- Page 1 and 2:

1Environmental Problems, TheirCause

- Page 3 and 4:

AirSOLAR ENERGYRESOURCESWaterEnergy

- Page 5 and 6:

changes that lead to an increasingl

- Page 7 and 8:

take the resources of 1.15 planet e

- Page 9 and 10:

Causes of Environmental Problems•

- Page 11 and 12:

Developing Countriesxx=Population (

- Page 13 and 14:

■ We should encourage earth-susta

- Page 15 and 16:

2. Write two-page scenarios describ

- Page 17 and 18:

A continent ages quickly once we co

- Page 19 and 20:

Good NewsMore foodSupported alarger

- Page 22 and 23:

Figure 2-8 Theodore (“Teddy”)Ro

- Page 24:

What Happened during the 1970s? The

- Page 27 and 28:

on which they and their ancestors h

- Page 29 and 30:

Science is an adventure of the huma

- Page 31 and 32:

CTIONSWhat Is Harmingthe Robins?Sup

- Page 33 and 34:

After building and testing a mathem

- Page 35 and 36:

I am going to give you a brief intr

- Page 37 and 38:

Figure 3-6 The pH scale, used to me

- Page 39 and 40:

The different molecules of DNA that

- Page 41 and 42:

Energy emitted from sun (kcal/cm 2

- Page 43:

aluminum foil. When solid water (ic

- Page 46 and 47:

nn23592 UUranium-235nucleus9236Kr14

- Page 48 and 49:

SolarenergyChemicalenergy(photosynt

- Page 50 and 51:

number of resource users. In other

- Page 52 and 53:

The earth’s thin film of living m

- Page 54 and 55:

(a) Eukaryotic CellNucleus(informat

- Page 56 and 57:

AtmosphereVegetationBiosphereand an

- Page 58 and 59:

Coastal chaparraland scrubConiferou

- Page 60 and 61:

NoorganismsLower limitof toleranceF

- Page 62 and 63:

Detritus feedersDecomposersLong-hor

- Page 64 and 65:

First TrophicLevelSecond TrophicLev

- Page 66 and 67:

Figure 4-20 Generalized pyramid of

- Page 68 and 69:

Terrestrial EcosystemsSwamps and ma

- Page 70 and 71:

every handful of topsoil break down

- Page 72 and 73:

suited for plant growth. It has a t

- Page 74 and 75:

Figure 4-29 Naturalcapital: simplif

- Page 76 and 77:

wildlife habitats, alter temperatur

- Page 78 and 79:

miningFertilizerexcretionuptake bya

- Page 80 and 81:

How Are Human Activities Affecting

- Page 82 and 83:

For example, people visit degraded

- Page 84 and 85:

There is grandeur to this view of l

- Page 86 and 87:

According to the theory of evolutio

- Page 88 and 89:

Black skimmerseizes small fishat wa

- Page 90 and 91:

5-4 SPECIATION, EXTINCTION,AND BIOD

- Page 92 and 93:

Scientists have also identified per

- Page 94 and 95:

Identify and extractgene with desir

- Page 96 and 97:

infrared radiation, as a rattlesnak

- Page 98 and 99:

To do science is to search for repe

- Page 100 and 101:

figure. Scientists hypothesize that

- Page 102 and 103:

ArcticCircleTropic ofCancerNorth Pa

- Page 104 and 105:

Winds can also affect regionalclima

- Page 106 and 107:

FPO(a) Rays of sunlight penetrateth

- Page 108 and 109:

ColdPolarTundraSubpolarDecreasing t

- Page 110 and 111:

Figure 6-20 Natural capital:some co

- Page 112 and 113:

Beisa oryxCape buffaloWildebeestTop

- Page 114 and 115:

Figure 6-25 Natural capitaldegradat

- Page 116 and 117:

Natural Capital DegradationGrasslan

- Page 118 and 119:

4540HarpyeagleEmergentlayer35Tocoto

- Page 120 and 121:

with sunlight available only 6-8 ho

- Page 122 and 123:

Natural Capital DegradationWhen we

- Page 124 and 125:

If there is magic on this planet, i

- Page 126 and 127:

there. Photosynthesis cannot take p

- Page 128 and 129:

Figure 7-7 View of an estuary taken

- Page 130 and 131:

Rocky Shore BeachSea starHermit cra

- Page 132 and 133:

Figure 7-12 Natural capital:some co

- Page 134 and 135:

EcologicalServicesClimatemoderation

- Page 136 and 137:

In warm months the bottom layer of

- Page 138 and 139:

According to scientists, we urgentl

- Page 140 and 141:

Animal and vegetable life is too co

- Page 142 and 143:

HighHighHighRate of immigrationor e

- Page 144 and 145:

mostly on land and eat insects that

- Page 146 and 147:

According to this hypothesis, musse

- Page 148 and 149:

Many people—influenced by movies

- Page 150 and 151:

strychnine, peyote, nicotine, and r

- Page 152 and 153:

It is tempting to think of mutualis

- Page 155 and 156:

How Do Species Replace One Another

- Page 157 and 158:

By contrast, grasslands are much le

- Page 159 and 160:

9Population EcologyPopulationContro

- Page 161 and 162:

The size of a population that inclu

- Page 163 and 164:

Number of reindeer2,0001,5001,00050

- Page 165 and 166:

Reproductive individuals in populat

- Page 167 and 168:

Percentage surviving (log scale)100

- Page 169 and 170:

A third type of alteration is using

- Page 171 and 172:

In the next chapter we will apply t

- Page 173 and 174:

The problems to be faced are vast a

- Page 175 and 176:

ates affect a country’s populatio

- Page 177 and 178:

United States Mexico CanadaPopulati

- Page 179 and 180:

and a high incidence of infectious

- Page 181 and 182:

Age100+95-9990-9485-8980-8475-7970-

- Page 183 and 184:

Age Distribution (%)403530252015105

- Page 185 and 186:

80Stage 1PreindustrialStage 2Transi

- Page 187 and 188:

also make up 70% of the world’s p

- Page 189 and 190:

Such experience also suggests that

- Page 191 and 192:

Forests precede civilizations, dese

- Page 193 and 194:

The Species ApproachGoalProtect spe

- Page 195 and 196:

parkways, trails, rivers, seashores

- Page 197 and 198:

Weak treesremovedFigure 11-8 Short

- Page 199 and 200:

AdvantagesHigher timberyieldsMaximu

- Page 201 and 202:

trees no faster than they are reple

- Page 203 and 204:

Sudden oak death White pine blister

- Page 205 and 206:

vere forest fires for two reasons.

- Page 207 and 208:

and degradation practices, Brazil

- Page 209 and 210:

SolutionsSustaining Tropical Forest

- Page 211 and 212:

• Integrate plans for managing pa

- Page 213 and 214:

Should Reserves Be as Large as Poss

- Page 215 and 216:

Figure 11-24 Endangered natural cap

- Page 217 and 218:

ity of ecosystems well enough to re

- Page 219 and 220:

original state? How much of it shou

- Page 221 and 222:

The last word in ignorance is the p

- Page 223 and 224:

Florida manatee Northern spotted ow

- Page 225 and 226:

each of these three species estimat

- Page 227 and 228:

BiophiliaBiologist EdwardO. Wilson

- Page 229 and 230:

Island species, many of them endemi

- Page 231 and 232:

Deliberately Introduced SpeciesPurp

- Page 233 and 234:

The Termite from HellForget killer

- Page 235 and 236:

© Karl Ammann. Biosynergy Institut

- Page 237 and 238:

tional Trade in Endangered Species

- Page 239 and 240:

Most people would say yes. The prob

- Page 241 and 242:

the act allows for economic concern

- Page 243 and 244:

ity, with the aim of reintroducing

- Page 245 and 246:

The Department of Defense controls

- Page 247 and 248:

13 SustainingAquatic BiodiversityBi

- Page 249 and 250:

CobiaHogfishKelpCarrageenPacific sa

- Page 251 and 252:

peated scraping. Slow-growing, long

- Page 253 and 254:

control approach and to be sure the

- Page 255 and 256:

(CITES), the 1979 Global Treaty on

- Page 257 and 258:

Beetle car, and some of its arterie

- Page 259 and 260:

What Role Can ReconciliationEcology

- Page 261 and 262:

eries. When it works, community-bas

- Page 263 and 264:

GULF OFMEXICOAgricultural areaTreat

- Page 265 and 266:

water withdrawal for irrigation. An

- Page 267 and 268:

SolutionsRebuilding Salmon Populati

- Page 269 and 270:

14 Foodand Soil ResourcesSoilBiodiv

- Page 271 and 272:

Industrialized agricultureShifting

- Page 273 and 274:

First green revolution(developed co

- Page 275 and 276:

Low-Tech Sustainable Agriculture in

- Page 277 and 278:

According to the U.S. Department of

- Page 279 and 280:

OvergrazingDeforestationErosionCaus

- Page 281 and 282:

(a) Terracing(b) Contour planting a

- Page 283 and 284:

2,000400Grain production(millions o

- Page 285 and 286:

People who are underfed and underwe

- Page 287 and 288:

14-6 INCREASING CROPPRODUCTIONWhat

- Page 289 and 290:

sistence farmers in developing coun

- Page 291 and 292:

capita meat production more than do

- Page 293 and 294:

A more expensive and less widely us

- Page 295 and 296:

Spotter airplaneFish farmingin cage

- Page 297 and 298:

estuaries. Then the fish are releas

- Page 299 and 300:

Currently, organic farming is used

- Page 301 and 302:

15 WaterResourcesWaterCASE STUDYWat

- Page 303 and 304: physically connects us to one anoth

- Page 305 and 306: Groundwater normally moves from poi

- Page 307 and 308: and wildlife could trigger “water

- Page 309 and 310: city’s water systems have been ta

- Page 311 and 312: for the dams and reservoirs and has

- Page 313 and 314: has devastated the area’s fishing

- Page 315 and 316: Aquifers provide drinking water for

- Page 317 and 318: WYOMINGCOLORADONEW MEXICOSOUTH DAKO

- Page 319 and 320: Mohamed El-Ashry of the World Resou

- Page 321 and 322: water waste by about 84% while irri

- Page 323 and 324: 15-8 TOO MUCH WATERWhat Causes Floo

- Page 325 and 326: gradually. Another way to reduce fl

- Page 327 and 328: 16 MineralGeology and NonrenewableR

- Page 329 and 330: AbyssalhillsAbyssalfloorOceanicridg

- Page 331 and 332: usually rides up over the denser oc

- Page 333 and 334: cant (less than 4.0 on the Richter

- Page 335 and 336: ported from their sources by water,

- Page 337 and 338: How Are Buried Mineral DepositsRemo

- Page 339 and 340: 16-6 ENVIRONMENTAL EFFECTSOF USING

- Page 341 and 342: Separationof ore fromgangueMetal or

- Page 343 and 344: Some analysts contend that all we n

- Page 345 and 346: Can We Find Substitutes for ScarceN

- Page 347 and 348: Typical citizens of advanced indust

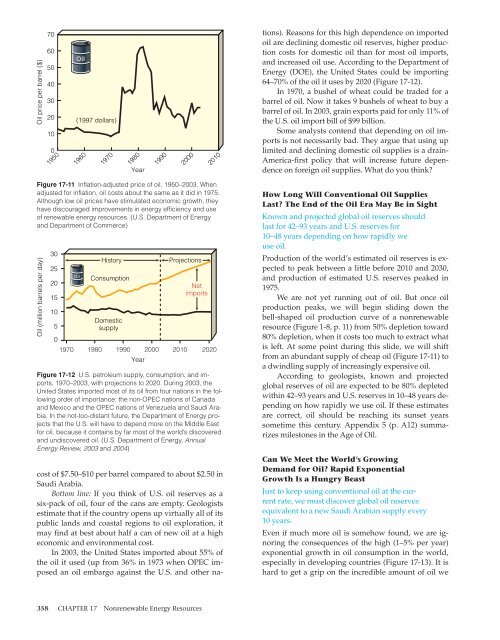

- Page 349 and 350: Figure 17-5 shows energy consumptio

- Page 351 and 352: Currently, oil has a high net energ

- Page 353: ArcticOceanCoalPrince WilliamSoundG

- Page 357 and 358: Coal-firedelectricitySynthetic oil

- Page 359 and 360: Burning natural gas emits CO 2 but

- Page 361 and 362: Trade-OffsCoalxHOW WOULD YOU VOTE?

- Page 363 and 364: Small amounts ofradioactive gasesUr

- Page 365 and 366: After more than 50 years of develop

- Page 367 and 368: CoalAmple supplyHigh net energyyiel

- Page 369 and 370: corrode and release their radioacti

- Page 371 and 372: out the entire rail or truck trip i

- Page 373 and 374: manently in 1998. Because of this e

- Page 375 and 376: 18 andEnergy EfficiencyRenewable En

- Page 377 and 378: Energy Inputs System Outputs86%8%3%

- Page 379 and 380: source. These systems have an energ

- Page 381 and 382: ABCombustion engine:Small, efficien

- Page 383 and 384: Atlanta’s 13-story Georgia Power

- Page 385 and 386: Net Energy EfficiencySuperinsulated

- Page 387 and 388: Why Are We Still Wasting So Much En

- Page 389 and 390: How Can We Cool Houses Naturally? I

- Page 391 and 392: AdvantagesFairly high netenergyWork

- Page 393 and 394: The DOE calls the Great Plains stat

- Page 395 and 396: AdvantagesLarge potentialsupply in

- Page 397 and 398: surface. Researchers in several cou

- Page 399 and 400: Primary EnergySourcesHydrogenProduc

- Page 401 and 402: Bioenergy power plantsWind farmSmal

- Page 403 and 404: Nuclear energy(fission and fusion)$

- Page 405 and 406:

19 andRisk, Toxicology,Human Health

- Page 407 and 408:

Number of individuals affectedVerys

- Page 409 and 410:

How Can We Estimate the Toxicity of

- Page 411 and 412:

dosage. With the threshold dose-res

- Page 413 and 414:

HormoneEstrogenlike chemicalAntiand

- Page 415 and 416:

19-4 BIOLOGICAL HAZARDS:DISEASE IN

- Page 417 and 418:

A typical virus consists of a shell

- Page 419 and 420:

For example, the West Nile virus ha

- Page 421 and 422:

eggs4. Parasite invadesblood cells,

- Page 423 and 424:

AgentContagiousSymptomsMortality(if

- Page 425 and 426:

Cause of DeathAnnual DeathsPoverty/

- Page 427 and 428:

■ How should limited funds be spe

- Page 429 and 430:

20 AirPollutionAirPopulationPolluti

- Page 431 and 432:

layer of rising and falling air cur

- Page 433 and 434:

Air Pollution in the Past: The Bad

- Page 435 and 436:

tems, most scientists say that it m

- Page 437 and 438:

UltrafineParticlesSea salt nucleiFi

- Page 439 and 440:

Warmer airInversion layerIncreasing

- Page 441 and 442:

4.75.45.14.75.25.35.35.55.95.54.75.

- Page 443 and 444:

when the soil pH falls below 5.1. E

- Page 445 and 446:

educe or eliminate emissions of SO

- Page 447 and 448:

FurnaceSlabSoilClothesdryerRadon-22

- Page 449 and 450:

How Many People Die Prematurely fro

- Page 451 and 452:

plant expansions, or sell them to o

- Page 453 and 454:

Cleaned gasElectrodesCleaned gasDir

- Page 455 and 456:

PreventionCover ceiling tilesand li

- Page 457 and 458:

21 andClimate ChangeOzone LossClima

- Page 459 and 460:

Average surface temperature (°C)Av

- Page 461 and 462:

380410Concentration of carbon dioxi

- Page 463 and 464:

Table 21-2 Major Characteristics of

- Page 465 and 466:

are dying because the permafrost un

- Page 467 and 468:

CellCloudsLandOceanAccording to the

- Page 469 and 470:

They suggest that this indicates th

- Page 471 and 472:

Agriculture• Shifts in food-growi

- Page 473 and 474:

ter temperatures in the Sierra Neva

- Page 475 and 476:

PreventionCut fossil fueluse (espec

- Page 477 and 478:

taxes on carbon emissions or fuel u

- Page 479 and 480:

What Can You Do?Reducing CO 2 Emiss

- Page 481 and 482:

Ultraviolet light hits a chlorofluo

- Page 483 and 484:

ozone in the stratosphere. From a h

- Page 485 and 486:

Abundance (parts per trillion)INDIV

- Page 487 and 488:

22 WaterPollutionWaterPollutionCont

- Page 489 and 490:

Table 22-2 Common Diseases Transmit

- Page 491 and 492:

Because point sources are at specif

- Page 493 and 494:

veloped countries. Two causes of th

- Page 495 and 496:

Nitrogen compoundsproduced by carsa

- Page 497 and 498:

ties of acids, pesticides, and othe

- Page 499 and 500:

ern India drink groundwater contami

- Page 501 and 502:

100 kilometers (62 miles) of the co

- Page 503 and 504:

Dumping industrial waste off U.S. c

- Page 505 and 506:

The key to protecting oceans is to

- Page 507 and 508:

PrimarySecondaryGritBar screen cham

- Page 509 and 510:

where bacteria break down remaining

- Page 511 and 512:

Officials are working to find ways

- Page 513 and 514:

It is a hard truth to swallow, but

- Page 515 and 516:

A weed is a plant whose virtues hav

- Page 517 and 518:

veloped countries, but use in devel

- Page 519 and 520:

U.S. Department of Agricultureresis

- Page 521 and 522:

What Goes Around CanCome AroundU.S.

- Page 523 and 524:

our bodies, and we should be concer

- Page 525 and 526:

U.S. Department of AgricultureAgric

- Page 527 and 528:

and opposition from agricultural ch

- Page 529 and 530:

Solid wastes are only raw materials

- Page 531 and 532:

24-2 PRODUCING LESS WASTEWhat Are O

- Page 533 and 534:

PharmaceuticalplantSludgeLocal farm

- Page 535 and 536:

matter and energy resources, cuts p

- Page 537 and 538:

Reduces globalwarmingReduces acidde

- Page 539 and 540:

xHOW WOULD YOU VOTE? Should househo

- Page 541 and 542:

Disposalwaste, pollutionUsebleach,d

- Page 543 and 544:

What Are the Advantages and Disadva

- Page 545 and 546:

What Harmful Chemicals Are in Your

- Page 547 and 548:

icals. Scientists are testing the u

- Page 549 and 550:

Most hazardous waste in the United

- Page 551 and 552:

PreventionPhase out leadedgasoline

- Page 553 and 554:

EPA advised women who may become pr

- Page 555 and 556:

When they can be found, responsible

- Page 557 and 558:

out use of these chemicals and to d

- Page 559 and 560:

25 SustainableCitiesBiodiversityEne

- Page 561 and 562:

Karachi10.4 million16.2 millionDhak

- Page 563 and 564:

Image provided courtesy of theU.S.

- Page 565 and 566:

InputsOutputsEnergyFoodWaterRawmate

- Page 567 and 568:

Despite joblessness, squalor, overc

- Page 569 and 570:

day—and injure another 15 million

- Page 571 and 572:

T rade-OffsMass Transit RailT rade-

- Page 573 and 574:

area (Figure 25-7) between 1862 and

- Page 575 and 576:

MajorhighwaysGreenbeltUrban centerS

- Page 577 and 578:

powered motorcycles by 2007, and is

- Page 579 and 580:

26 andEconomics, Environment,Sustai

- Page 581 and 582:

price matches what buyers are willi

- Page 583 and 584:

SunEARTHFigure 26-4 Ecological econ

- Page 585 and 586:

CostHighLowOptimum pollutionclean-u

- Page 587 and 588:

onment, their flow rates through th

- Page 589 and 590:

cluding costs, as much as possible,

- Page 591 and 592:

• Decreases depletion and degrada

- Page 593 and 594:

Should We Rely More on Tradable Pol

- Page 595 and 596:

Figure 26-14 Data on the global dis

- Page 597 and 598:

Microloans to the PoorMost of thewo

- Page 599 and 600:

Sunset BusinessesCoal miningOil pro

- Page 601 and 602:

27 andPolitics, Environment,Sustain

- Page 603 and 604:

ness, and environmental leaders and

- Page 605 and 606:

Leaders are persons whom other peop

- Page 607 and 608:

issue as the key to making governme

- Page 609 and 610:

LobbyistsLobbyistsLawmaking bodyPub

- Page 611 and 612:

19691970197119721973197419751976197

- Page 613 and 614:

noise to certain levels or to elimi

- Page 615 and 616:

The spearhead of the global conserv

- Page 617 and 618:

Such audits have resulted in numero

- Page 619 and 620:

natural capital. According to envir

- Page 621 and 622:

Speth and several other national an

- Page 623 and 624:

■ Open all discussions and findin

- Page 625 and 626:

7. Explain why you agree or disagre

- Page 627 and 628:

The main ingredients of an environm

- Page 629 and 630:

global economy with minimal governm

- Page 631 and 632:

What Is the Environmental WisdomWor

- Page 633 and 634:

onmental education. They cite some

- Page 635 and 636:

What Are Our Basic Needs?Obviously,

- Page 637 and 638:

new relationship with the earth tha

- Page 639 and 640:

APPENDIX 1UNITS OF MEASURELENGTHMet

- Page 641 and 642:

1930s 1940s 1950s1938 Federal Food,

- Page 643 and 644:

1970s1971Biologist BarryCommonerpub

- Page 645 and 646:

1991-2000Continuing efforts by anti

- Page 647 and 648:

OHcommon covalent compounds, formed

- Page 649 and 650:

A PPENDIX 4CLASSIFYING AND NAMING S

- Page 651 and 652:

GLOSSARYabiotic Nonliving. Compare

- Page 653 and 654:

CFCsSee chlorofluorocarbons.chain r

- Page 655 and 656:

timeters (10 inches) a year. Such a

- Page 657 and 658:

eutrophication Physical, chemical,

- Page 659 and 660:

high-throughput economy The situati

- Page 661 and 662:

distribution facilities. Compare hu

- Page 663 and 664:

and with atoms of one or more other

- Page 665 and 666:

adioactive decay Change of a radioi

- Page 667 and 668:

soil permeability Rate at which wat

- Page 669:

transmissible disease A disease tha