<br />

2,671,525 3,187,775 1,645,264 (19,577) - 130,267 1,755,954 1,396,499<br />

Provision for contingent liabilities<br />

8,330,822 9,592,012 3,490,867 (369,268) 14,023 463,051 3,598,673 2,954,040<br />

Civil lawsuits 3,126,588 3,676,030 1,421,603 (116,528) 5,329 143,233 1,453,637 1,236,475<br />

Labor claims 2,696,453 3,394,717 1,229,130 (244,406) 4,410 296,524 1,285,658 1,018,865<br />

Tax and social security contributions 2,457,039 2,472,528 821,500 (8,317) 4,183 23,294 840,660 679,180<br />

Other 50,742 48,737 18,634 (17) 101 - 18,718 19,520<br />

Adjustments of operations carried out in futures settlement market<br />

31,881 8,285 8,983 (5,669) - - 3,314 12,585<br />

Provision related to health insurance operations<br />

625,771 639,450 253,836 - - 1,943 255,779 250,309<br />

Other non-deductible provisions<br />

5,412,894 6,042,767 2,068,585 (1,041,152) 19,460 567,538 1,614,431 1,622,587<br />

Related to provisions exceeding the minimum required not disbursed – allowance for loan losses<br />

5,058,415 5,058,415 2,023,365 - - - 2,023,365 1,719,861<br />

Reflected in stockholders’ equity accounts<br />

Corporate reorganizations<br />

Adjustment to market value of available-for-sale securities<br />

- 10,689,182 3,791,284 (156,962) - - 3,634,322 -<br />

- 276,408 148,011 (44,656) - 7,208 110,563 213,639<br />

Total 22,131,308 35,494,294 35,507,358 (4,750,977) 221,259 4,712,856 35,690,496 28,271,169<br />

Social contribution for offset arising from Option established in article 8 of Provisional Measure<br />

No. 2,158-35 of 08/24/2001<br />

658,941 (6,120) - - 652,821 690,648<br />

(1)<br />

(2)<br />

Effect of change in consolidation criteria (Note 2b).<br />

From a financial point of view, rather than recording the provision of R$ 24,528,704 (R$ 22,131,308 at 03/31/2012) and deferred tax assets of R$ 9,251,516 (R$ 7,955,881 at 03/31/2012), only the net provisions of the corresponding tax effects should be considered, which<br />

would reduce the total deferred tax assets from R$ 35,690,496 (R$ 28,271,169 at 03/31/2012) to R$ 26,438,980 (R$ 20,315,288 at 03/31/2012).<br />

At ITAÚ UNIBANCO HOLDING, the deferred tax assets totaled R$ 699,465 (R$ 591,530 at 03/31/2012) and are basically represented by legal liabilities – tax and social security of R$ 462,061 (R$ 359,125<br />

at 03/31/2012), which expected realization is dependent upon the progress of the lawsuit, and tax loss of R$ 233,683 (R$ 263,281 at 03/31/2012).<br />

<strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 160