Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

130 Annual Report | Financial Report | Financial statements of Swiss <strong>Post</strong> Group<br />

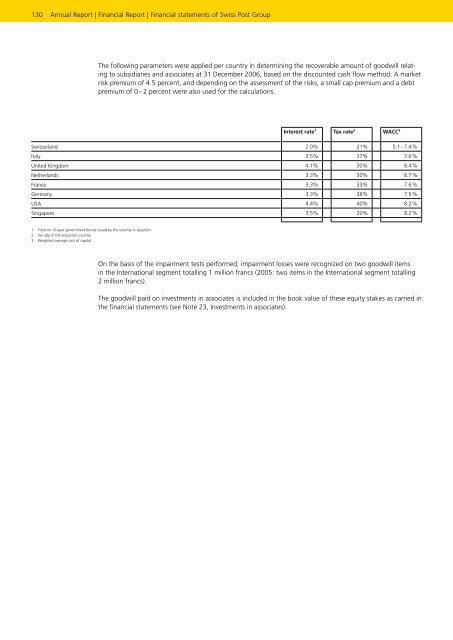

The following parameters were applied per country in determining the recoverable amount of goodwill relating<br />

to subsidiaries and associates at 31 December 2006, based on the discounted cash flow method. A market<br />

risk premium of 4.5 percent, and depending on the assessment of the risks, a small cap premium and a debt<br />

premium of 0 – 2 percent were also used for the calculations.<br />

Interest rate 1 Tax rate 2 WACC 3<br />

Switzerland 2.0% 21% 5.1 – 7.4 %<br />

Italy 3.5% 37% 7.6 %<br />

United Kingdom 4.1% 30% 8.4 %<br />

Netherlands 3.3% 30% 8.7 %<br />

France 3.3% 33% 7.6 %<br />

Germany 3.3% 38% 7.5 %<br />

USA 4.4% 40% 8.2 %<br />

Singapore 3.5% 20% 8.2 %<br />

1 Yield on 10year government bonds issued by the country in question.<br />

2 Tax rate in the acquiree’s country.<br />

3 Weighted average cost of capital.<br />

On the basis of the impairment tests performed, impairment losses were recognized on two goodwill items<br />

in the International segment totalling 1 million francs (2005: two items in the International segment totalling<br />

2 million francs).<br />

The goodwill paid on investments in associates is included in the book value of these equity stakes as carried in<br />

the financial statements (see Note 23, Investments in associates).