IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Investments in other companies include an atypical silent partner investment in “Wienerberg City” Errichtungsgesellschaft<br />

m.b.H., which has an acquisition cost of TEUR 10,000. <strong>IMMOEAST</strong> Beteiligungs GmbH as the atypical silent<br />

partner participates in the profit and loss, and total assets of the company (including goodwill and undisclosed<br />

reserves) in proportion to its investment. The allocation of losses is limited to a maximum of 120% of the silent partner<br />

contribution. During the <strong>2006</strong>/<strong>07</strong> financial year, a revaluation of TEUR 1,300.1 was recorded to this investment,<br />

but not recognised through profit or loss. The carrying value totalled TEUR 11,<strong>07</strong>5.9 as of 30 April 20<strong>07</strong>.<br />

Financial instruments comprise securities and derivatives. Information on the conditions and market values of the<br />

derivatives is provided under points 8.1.2.2.1.2 and 8.1.2.2.2.<br />

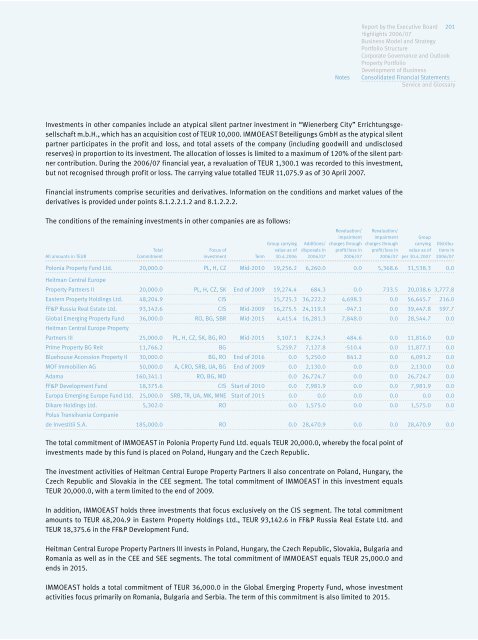

The conditions of the remaining investments in other companies are as follows:<br />

The total commitment of <strong>IMMOEAST</strong> in Polonia Property Fund Ltd. equals TEUR 20,000.0, whereby the focal point of<br />

investments made by this fund is placed on Poland, Hungary and the Czech Republic.<br />

The investment activities of Heitman Central Europe Property Partners II also concentrate on Poland, Hungary, the<br />

Czech Republic and Slovakia in the CEE segment. The total commitment of <strong>IMMOEAST</strong> in this investment equals<br />

TEUR 20,000.0, with a term limited to the end of 2009.<br />

In addition, <strong>IMMOEAST</strong> holds three investments that focus exclusively on the CIS segment. The total commitment<br />

amounts to TEUR 48,204.9 in Eastern Property Holdings Ltd., TEUR 93,142.6 in FF&P Russia Real Estate Ltd. and<br />

TEUR 18,375.6 in the FF&P Development Fund.<br />

Heitman Central Europe Property Partners III invests in Poland, Hungary, the Czech Republic, Slovakia, Bulgaria and<br />

Romania as well as in the CEE and SEE segments. The total commitment of <strong>IMMOEAST</strong> equals TEUR 25,000.0 and<br />

ends in 2015.<br />

<strong>IMMOEAST</strong> holds a total commitment of TEUR 36,000.0 in the Global Emerging Property Fund, whose investment<br />

activities focus primarily on Romania, Bulgaria and Serbia. The term of this commitment is also limited to 2015.<br />

<strong>Report</strong> by the Executive Board 201<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary<br />

Revaluation/ Revaluation/<br />

impairment impairment Group<br />

Group carrying Additions/ charges through charges through carrying Distribu-<br />

Total Focus of value as of disposals in profit/loss in profit/loss in value as of tions in<br />

All amounts in TEUR Commitment investment Term 30.4.<strong>2006</strong> <strong>2006</strong>/<strong>07</strong> <strong>2006</strong>/<strong>07</strong> <strong>2006</strong>/<strong>07</strong> per 30.4.20<strong>07</strong> <strong>2006</strong>/<strong>07</strong><br />

Polonia Property Fund Ltd.<br />

Heitman Central Europe<br />

20,000.0 PL, H, CZ Mid-2010 19,256.2 6,260.0 0.0 5,368.6 31,538.3 0.0<br />

Property Partners II 20,000.0 PL, H, CZ, SK End of 2009 19,274.4 684.3 0.0 733.5 20,038.6 3,777.8<br />

Eastern Property Holdings Ltd. 48,204.9 CIS 15,725.3 36,222.2 4,698.3 0.0 56,645.7 216.0<br />

FF&P Russia Real Estate Ltd. 93,142.6 CIS Mid-2009 16,275.5 24,119.3 -947.1 0.0 39,447.8 597.7<br />

Global Emerging Property Fund<br />

Heitman Central Europe Property<br />

36,000.0 RO, BG, SBR Mid-2015 4,415.4 16,281.3 7,848.0 0.0 28,544.7 0.0<br />

Partners III 25,000.0 PL, H, CZ, SK, BG, RO Mid-2015 3,1<strong>07</strong>.1 8,224.3 484.6 0.0 11,816.0 0.0<br />

Prime Property BG Reit 11,766.2 BG 5,259.7 7,127.8 -510.4 0.0 11,877.1 0.0<br />

Bluehouse Accession Property II 30,000.0 BG, RO End of 2016 0.0 5,250.0 841.2 0.0 6,091.2 0.0<br />

MOF Immobilien AG 50,000.0 A, CRO, SRB, UA, BG End of 2009 0.0 2,130.0 0.0 0.0 2,130.0 0.0<br />

Adama 160,341.1 RO, BG, MD 0.0 26,724.7 0.0 0.0 26,724.7 0.0<br />

FF&P Development Fund 18,375.6 CIS Start of 2010 0.0 7,981.9 0.0 0.0 7,981.9 0.0<br />

Europa Emerging Europe Fund Ltd. 25,000.0 SRB, TR, UA, MK, MNE Start of 2015 0.0 0.0 0.0 0.0 0.0 0.0<br />

Dikare Holdings Ltd.<br />

Polus Transilvania Companie<br />

5,302.0 RO 0.0 1,575.0 0.0 0.0 1,575.0 0.0<br />

de Investitii S.A. 185,000.0 RO 0.0 28,470.9 0.0 0.0 28,470.9 0.0<br />

Notes