IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

c) Receivables - Reimbursement of contingencies<br />

The Receivables balance arising from reimbursements of contingencies totals R$ 696,725 (R$ 736,224 at<br />

03/31/2012) (Note 13a), basically represented by the guarantee in the <strong>Banco</strong> Banerj S.A. privatization<br />

process occurred in 1997, in which the State of Rio de Janeiro created a fund to guarantee the equity<br />

recomposition of Civil, Labor and Tax Contingencies.<br />

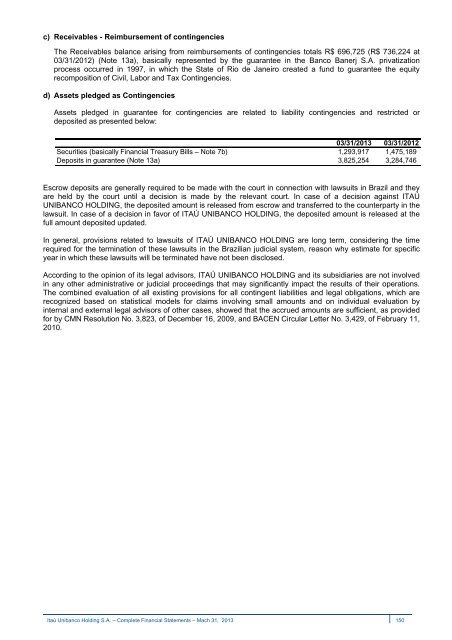

d) Assets pledged as Contingencies<br />

Assets pledged in guarantee for contingencies are related to liability contingencies and restricted or<br />

deposited as presented below:<br />

03/31/2013 03/31/2012<br />

Securities (basically Financial Treasury Bills – Note 7b) 1,293,917 1,475,189<br />

Deposits in guarantee (Note 13a) 3,825,254 3,284,746<br />

Escrow deposits are generally required to be made with the court in connection with lawsuits in Brazil and they<br />

are held by the court until a decision is made by the relevant court. In case of a decision against ITAÚ<br />

UNIBANCO HOLDING, the deposited amount is released from escrow and transferred to the counterparty in the<br />

lawsuit. In case of a decision in favor of ITAÚ UNIBANCO HOLDING, the deposited amount is released at the<br />

full amount deposited updated.<br />

In general, provisions related to lawsuits of ITAÚ UNIBANCO HOLDING are long term, considering the time<br />

required for the termination of these lawsuits in the Brazilian judicial system, reason why estimate for specific<br />

year in which these lawsuits will be terminated have not been disclosed.<br />

According to the opinion of its legal advisors, ITAÚ UNIBANCO HOLDING and its subsidiaries are not involved<br />

in any other administrative or judicial proceedings that may significantly impact the results of their operations.<br />

The combined evaluation of all existing provisions for all contingent liabilities and legal obligations, which are<br />

recognized based on statistical models for claims involving small amounts and on individual evaluation by<br />

internal and external legal advisors of other cases, showed that the accrued amounts are sufficient, as provided<br />

for by CMN Resolution No. 3,823, of December 16, 2009, and BACEN Circular Letter No. 3,429, of February 11,<br />

2010.<br />

<strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 150