IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The impairment charges to the following properties resulted solely from an increase in the value of the local currency<br />

against the Euro. The Euro fair values of these objects as of 30 April 20<strong>07</strong> exceed the Euro fair values as of 30 April<br />

<strong>2006</strong> at these exchange rates, and an impairment charge was required because the carrying value exceeded the fair<br />

value that resulted from the translation from local currency into the Group currency:<br />

• Global Business Center • Szepvölgi Business Park<br />

• Pharma Park • Camel Park<br />

• Shark Park • Millenium Tower I<br />

An impairment charge was recognised for the Arpad Centre because of the high vacancy rate, which exceeds 50% of<br />

the available office space. In addition, the valuation return was raised to better reflect the increased rental risk.<br />

The loss of the tenant for the Dunaharaszti logistics hall was reflected in an appropriate impairment charge. The<br />

discount factor was also increased to adequately reflect the risk associated with a new rental.<br />

An impairment charge was recognised for the Globe 3 office property due to the vacancy rate, which equals roughly<br />

20% of the available space. The rental risk was reflected through an increase in the valuation return.<br />

The property valuation experts have classified the following objects as “over-rented”, which means the market rents<br />

realisable after the end of the current contracts will be less than the rents currently paid by tenants:<br />

• Bokserska Distribution Park • Bokserska Office Center<br />

• Crown Point • Crown Tower<br />

• Cybernetiki Office Center • Lopuszanska<br />

• Green Point 7 • Silesia Logistik Center<br />

The other impairment charges were generally based on an increase in foreign exchange rates against the Euro as well<br />

as investments that did not lead to an increase in the value of the objects.<br />

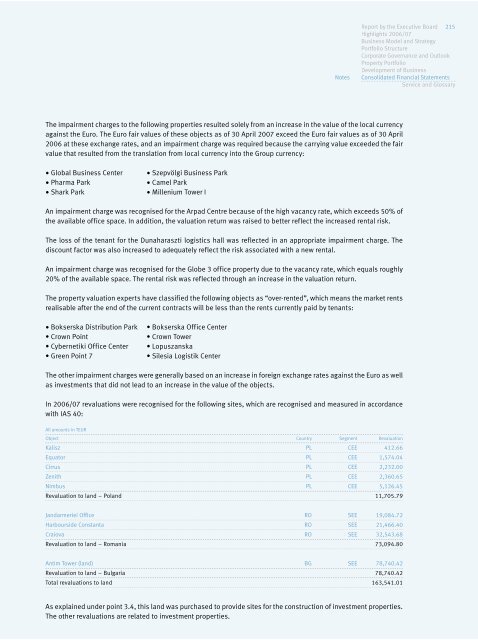

In <strong>2006</strong>/<strong>07</strong> revaluations were recognised for the following sites, which are recognised and measured in accordance<br />

with IAS 40:<br />

All amounts in TEUR<br />

Object Country Segment Revaluation<br />

Kalisz PL CEE 412.66<br />

Equator PL CEE 1,574.04<br />

Cirrus PL CEE 2,232.00<br />

Zenith PL CEE 2,360.65<br />

Nimbus PL CEE 5,126.45<br />

Revaluation to land – Poland 11,705.79<br />

Jandarmeriei Office RO SEE 19,084.72<br />

Harbourside Constanta RO SEE 21,466.40<br />

Craiova RO SEE 32,543.68<br />

Revaluation to land – Romania 73,094.80<br />

Antim Tower (land) BG SEE 78,740.42<br />

Revaluation to land – Bulgaria 78,740.42<br />

Total revaluations to land 163,541.01<br />

Notes<br />

As explained under point 3.4, this land was purchased to provide sites for the construction of investment properties.<br />

The other revaluations are related to investment properties.<br />

<strong>Report</strong> by the Executive Board 215<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary