IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

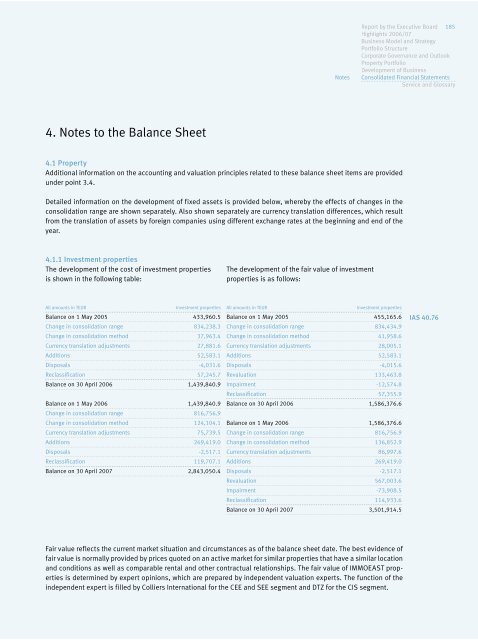

4. Notes to the Balance Sheet<br />

4.1 Property<br />

Additional information on the accounting and valuation principles related to these balance sheet items are provided<br />

under point 3.4.<br />

Detailed information on the development of fixed assets is provided below, whereby the effects of changes in the<br />

consolidation range are shown separately. Also shown separately are currency translation differences, which result<br />

from the translation of assets by foreign companies using different exchange rates at the beginning and end of the<br />

year.<br />

4.1.1 Investment properties<br />

The development of the cost of investment properties<br />

is shown in the following table:<br />

All amounts in TEUR Investment properties<br />

Balance on 1 May 2005 433,960.5<br />

Change in consolidation range 834,238.3<br />

Change in consolidation method 37,963.4<br />

Currency translation adjustments 27,881.6<br />

Additions 52,583.1<br />

Disposals -4,031.6<br />

Reclassification 57,245.7<br />

Balance on 30 April <strong>2006</strong> 1,439,840.9<br />

Balance on 1 May <strong>2006</strong> 1,439,840.9<br />

Change in consolidation range 816,756.9<br />

Change in consolidation method 124,104.1<br />

Currency translation adjustments 75,739.5<br />

Additions 269,419.0<br />

Disposals -2,517.1<br />

Reclassification 119,7<strong>07</strong>.1<br />

Balance on 30 April 20<strong>07</strong> 2,843,050.4<br />

The development of the fair value of investment<br />

properties is as follows:<br />

All amounts in TEUR Investment properties<br />

Balance on 1 May 2005 455,165.6<br />

Change in consolidation range 834,434.9<br />

Change in consolidation method 41,958.6<br />

Currency translation adjustments 28,005.1<br />

Additions 52,583.1<br />

Disposals -4,015.6<br />

Revaluation 133,463.8<br />

Impairment -12,574.8<br />

Reclassification 57,355.9<br />

Balance on 30 April <strong>2006</strong> 1,586,376.6<br />

Balance on 1 May <strong>2006</strong> 1,586,376.6<br />

Change in consolidation range 816,756.9<br />

Change in consolidation method 136,852.9<br />

Currency translation adjustments 86,997.6<br />

Additions 269,419.0<br />

Disposals -2,517.1<br />

Revaluation 567,003.6<br />

Impairment -73,908.5<br />

Reclassification 114,933.6<br />

Fair value reflects the current market situation and circumstances as of the balance sheet date. The best evidence of<br />

fair value is normally provided by prices quoted on an active market for similar properties that have a similar location<br />

and conditions as well as comparable rental and other contractual relationships. The fair value of <strong>IMMOEAST</strong> properties<br />

is determined by expert opinions, which are prepared by independent valuation experts. The function of the<br />

independent expert is filled by Colliers International for the CEE and SEE segment and DTZ for the CIS segment.<br />

Notes<br />

Balance on 30 April 20<strong>07</strong> 3,501,914.5<br />

<strong>Report</strong> by the Executive Board 185<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary<br />

IAS 40.76