Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

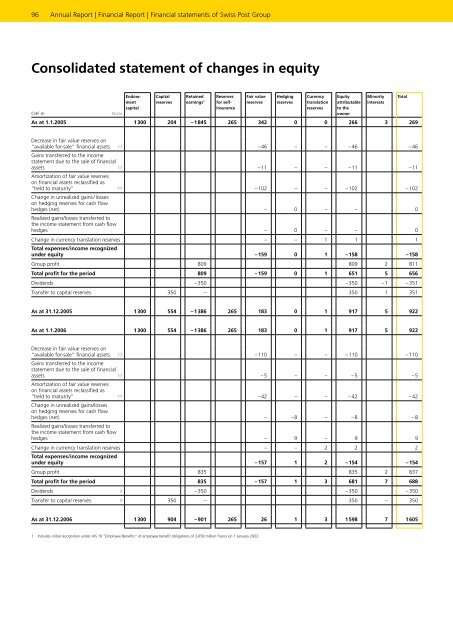

96 Annual Report | Financial Report | Financial statements of Swiss <strong>Post</strong> Group<br />

Consolidated statement of changes in equity<br />

Endowment<br />

capital<br />

Capital<br />

reserves<br />

Retained<br />

earnings 1<br />

Reserves<br />

for selfinsurance<br />

Fair value<br />

reserves<br />

Hedging<br />

reserves<br />

Currency<br />

translation<br />

reserves<br />

Equity<br />

attributable<br />

to the<br />

owner<br />

Minority<br />

interests<br />

CHF m Note<br />

As at 1.1.2005 1 300 204 – 1 845 265 342 0 0 266 3 269<br />

Decrease in fair value reserves on<br />

“available forsale” financial assets<br />

Gains transferred to the income<br />

17 – 46 – – – 46 – 46<br />

statement due to the sale of financial<br />

assets<br />

Amortization of fair value reserves<br />

on financial assets reclassified as<br />

17 – 11 – – – 11 – 11<br />

“held to maturity”<br />

Change in unrealized gains / losses<br />

on hedging reserves for cash flow<br />

17 – 102 – – – 102 – 102<br />

hedges (net)<br />

Realized gains/losses transferred to<br />

– 0 – – 0<br />

the income statement from cash flow<br />

hedges – 0 – – 0<br />

Change in currency translation reserves<br />

Total expenses/income recognized<br />

– – 1 1 1<br />

under equity – 159 0 1 – 158 – 158<br />

Group profit 809 809 2 811<br />

Total profit for the period 809 – 159 0 1 651 5 656<br />

Dividends – 350 – 350 – 1 – 351<br />

Transfer to capital reserves 350 – 350 1 351<br />

As at 31.12.2005 1 300 554 – 1 386 265 183 0 1 917 5 922<br />

As at 1.1.2006 1 300 554 – 1 386 265 183 0 1 917 5 922<br />

Decrease in fair value reserves on<br />

“available forsale” financial assets<br />

Gains transferred to the income<br />

17 – 110 – – – 110 – 110<br />

statement due to the sale of financial<br />

assets<br />

Amortization of fair value reserves<br />

on financial assets reclassified as<br />

17 – 5 – – – 5 – 5<br />

“held to maturity”<br />

Change in unrealized gains/losses<br />

on hedging reserves for cash flow<br />

17 – 42 – – – 42 – 42<br />

hedges (net)<br />

Realized gains/losses transferred to<br />

– – 8 – – 8 – 8<br />

the income statement from cash flow<br />

hedges – 9 – 9 9<br />

Change in currency translation reserves<br />

Total expenses/income recognized<br />

– – 2 2 2<br />

under equity – 157 1 2 – 154 – 154<br />

Group profit 835 835 2 837<br />

Total profit for the period 835 – 157 1 3 681 7 688<br />

Dividends 9 – 350 – 350 – 350<br />

Transfer to capital reserves 9 350 – 350 – 350<br />

As at 31.12.2006 1 300 904 – 901 265 26 1 3 1 598 7 1 605<br />

1 Includes initial recognition under IAS 19 “Employee Benefits” of employee benefit obligations of 3,658 million francs on 1 January 2002.<br />

Total