IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

212 <strong>IMMOEAST</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>/<strong>07</strong><br />

IAS 12.81 (g),<br />

IAS 12.82<br />

4.14 Contingent liabilities and guarantees<br />

Additional information on this balance sheet position is provided under point 3.15.<br />

Contingent liabilities are valued in accordance with IAS 37 and IFRS 3.48 (see 3.12). The Group had no outstanding<br />

guarantees as of the balance sheet date.<br />

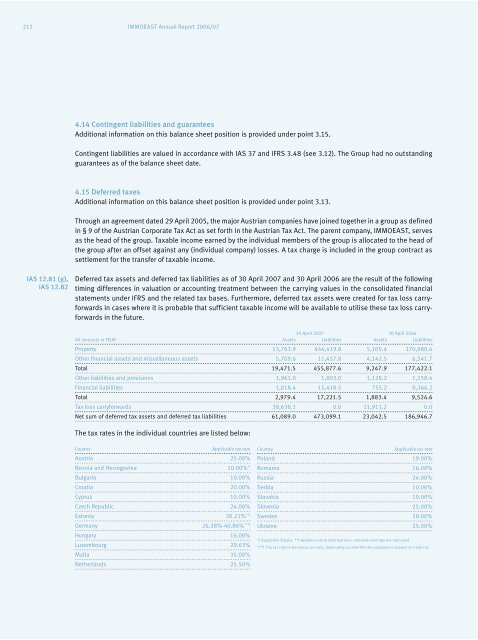

4.15 Deferred taxes<br />

Additional information on this balance sheet position is provided under point 3.13.<br />

Through an agreement dated 29 April 2005, the major Austrian companies have joined together in a group as defined<br />

in § 9 of the Austrian Corporate Tax Act as set forth in the Austrian Tax Act. The parent company, <strong>IMMOEAST</strong>, serves<br />

as the head of the group. Taxable income earned by the individual members of the group is allocated to the head of<br />

the group after an offset against any (individual company) losses. A tax charge is included in the group contract as<br />

settlement for the transfer of taxable income.<br />

Deferred tax assets and deferred tax liabilities as of 30 April 20<strong>07</strong> and 30 April <strong>2006</strong> are the result of the following<br />

timing differences in valuation or accounting treatment between the carrying values in the consolidated financial<br />

statements under IFRS and the related tax bases. Furthermore, deferred tax assets were created for tax loss carryforwards<br />

in cases where it is probable that sufficient taxable income will be available to utilise these tax loss carryforwards<br />

in the future.<br />

30 April 20<strong>07</strong> 30 April <strong>2006</strong><br />

All amounts in TEUR Assets Liabilities Assets Liabilities<br />

Property 13,761.9 444,419.8 5,105.4 170,880.4<br />

Other financial assets and miscellaneous assets 5,709.6 11,457.8 4,142.5 6,541.7<br />

Total 19,471.5 455,877.6 9,247.9 177,422.1<br />

Other liabilities and provisions 1,961.0 1,803.0 1,128.2 1,158.4<br />

Financial liabilities 1,018.4 15,418.5 755.2 8,366.2<br />

Total 2,979.4 17,221.5 1,883.4 9,524.6<br />

Tax loss carryforwards 38,638.1 0.0 11,911.2 0.0<br />

Net sum of deferred tax assets and deferred tax liabilities 61,089.0 473,099.1 23,042.5 186,946.7<br />

The tax rates in the individual countries are listed below:<br />

Country Applicable tax rate<br />

Austria 25.00%<br />

Bosnia and Herzegovina 10.00% *)<br />

Bulgaria 10.00%<br />

Croatia 20.00%<br />

Cyprus 10.00%<br />

Czech Republic 24.00%<br />

Estonia 28.21% **)<br />

Germany 26.38%-40.86% ***)<br />

Hungary 16.00%<br />

Luxembourg 29.63%<br />

Malta 35.00%<br />

Netherlands 25.50%<br />

Country Applicable tax rate<br />

Poland 19.00%<br />

Romania 16.00%<br />

Russia 24.00%<br />

Serbia 10.00%<br />

Slovakia 19.00%<br />

Slovenia 25.00%<br />

Sweden 28.00%<br />

Ukraine 25.00%<br />

*) Republika Srpska **) Applies only to distributions, retained earnings are not taxed<br />

***) The tax rate in Germany can vary, depending on whether the company is subject to trade tax