IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

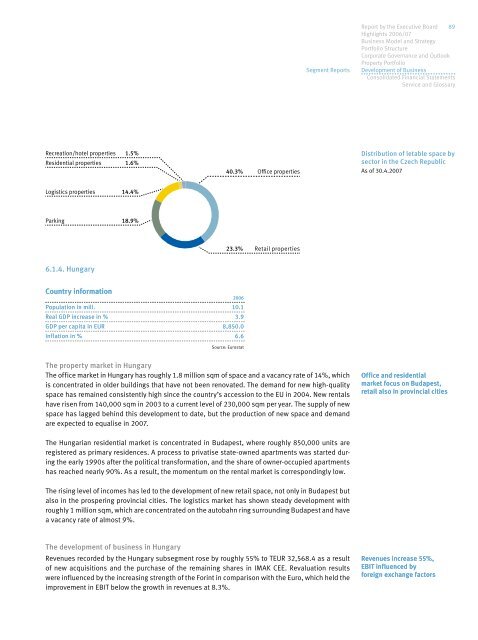

Recreation/hotel properties 1.5%<br />

Residential properties 1.6%<br />

Logistics properties 14.4%<br />

Parking 18.9%<br />

6.1.4. Hungary<br />

Country information<br />

Population in mill.<br />

<strong>2006</strong><br />

10.1<br />

Real GDP increase in % 3.9<br />

GDP per capita in EUR 8,850.0<br />

I n f l a t i o n i n % 6 . 6<br />

40.3% Office properties<br />

23.3% Retail properties<br />

Source: Eurostat<br />

Segment <strong>Report</strong>s<br />

The property market in Hungary<br />

The office market in Hungary has roughly 1.8 million sqm of space and a vacancy rate of 14%, which<br />

is concentrated in older buildings that have not been renovated. The demand for new high-quality<br />

space has remained consistently high since the country’s accession to the EU in 2004. New rentals<br />

have risen from 140,000 sqm in 2003 to a current level of 230,000 sqm per year. The supply of new<br />

space has lagged behind this development to date, but the production of new space and demand<br />

are expected to equalise in 20<strong>07</strong>.<br />

The Hungarian residential market is concentrated in Budapest, where roughly 850,000 units are<br />

registered as primary residences. A process to privatise state-owned apartments was started during<br />

the early 1990s after the political transformation, and the share of owner-occupied apartments<br />

has reached nearly 90%. As a result, the momentum on the rental market is correspondingly low.<br />

The rising level of incomes has led to the development of new retail space, not only in Budapest but<br />

also in the prospering provincial cities. The logistics market has shown steady development with<br />

roughly 1 million sqm, which are concentrated on the autobahn ring surrounding Budapest and have<br />

a vacancy rate of almost 9%.<br />

The development of business in Hungary<br />

Revenues recorded by the Hungary subsegment rose by roughly 55% to TEUR 32,568.4 as a result<br />

of new acquisitions and the purchase of the remaining shares in IMAK CEE. Revaluation results<br />

were influenced by the increasing strength of the Forint in comparison with the Euro, which held the<br />

improvement in EBIT below the growth in revenues at 8.3%.<br />

<strong>Report</strong> by the Executive Board 89<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary<br />

Distribution of letable space by<br />

sector in the Czech Republic<br />

As of 30.4.20<strong>07</strong><br />

Office and residential<br />

market focus on Budapest,<br />

retail also in in provincial cities<br />

Revenues increase 55%,<br />

EBIT influenced by<br />

foreign exchange factors