Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

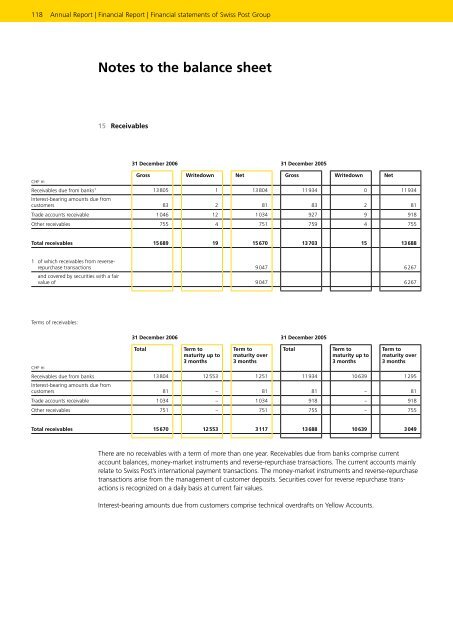

118 Annual Report | Financial Report | Financial statements of Swiss <strong>Post</strong> Group<br />

CHF m<br />

Notes to the balance sheet<br />

15 Receivables<br />

31 December 2006 31 December 2005<br />

Gross Writedown Net Gross Writedown Net<br />

Receivables due from banks 1 13 805 1 13 804 11 934 0 11 934<br />

Interestbearing amounts due from<br />

customers 83 2 81 83 2 81<br />

Trade accounts receivable 1 046 12 1 034 927 9 918<br />

Other receivables 755 4 751 759 4 755<br />

Total receivables 15 689 19 15 670 13 703 15 13 688<br />

1<br />

of which receivables from reverserepurchase<br />

transactions<br />

and covered by securities with a fair<br />

9 047 6 267<br />

value of 9 047 6 267<br />

Terms of receivables:<br />

31 December 2006 31 December 2005<br />

Total Term to<br />

maturity up to<br />

3 months<br />

Term to<br />

maturity over<br />

3 months<br />

Total Term to<br />

maturity up to<br />

3 months<br />

Term to<br />

maturity over<br />

3 months<br />

CHF m<br />

Receivables due from banks<br />

Interestbearing amounts due from<br />

13 804 12 553 1 251 11 934 10 639 1 295<br />

customers 81 – 81 81 – 81<br />

Trade accounts receivable 1 034 – 1 034 918 – 918<br />

Other receivables 751 – 751 755 – 755<br />

Total receivables 15 670 12 553 3 117 13 688 10 639 3 049<br />

There are no receivables with a term of more than one year. Receivables due from banks comprise current<br />

account balances, moneymarket instruments and reverserepurchase transactions. The current accounts mainly<br />

relate to Swiss <strong>Post</strong>’s international payment transactions. The moneymarket instruments and reverserepurchase<br />

transactions arise from the management of customer deposits. Securities cover for reverse repurchase transactions<br />

is recognized on a daily basis at current fair values.<br />

Interestbearing amounts due from customers comprise technical overdrafts on Yellow Accounts.