IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

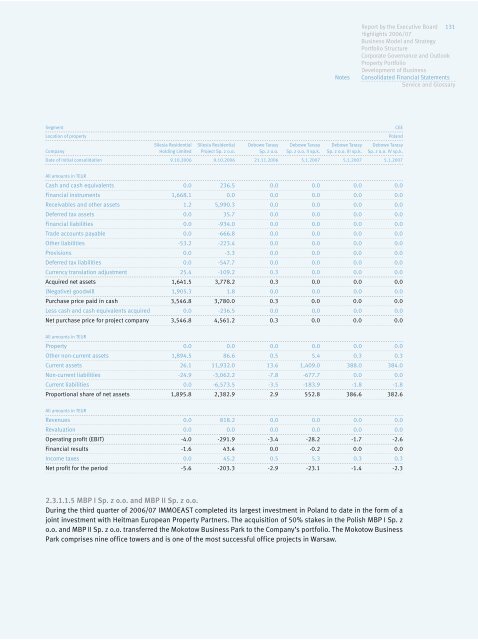

Segment CEE<br />

Location of property Poland<br />

Silesia Residential Silesia Residential Debowe Tarasy Debowe Tarasy Debowe Tarasy Debowe Tarasy<br />

Company Holding Limited Project Sp. z o.o. Sp. z o.o. Sp. z o.o. II sp.k. Sp. z o.o. III sp.k. Sp. z o.o. IV sp.k.<br />

Date of initial consolidation 9.10.<strong>2006</strong> 9.10.<strong>2006</strong> 21.11.<strong>2006</strong> 5.1.20<strong>07</strong> 5.1.20<strong>07</strong> 5.1.20<strong>07</strong><br />

All amounts in TEUR<br />

Cash and cash equivalents 0.0 236.5 0.0 0.0 0.0 0.0<br />

Financial instruments 1,668.1 0.0 0.0 0.0 0.0 0.0<br />

Receivables and other assets 1.2 5,990.3 0.0 0.0 0.0 0.0<br />

Deferred tax assets 0.0 35.7 0.0 0.0 0.0 0.0<br />

Financial liabilities 0.0 -934.0 0.0 0.0 0.0 0.0<br />

Trade accounts payable 0.0 -666.8 0.0 0.0 0.0 0.0<br />

Other liabilities -53.2 -223.4 0.0 0.0 0.0 0.0<br />

Provisions 0.0 -3.3 0.0 0.0 0.0 0.0<br />

Deferred tax liabilities 0.0 -547.7 0.0 0.0 0.0 0.0<br />

Currency translation adjustment 25.4 -109.2 0.3 0.0 0.0 0.0<br />

Acquired net assets 1,641.5 3,778.2 0.3 0.0 0.0 0.0<br />

(Negative) goodwill 1,905.3 1.8 0.0 0.0 0.0 0.0<br />

Purchase price paid in cash 3,546.8 3,780.0 0.3 0.0 0.0 0.0<br />

Less cash and cash equivalents acquired 0.0 -236.5 0.0 0.0 0.0 0.0<br />

Net purchase price for project company 3,546.8 4,561.2 0.3 0.0 0.0 0.0<br />

All amounts in TEUR<br />

Property 0.0 0.0 0.0 0.0 0.0 0.0<br />

Other non-current assets 1,894.5 86.6 0.5 5.4 0.3 0.3<br />

Current assets 26.1 11,932.0 13.6 1,409.0 388.0 384.0<br />

Non-current liabilities -24.9 -3,062.2 -7.8 -677.7 0.0 0.0<br />

Current liabilities 0.0 -6,573.5 -3.5 -183.9 -1.8 -1.8<br />

Proportional share of net assets 1,895.8 2,382.9 2.9 552.8 386.6 382.6<br />

All amounts in TEUR<br />

Revenues 0.0 818.2 0.0 0.0 0.0 0.0<br />

Revaluation 0.0 0.0 0.0 0.0 0.0 0.0<br />

Operating profit (EBIT) -4.0 -291.9 -3.4 -28.2 -1.7 -2.6<br />

Financial results -1.6 43.4 0.0 -0.2 0.0 0.0<br />

Income taxes 0.0 45.2 0.5 5.3 0.3 0.3<br />

Net profit for the period -5.6 -203.3 -2.9 -23.1 -1.4 -2.3<br />

2.3.1.1.5 MBP I Sp. z o.o. and MBP II Sp. z o.o.<br />

During the third quarter of <strong>2006</strong>/<strong>07</strong> <strong>IMMOEAST</strong> completed its largest investment in Poland to date in the form of a<br />

joint investment with Heitman European Property Partners. The acquisition of 50% stakes in the Polish MBP I Sp. z<br />

o.o. and MBP II Sp. z o.o. transferred the Mokotow Business Park to the Company’s portfolio. The Mokotow Business<br />

Park comprises nine office towers and is one of the most successful office projects in Warsaw.<br />

Notes<br />

<strong>Report</strong> by the Executive Board 131<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary