Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

86 Annual Report | Financial Report | Financial commentary<br />

Group result<br />

The value of the company<br />

In accordance with the Federal Council’s strategic targets, Swiss <strong>Post</strong> must increase the company’s value. This is<br />

measured in terms of value added (VA). The VA is an absolute figure (millions of francs) and indicates how<br />

much added value the company as a whole or a specific unit generates. Value added is created when, after<br />

being adjusted for tax, the operating result exceeds the required interest on invested capital (operating assets<br />

multiplied by the weighted cost of capital). In addition to net operating profit after tax, this approach also<br />

takes into account the risks (cost of capital) and the capital employed (net operating assets). For the Financial<br />

<strong>Service</strong>s segment, the value is determined on the basis of equity, calculated in accordance with the regulations<br />

of Basel II, instead of the operating assets.<br />

In 2006, Swiss <strong>Post</strong> once again fulfilled the Federal Council’s expectations and generated value added of<br />

532 million francs. The calculation was based on a cost of equity of 10 percent for Financial <strong>Service</strong>s and for<br />

the other business areas on an average equity and debtweighted cost of capital for the Group of 7.2 percent.<br />

The increase in the value of the company stagnated year on year due to the fact that the higher operating<br />

capital (growthdriven increase in equity at <strong>Post</strong>Finance, acquisitions) offset the positive effect of the rise in<br />

profits.<br />

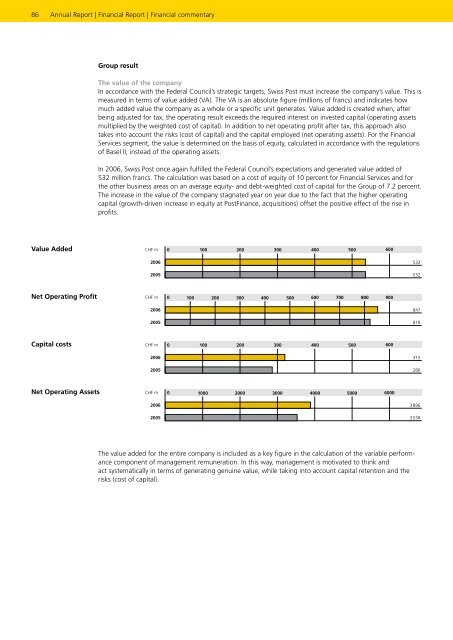

Value Added CHF m 0 100 200 300 400<br />

500<br />

600<br />

2006<br />

2005<br />

Net Operating Profit CHF m 0 100 200 300 400 500 600 700 800 900<br />

2006<br />

2005<br />

Capital costs CHF m 0<br />

100 200 300 400<br />

500<br />

600<br />

2006<br />

2005<br />

Net Operating Assets CHF m 0<br />

1000 2000 3000<br />

4000<br />

5000<br />

6000<br />

2006<br />

2005<br />

The value added for the entire company is included as a key figure in the calculation of the variable performance<br />

component of management remuneration. In this way, management is motivated to think and<br />

act systematically in terms of generating genuine value, while taking into account capital retention and the<br />

risks (cost of capital).<br />

532<br />

532<br />

847<br />

818<br />

315<br />

286<br />

3 896<br />

3 538