IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

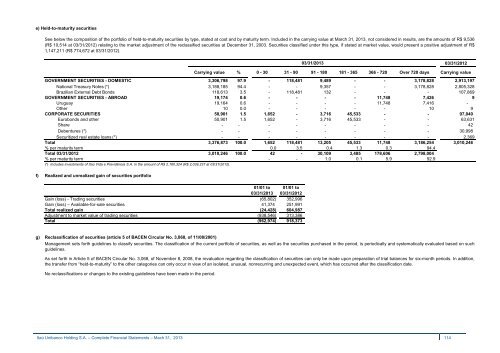

e) Held-to-maturity securities<br />

See below the composition of the portfolio of held-to-maturity securities by type, stated at cost and by maturity term. Included in the carrying value at March 31, 2013, not considered in results, are the amounts of R$ 9,536<br />

(R$ 10,514 at 03/31/2012) relating to the market adjustment of the reclassified securities at December 31, 2003. Securities classified under this type, if stated at market value, would present a positive adjustment of R$<br />

1,147,211 (R$ 774,672 at 03/31/2012).<br />

03/31/2013<br />

03/31/2012<br />

GOVERNMENT SECURITIES - DOMESTIC<br />

National Treasury Notes (*)<br />

Brazilian External Debt Bonds<br />

GOVERNMENT SECURITIES - ABROAD<br />

Uruguay<br />

Other<br />

CORPORATE SECURITIES<br />

Eurobonds and other<br />

Share<br />

Debentures (*)<br />

Securitized real estate loans (*)<br />

Total<br />

% per maturity term<br />

Total 03/31/2012<br />

% per maturity term<br />

(*) Includes investments of <strong>Itaú</strong> Vida e Previdência S.A. in the amount of R$ 2,160,324 (R$ 2,039,237 at 03/31/2012).<br />

Carrying value % 0 - 30 31 - 90 91 - 180 181 - 365 366 - 720 Over 720 days Carrying value<br />

3,306,798 97.9 - 118,481 9,489 - - 3,178,828 2,913,197<br />

3,188,185 94.4 - - 9,357 - - 3,178,828 2,805,328<br />

118,613 3.5 - 118,481 132 - - - 107,869<br />

19,174 0.6 - - - - 11,748 7,426 9<br />

19,164 0.6 - - - - 11,748 7,416 -<br />

10 0.0 - - - - - 10 9<br />

50,901 1.5 1,652 - 3,716 45,533 - - 97,040<br />

50,901 1.5 1,652 - 3,716 45,533 - - 63,631<br />

- - - - - - - - 42<br />

- - - - - - - - 30,998<br />

- - - - - - - - 2,369<br />

3,376,873 100.0 1,652 118,481 13,205 45,533 11,748 3,186,254 3,010,246<br />

0.0 3.5 0.4 1.3 0.3 94.4<br />

3,010,246 100.0 42 - 30,109 3,485 178,606 2,798,004<br />

- - 1.0 0.1 5.9 92.9<br />

f)<br />

Realized and unrealized gain of securities portfolio<br />

Gain (loss) - Trading securities<br />

Gain (loss) – Available-for-sale securities<br />

Total realized gain<br />

Adjustment to market value of trading securities<br />

Total<br />

01/01 to<br />

03/31/2013<br />

01/01 to<br />

03/31/2012<br />

(65,802) 352,996<br />

41,374 251,991<br />

(24,428) 604,987<br />

(938,546) 313,386<br />

(962,974) 918,373<br />

g)<br />

Reclassification of securities (article 5 of BACEN Circular No. 3,068, of 11/08/2001)<br />

Management sets forth guidelines to classify securities. The classification of the current portfolio of securities, as well as the securities purchased in the period, is periodically and systematically evaluated based on such<br />

guidelines.<br />

As set forth in Article 5 of BACEN Circular No. 3,068, of November 8, 2008, the revaluation regarding the classification of securities can only be made upon preparation of trial balances for six-month periods. In addition,<br />

the transfer from “held-to-maturity” to the other categories can only occur in view of an isolated, unusual, nonrecurring and unexpected event, which has occurred after the classification date.<br />

No reclassifications or changes to the existing guidelines have been made in the period.<br />

<strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 114