Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

general economic growth and is expected<br />

to continue, albeit at a slower<br />

pace. Other consumers from Israel<br />

to Kuwait and Dubai, are also minor<br />

importers with limited growth expectations.<br />

SUPPLYING A GROWING MARKET<br />

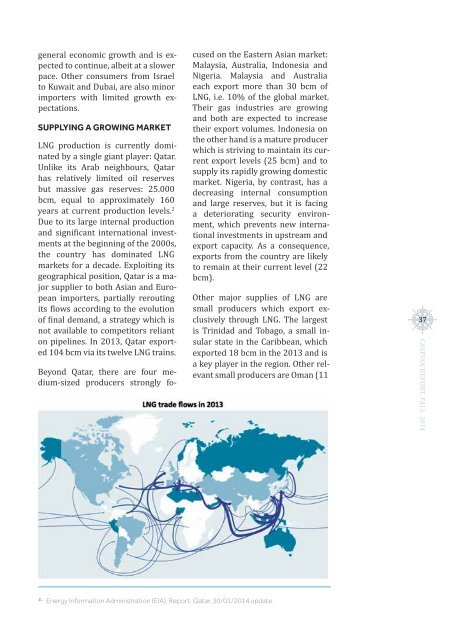

LNG production is currently dominated<br />

by a single giant player: Qatar.<br />

Unlike its Arab neighbours, Qatar<br />

has relatively limited oil reserves<br />

but massive gas reserves: 25.000<br />

bcm, equal to approximately 160<br />

years at current production levels. 2<br />

Due to its large internal production<br />

and significant international investments<br />

at the beginning of the 2000s,<br />

the country has dominated LNG<br />

markets for a decade. Exploiting its<br />

geographical position, Qatar is a major<br />

supplier to both Asian and European<br />

importers, partially rerouting<br />

its flows according to the evolution<br />

of final demand, a strategy which is<br />

not available to competitors reliant<br />

on pipelines. In 2013, Qatar exported<br />

104 bcm via its twelve LNG trains.<br />

Beyond Qatar, there are four medium-sized<br />

producers strongly focused<br />

on the Eastern Asian market:<br />

Malaysia, Australia, Indonesia and<br />

Nigeria. Malaysia and Australia<br />

each export more than 30 bcm of<br />

LNG, i.e. 10% of the global market.<br />

Their gas industries are growing<br />

and both are expected to increase<br />

their export volumes. Indonesia on<br />

the other hand is a mature producer<br />

which is striving to maintain its current<br />

export levels (25 bcm) and to<br />

supply its rapidly growing domestic<br />

market. Nigeria, by contrast, has a<br />

decreasing internal consumption<br />

and large reserves, but it is facing<br />

a deteriorating security environment,<br />

which prevents new international<br />

investments in upstream and<br />

export capacity. As a consequence,<br />

exports from the country are likely<br />

to remain at their current level (22<br />

bcm).<br />

Other major supplies of LNG are<br />

small producers which export exclusively<br />

through LNG. The largest<br />

is Trinidad and Tobago, a small insular<br />

state in the Caribbean, which<br />

exported 18 bcm in the 2013 and is<br />

a key player in the region. Other relevant<br />

small producers are Oman (11<br />

37<br />

CASPIAN REPORT, FALL <strong>2014</strong><br />

2.<br />

Energy Information Administration (EIA), <strong>Report</strong>: Qatar, 30/01/<strong>2014</strong> update.