Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Annual Report | Financial Report | Financial statements of Swiss <strong>Post</strong> Group<br />

Cash flow hedges are used to hedge future transactions. Changes in value to the extent a hedge is effective<br />

are recognized in equity, while changes in value to the extent a hedge is ineffective are recognized in the income<br />

statement.<br />

Derivatives that are not accounted for using hedge accounting are treated as instruments held for trading.<br />

Derivative financial instruments acquired for trading purposes are recognized at fair value when the transaction<br />

is concluded and are subsequently measured at fair value. Changes in the fair value of instruments held<br />

for trading are recognized in the income statement.<br />

The fair values of financial instruments are determined on the basis of stock market prices and valuation models<br />

(annuity method, etc.). For listed financial instruments, the fair values correspond to the market prices.<br />

For unlisted monetary financial instruments, the fair values are determined by discounting the cash flows, using<br />

the current interest rate applicable to similar instruments with the same maturity.<br />

Repurchase and reverse repurchase (repo) transactions and securities lending transactions<br />

Cash outflows arising from reverse repurchase transactions are stated as receivables due from banks. Financial<br />

assets obtained from transactions as collateral are not recognized in the balance sheet. Transactions are<br />

accounted for in the balance sheet on their due date. Interest income from reverse repurchase transactions is<br />

accounted for under the accrualbased accounting principle.<br />

Financial assets transferred as collateral in repurchase transactions continue to be recognized in the balance<br />

sheet under “Financial assets“. The cash inflow is reported under “Other financial liabilities“. Interest expenses<br />

from repurchase transactions are accounted for under the accrualbased accounting principle.<br />

In respect of securities lending and borrowing, Swiss <strong>Post</strong> engages in securities lending only. The loaned financial<br />

instruments continue to be recognized in the balance sheet as financial assets.<br />

Securities cover for repurchase, reverse repurchase and securities lending transactions is recognized on a daily<br />

basis at current fair values.<br />

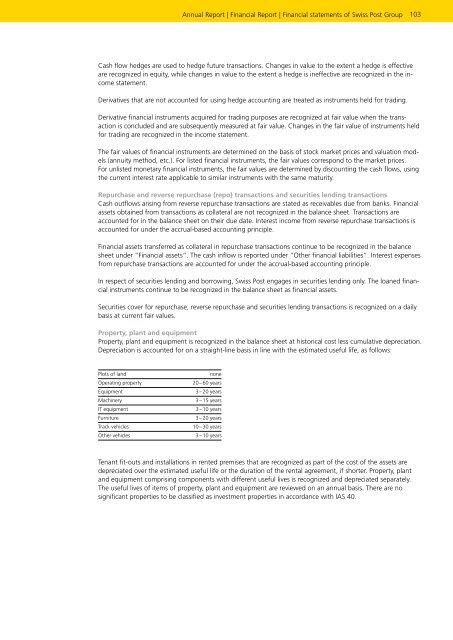

Property, plant and equipment<br />

Property, plant and equipment is recognized in the balance sheet at historical cost less cumulative depreciation.<br />

Depreciation is accounted for on a straightline basis in line with the estimated useful life, as follows:<br />

Plots of land none<br />

Operating property 20 – 60 years<br />

Equipment 3 – 20 years<br />

Machinery 3 – 15 years<br />

IT equipment 3 – 10 years<br />

Furniture 3 – 20 years<br />

Track vehicles 10 – 30 years<br />

Other vehicles 3 – 10 years<br />

Tenant fitouts and installations in rented premises that are recognized as part of the cost of the assets are<br />

depreciated over the estimated useful life or the duration of the rental agreement, if shorter. Property, plant<br />

and equipment comprising components with different useful lives is recognized and depreciated separately.<br />

The useful lives of items of property, plant and equipment are reviewed on an annual basis. There are no<br />

significant properties to be classified as investment properties in accordance with IAS 40.<br />

103