Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

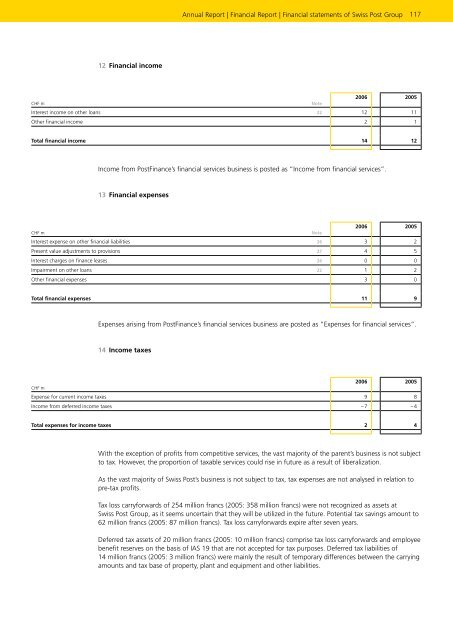

12 Financial income<br />

Annual Report | Financial Report | Financial statements of Swiss <strong>Post</strong> Group<br />

CHF m Note<br />

117<br />

2006 2005<br />

Interest income on other loans 22 12 11<br />

Other financial income 2 1<br />

Total financial income 14 12<br />

Income from <strong>Post</strong>Finance’s financial services business is posted as “Income from financial services”.<br />

13 Financial expenses<br />

CHF m Note<br />

2006 2005<br />

Interest expense on other financial liabilities 26 3 2<br />

Present value adjustments to provisions 27 4 5<br />

Interest charges on finance leases 26 0 0<br />

Impairment on other loans 22 1 2<br />

Other financial expenses 3 0<br />

Total financial expenses 11 9<br />

CHF m<br />

Expenses arising from <strong>Post</strong>Finance’s financial services business are posted as “Expenses for financial services”.<br />

14 Income taxes<br />

2006 2005<br />

Expense for current income taxes 9 8<br />

Income from deferred income taxes – 7 – 4<br />

Total expenses for income taxes 2 4<br />

With the exception of profits from competitive services, the vast majority of the parent’s business is not subject<br />

to tax. However, the proportion of taxable services could rise in future as a result of liberalization.<br />

As the vast majority of Swiss <strong>Post</strong>’s business is not subject to tax, tax expenses are not analysed in relation to<br />

pretax profits.<br />

Tax loss carryforwards of 254 million francs (2005: 358 million francs) were not recognized as assets at<br />

Swiss <strong>Post</strong> Group, as it seems uncertain that they will be utilized in the future. Potential tax savings amount to<br />

62 million francs (2005: 87 million francs). Tax loss carryforwards expire after seven years.<br />

Deferred tax assets of 20 million francs (2005: 10 million francs) comprise tax loss carryforwards and employee<br />

benefit reserves on the basis of IAS 19 that are not accepted for tax purposes. Deferred tax liabilities of<br />

14 million francs (2005: 3 million francs) were mainly the result of temporary differences between the carrying<br />

amounts and tax base of property, plant and equipment and other liabilities.