IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

218 <strong>IMMOEAST</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>/<strong>07</strong><br />

IFRS 7.20 (a)<br />

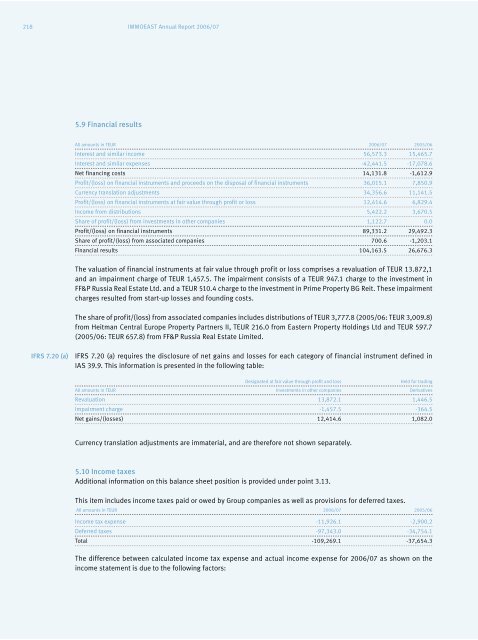

5.9 Financial results<br />

All amounts in TEUR <strong>2006</strong>/<strong>07</strong> 2005/06<br />

Interest and similar income 56,573.3 15,465.7<br />

Interest and similar expenses -42,441.5 -17,<strong>07</strong>8.6<br />

Net financing costs 14,131.8 -1,612.9<br />

Profit/(loss) on financial instruments and proceeds on the disposal of financial instruments 36,015.1 7,850.9<br />

Currency translation adjustments 34,356.6 11,141.5<br />

Profit/(loss) on financial instruments at fair value through profit or loss 12,414.6 6,829.4<br />

Income from distributions 5,422.2 3,670.5<br />

Share of profit/(loss) from investments in other companies 1,122.7 0.0<br />

Profit/(loss) on financial instruments 89,331.2 29,492.3<br />

Share of profit/(loss) from associated companies 700.6 -1,203.1<br />

Financial results 104,163.5 26,676.3<br />

The valuation of financial instruments at fair value through profit or loss comprises a revaluation of TEUR 13.872,1<br />

and an impairment charge of TEUR 1,457.5. The impairment consists of a TEUR 947.1 charge to the investment in<br />

FF&P Russia Real Estate Ltd. and a TEUR 510.4 charge to the investment in Prime Property BG Reit. These impairment<br />

charges resulted from start-up losses and founding costs.<br />

The share of profit/(loss) from associated companies includes distributions of TEUR 3,777.8 (2005/06: TEUR 3,009.8)<br />

from Heitman Central Europe Property Partners II, TEUR 216.0 from Eastern Property Holdings Ltd and TEUR 597.7<br />

(2005/06: TEUR 657.8) from FF&P Russia Real Estate Limited.<br />

IFRS 7.20 (a) requires the disclosure of net gains and losses for each category of financial instrument defined in<br />

IAS 39.9. This information is presented in the following table:<br />

Designated at fair value through profit and loss Held for trading<br />

All amounts in TEUR Investments in other companies Derivatives<br />

Revaluation 13,872.1 1,446.5<br />

Impairment charge -1,457.5 -364.5<br />

Net gains/(losses) 12,414.6 1,082.0<br />

Currency translation adjustments are immaterial, and are therefore not shown separately.<br />

5.10 Income taxes<br />

Additional information on this balance sheet position is provided under point 3.13.<br />

This item includes income taxes paid or owed by Group companies as well as provisions for deferred taxes.<br />

All amounts in TEUR <strong>2006</strong>/<strong>07</strong> 2005/06<br />

Income tax expense -11,926.1 -2,900.2<br />

Deferred taxes -97,343.0 -34,754.1<br />

Total -109,269.1 -37,654.3<br />

The difference between calculated income tax expense and actual income expense for <strong>2006</strong>/<strong>07</strong> as shown on the<br />

income statement is due to the following factors: