IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

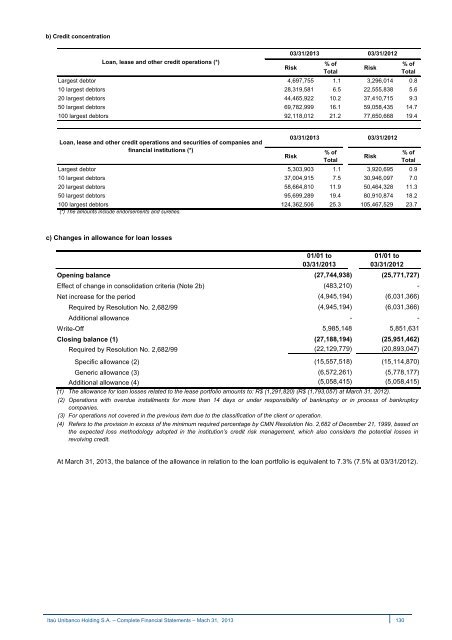

) Credit concentration<br />

Loan, lease and other credit operations (*)<br />

03/31/2013 03/31/2012<br />

Largest debtor 4,697,755 1.1 3,296,014 0.8<br />

10 largest debtors 28,319,581 6.5 22,555,838 5.6<br />

20 largest debtors 44,465,922 10.2 37,410,715 9.3<br />

50 largest debtors 69,782,999 16.1 59,058,435 14.7<br />

100 largest debtors 92,118,012 21.2 77,650,668 19.4<br />

Risk<br />

% of<br />

Total<br />

Risk<br />

% of<br />

Total<br />

Loan, lease and other credit operations and securities of companies and<br />

financial institutions (*)<br />

03/31/2013 03/31/2012<br />

Largest debtor 5,303,903 1.1 3,920,695 0.9<br />

10 largest debtors 37,004,915 7.5 30,946,097 7.0<br />

20 largest debtors 58,664,810 11.9 50,464,328 11.3<br />

50 largest debtors 95,699,289 19.4 80,910,874 18.2<br />

100 largest debtors 124,362,506 25.3 105,467,529 23.7<br />

(*) The amounts include endorsements and sureties.<br />

Risk<br />

% of<br />

Total<br />

Risk<br />

% of<br />

Total<br />

c) Changes in allowance for loan losses<br />

Opening balance<br />

(27,744,938) (25,771,727)<br />

Effect of change in consolidation criteria (Note 2b) (483,210) -<br />

Net increase for the period<br />

(4,945,194) (6,031,366)<br />

Required by Resolution No. 2,682/99 (4,945,194) (6,031,366)<br />

Additional allowance - -<br />

Write-Off<br />

5,985,148 5,851,631<br />

Closing balance (1)<br />

(27,188,194) (25,951,462)<br />

Required by Resolution No. 2,682/99 (22,129,779) (20,893,047)<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

01/01 to<br />

03/31/2013<br />

01/01 to<br />

03/31/2012<br />

Specific allowance (2) (15,557,518) (15,114,870)<br />

Generic allowance (3) (6,572,261) (5,778,177)<br />

Additional allowance (4) (5,058,415) (5,058,415)<br />

The allowance for loan losses related to the lease portfolio amounts to: R$ (1,291,820) (R$ (1,793,057) at March 31, 2012).<br />

Operations with overdue installments for more than 14 days or under responsibility of bankruptcy or in process of bankruptcy<br />

companies.<br />

For operations not covered in the previous item due to the classification of the client or operation.<br />

Refers to the provision in excess of the minimum required percentage by CMN Resolution No. 2,682 of December 21, 1999, based on<br />

the expected loss methodology adopted in the institution’s credit risk management, which also considers the potential losses in<br />

revolving credit.<br />

At March 31, 2013, the balance of the allowance in relation to the loan portfolio is equivalent to 7.3% (7.5% at 03/31/2012).<br />

<strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 130