IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Balance Sheet<br />

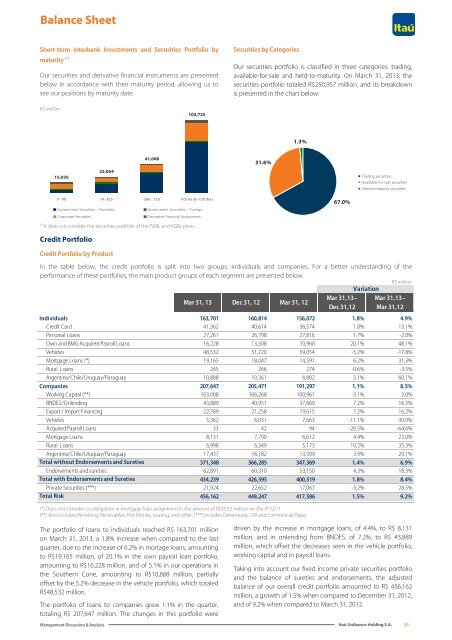

Short-term Interbank Investments and Securities Portfolio by<br />

maturity (*)<br />

Our securities and derivative financial instruments are presented<br />

below in accordance with their maturity period, allowing us to<br />

see our positions by maturity date.<br />

Securities by Categories<br />

Our securities portfolio is classified in three categories: trading,<br />

available-for-sale and held-to-maturity. On March 31, 2013, the<br />

securities portfolio totaled R$250,957 million, and its breakdown<br />

is presented in the chart below:<br />

R$ million<br />

103,725<br />

1.3%<br />

15,035<br />

23,054<br />

41,008<br />

31.6%<br />

Trading securities<br />

Available-for-sale securities<br />

Held-to-maturity securities<br />

0 - 90 91-365 366 - 720 Acima de 720 dias<br />

Government Securities – Domestic<br />

Government Securities – Foreign<br />

Corporate Securities<br />

Derivative Financial Instruments<br />

(*)<br />

It does not consider the securities portfolio of the PGBL and VGBL plans .<br />

67.0%<br />

Credit Portfolio<br />

Credit Portfolio by Product<br />

In the table below, the credit portfolio is split into two groups: individuals and companies. For a better understanding of the<br />

performance of these portfolios, the main product groups of each segment are presented below.<br />

R$ million<br />

Variation<br />

Mar 31, 13 Dec 31, 12 Mar 31, 12<br />

Mar 31,13–<br />

Dec 31,12<br />

Mar 31,13–<br />

Mar 31,12<br />

Individuals 163,701 160,814 156,072 1.8% 4.9%<br />

Credit Card 41,362 40,614 36,574 1.8% 13.1%<br />

Personal Loans 27,261 26,798 27,816 1.7% -2.0%<br />

Own and BMG Acquired Payroll Loans 16,228 13,508 10,960 20.1% 48.1%<br />

Vehicles 48,532 51,220 59,054 -5.2% -17.8%<br />

Mortgage Loans (*) 19,165 18,047 14,591 6.2% 31.3%<br />

Rural Loans 265 266 274 -0.6% -3.5%<br />

Argentina/Chile/Uruguay/Paraguay 10,888 10,361 6,802 5.1% 60.1%<br />

Companies 207,647 205,471 191,297 1.1% 8.5%<br />

Working Capital (**) 103,008 106,268 100,961 -3.1% 2.0%<br />

BNDES/Onlending 43,889 40,951 37,669 7.2% 16.5%<br />

Export / Import Financing 22,789 21,258 19,615 7.2% 16.2%<br />

Vehicles 5,362 6,031 7,663 -11.1% -30.0%<br />

Acquired Payroll Loans 33 42 94 -20.5% -64.6%<br />

Mortgage Loans 8,131 7,790 6,612 4.4% 23.0%<br />

Rural Loans 6,998 6,349 5,173 10.2% 35.3%<br />

Argentina/Chile/Uruguay/Paraguay 17,437 16,782 13,509 3.9% 29.1%<br />

Total without Endorsements and Sureties 371,348 366,285 347,369 1.4% 6.9%<br />

Endorsements and sureties 62,891 60,310 53,150 4.3% 18.3%<br />

Total with Endorsements and Sureties 434,239 426,595 400,519 1.8% 8.4%<br />

Private Securities (***) 21,924 22,652 17,067 -3.2% 28.5%<br />

Total Risk 456,162 449,247 417,586 1.5% 9.2%<br />

(*) Does not consider co-obligation in mortgage loan assignment in the amount of R$353.5 million on the 4 th Q/11.<br />

(**) Also includes Revolving, Receivables, Hot Money, Leasing, and other; (***) Includes Debentures, CRI and Commercial Paper.<br />

The portfolio of loans to individuals reached R$ 163,701 million<br />

on March 31, 2013, a 1.8% increase when compared to the last<br />

quarter, due to the increase of 6.2% in mortage loans, amounting<br />

to R$19,165 million, of 20.1% in the own payroll loan portfolio,<br />

amounting to R$16,228 million, and of 5.1% in our operations in<br />

the Southern Cone, amounting to R$10,888 million, partially<br />

offset by the 5.2% decrease in the vehicle portfolio, which totaled<br />

R$48,532 million.<br />

The portfolio of loans to companies grew 1.1% in the quarter,<br />

totaling R$ 207,647 million. The changes in this portfolio were<br />

driven by the increase in mortgage loans, of 4.4%, to R$ 8,131<br />

million, and in onlending from BNDES, of 7.2%, to R$ 43,889<br />

million, which offset the decreases seen in the vehicle portfolio,<br />

working capital and in payroll loans.<br />

Taking into account our fixed income private securities portfolio<br />

and the balance of sureties and endorsements, the adjusted<br />

balance of our overall credit portfolio amounted to R$ 456,162<br />

million, a growth of 1.5% when compared to December 31, 2012,<br />

and of 9.2% when compared to March 31, 2012.<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

29