Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

Service-oriented - Die Schweizerische Post

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

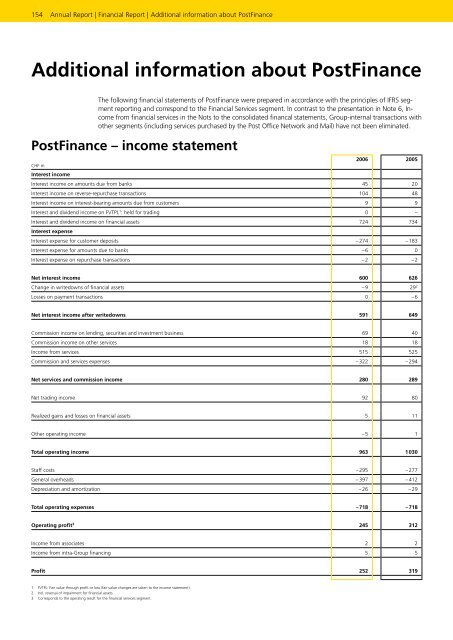

154 Annual Report | Financial Report | Additional information about <strong>Post</strong>Finance<br />

Additional information about <strong>Post</strong>Finance<br />

The following financial statements of <strong>Post</strong>Finance were prepared in accordance with the principles of IFRS segment<br />

reporting and correspond to the Financial <strong>Service</strong>s segment. In contrast to the presentation in Note 6, Income<br />

from financial services in the Nots to the consolidated financal statements, Groupinternal transactions with<br />

other segments (including services purchased by the <strong>Post</strong> Office Network and Mail) have not been eliminated.<br />

<strong>Post</strong>Finance – income statement<br />

2006 2005<br />

CHF m<br />

Interest income<br />

Interest income on amounts due from banks 45 20<br />

Interest income on reverserepurchase transactions<br />

Interest income on interestbearing amounts due from customers<br />

Interest and dividend income on FVTPL1 104<br />

48<br />

9<br />

9<br />

: held for trading<br />

0<br />

–<br />

Interest and dividend income on financial assets<br />

Interest expense<br />

724<br />

734<br />

Interest expense for customer deposits<br />

– 274<br />

– 183<br />

Interest expense for amounts due to banks<br />

– 6<br />

0<br />

Interest expense on repurchase transactions<br />

– 2<br />

– 2<br />

Net interest income<br />

Change in writedowns of financial assets<br />

Losses on payment transactions<br />

Net interest income after writedowns 591 649<br />

Commission income on lending, securities and investment business<br />

69<br />

40<br />

Commission income on other services<br />

18<br />

18<br />

Income from services 515 525<br />

Commission and services expenses – 322 – 294<br />

Net services and commission income 280 289<br />

Net trading income 92 80<br />

Realized gains and losses on financial assets 5 11<br />

Other operating income – 5 1<br />

Total operating income 963 1 030<br />

Staff costs – 295 – 277<br />

General overheads – 397 – 412<br />

Depreciation and amortization – 26 – 29<br />

Total operating expenses – 718 – 718<br />

Operating profit 3 245 312<br />

Income from associates 2 2<br />

Income from intraGroup financing 5 5<br />

Profit 252 319<br />

1 FVTPL: Fair value through profit or loss (fair value changes are taken to the income statement).<br />

2 Incl. reversal of impairment for financial assets.<br />

3 Corresponds to the operating result for the financial services segment.<br />

600<br />

– 9<br />

0<br />

626<br />

29 2<br />

– 6