IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

192 <strong>IMMOEAST</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>/<strong>07</strong><br />

IAS 38.118<br />

IAS 38.122<br />

(a), (d)<br />

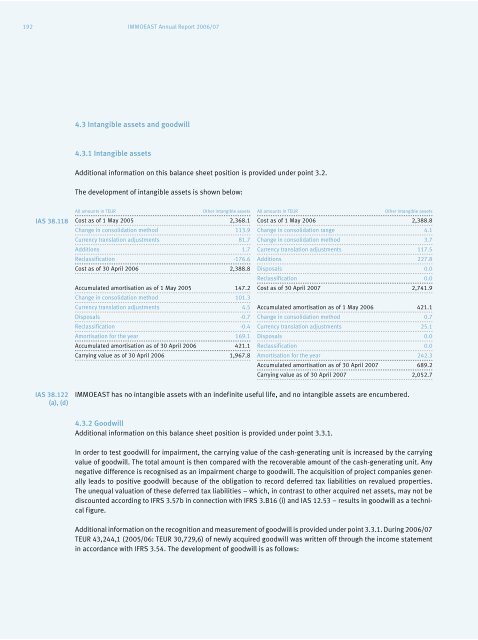

4.3 Intangible assets and goodwill<br />

4.3.1 Intangible assets<br />

Additional information on this balance sheet position is provided under point 3.2.<br />

The development of intangible assets is shown below:<br />

All amounts in TEUR Other intangible assets<br />

Cost as of 1 May 2005 2,368.1<br />

Change in consolidation method 113.9<br />

Currency translation adjustments 81.7<br />

Additions 1.7<br />

Reclassification -176.6<br />

Cost as of 30 April <strong>2006</strong> 2,388.8<br />

Accumulated amortisation as of 1 May 2005 147.2<br />

<strong>IMMOEAST</strong> has no intangible assets with an indefinite useful life, and no intangible assets are encumbered.<br />

4.3.2 Goodwill<br />

Additional information on this balance sheet position is provided under point 3.3.1.<br />

All amounts in TEUR Other intangible assets<br />

Cost as of 1 May <strong>2006</strong> 2,388.8<br />

Change in consolidation range 4.1<br />

Change in consolidation method 3.7<br />

Currency translation adjustments 117.5<br />

Additions 227.8<br />

Disposals 0.0<br />

Reclassification 0.0<br />

Cost as of 30 April 20<strong>07</strong> 2,741.9<br />

Change in consolidation method 101.3<br />

Currency translation adjustments 4.5 Accumulated amortisation as of 1 May <strong>2006</strong> 421.1<br />

Disposals -0.7 Change in consolidation method 0.7<br />

Reclassification -0.4 Currency translation adjustments 25.1<br />

Amortisation for the year 169.1 Disposals 0.0<br />

Accumulated amortisation as of 30 April <strong>2006</strong> 421.1 Reclassification 0.0<br />

Carrying value as of 30 April <strong>2006</strong> 1,967.8 Amortisation for the year 242.3<br />

Accumulated amortisation as of 30 April 20<strong>07</strong> 689.2<br />

Carrying value as of 30 April 20<strong>07</strong> 2,052.7<br />

In order to test goodwill for impairment, the carrying value of the cash-generating unit is increased by the carrying<br />

value of goodwill. The total amount is then compared with the recoverable amount of the cash-generating unit. Any<br />

negative difference is recognised as an impairment charge to goodwill. The acquisition of project companies generally<br />

leads to positive goodwill because of the obligation to record deferred tax liabilities on revalued properties.<br />

The unequal valuation of these deferred tax liabilities – which, in contrast to other acquired net assets, may not be<br />

discounted according to IFRS 3.57b in connection with IFRS 3.B16 (i) and IAS 12.53 – results in goodwill as a technical<br />

figure.<br />

Additional information on the recognition and measurement of goodwill is provided under point 3.3.1. During <strong>2006</strong>/<strong>07</strong><br />

TEUR 43,244,1 (2005/06: TEUR 30,729,6) of newly acquired goodwill was written off through the income statement<br />

in accordance with IFRS 3.54. The development of goodwill is as follows: