Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

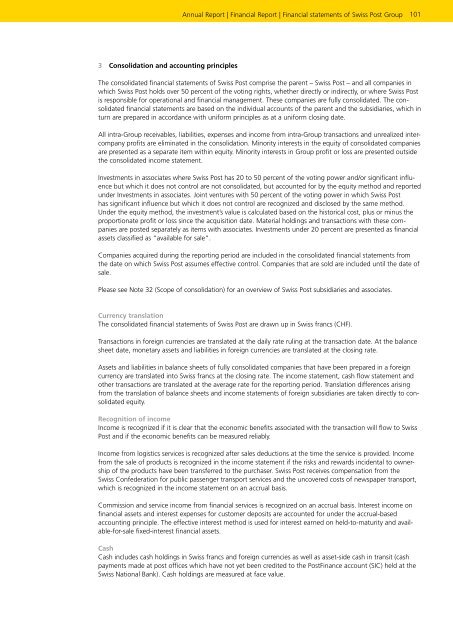

3 Consolidation and accounting principles<br />

Annual Report | Financial Report | Financial statements of Swiss <strong>Post</strong> Group<br />

The consolidated financial statements of Swiss <strong>Post</strong> comprise the parent – Swiss <strong>Post</strong> – and all companies in<br />

which Swiss <strong>Post</strong> holds over 50 percent of the voting rights, whether directly or indirectly, or where Swiss <strong>Post</strong><br />

is responsible for operational and financial management. These companies are fully consolidated. The consolidated<br />

financial statements are based on the individual accounts of the parent and the subsidiaries, which in<br />

turn are prepared in accordance with uniform principles as at a uniform closing date.<br />

All intraGroup receivables, liabilities, expenses and income from intraGroup transactions and unrealized intercompany<br />

profits are eliminated in the consolidation. Minority interests in the equity of consolidated companies<br />

are presented as a separate item within equity. Minority interests in Group profit or loss are presented outside<br />

the consolidated income statement.<br />

Investments in associates where Swiss <strong>Post</strong> has 20 to 50 percent of the voting power and/or significant influence<br />

but which it does not control are not consolidated, but accounted for by the equity method and reported<br />

under Investments in associates. Joint ventures with 50 percent of the voting power in which Swiss <strong>Post</strong><br />

has significant influence but which it does not control are recognized and disclosed by the same method.<br />

Under the equity method, the investment’s value is calculated based on the historical cost, plus or minus the<br />

proportionate profit or loss since the acquisition date. Material holdings and transactions with these companies<br />

are posted separately as items with associates. Investments under 20 percent are presented as financial<br />

assets classified as “available for sale“.<br />

Companies acquired during the reporting period are included in the consolidated financial statements from<br />

the date on which Swiss <strong>Post</strong> assumes effective control. Companies that are sold are included until the date of<br />

sale.<br />

Please see Note 32 (Scope of consolidation) for an overview of Swiss <strong>Post</strong> subsidiaries and associates.<br />

Currency translation<br />

The consolidated financial statements of Swiss <strong>Post</strong> are drawn up in Swiss francs (CHF).<br />

Transactions in foreign currencies are translated at the daily rate ruling at the transaction date. At the balance<br />

sheet date, monetary assets and liabilities in foreign currencies are translated at the closing rate.<br />

Assets and liabilities in balance sheets of fully consolidated companies that have been prepared in a foreign<br />

currency are translated into Swiss francs at the closing rate. The income statement, cash flow statement and<br />

other transactions are translated at the average rate for the reporting period. Translation differences arising<br />

from the translation of balance sheets and income statements of foreign subsidiaries are taken directly to consolidated<br />

equity.<br />

Recognition of income<br />

Income is recognized if it is clear that the economic benefits associated with the transaction will flow to Swiss<br />

<strong>Post</strong> and if the economic benefits can be measured reliably.<br />

Income from logistics services is recognized after sales deductions at the time the service is provided. Income<br />

from the sale of products is recognized in the income statement if the risks and rewards incidental to ownership<br />

of the products have been transferred to the purchaser. Swiss <strong>Post</strong> receives compensation from the<br />

Swiss Confederation for public passenger transport services and the uncovered costs of newspaper transport,<br />

which is recognized in the income statement on an accrual basis.<br />

Commission and service income from financial services is recognized on an accrual basis. Interest income on<br />

financial assets and interest expenses for customer deposits are accounted for under the accrualbased<br />

accounting principle. The effective interest method is used for interest earned on heldtomaturity and availableforsale<br />

fixedinterest financial assets.<br />

Cash<br />

Cash includes cash holdings in Swiss francs and foreign currencies as well as assetside cash in transit (cash<br />

payments made at post offices which have not yet been credited to the <strong>Post</strong>Finance account (SIC) held at the<br />

Swiss National Bank). Cash holdings are measured at face value.<br />

101