IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2006</strong>/<strong>07</strong>. However, the extensive investment programme planned for the coming years is expected<br />

to lead to a more equal distribution of rental income over a number of sectors.<br />

Revaluation results<br />

Revaluation results include all increases and decreases in the value of investment properties as well<br />

as any impairment charges to development projects. In comparison to the previous year, revaluation<br />

results rose by 322% to TEUR 493,095.1. Properties acquired during the reporting year generated<br />

TEUR 297,464.9 or roughly 60% of the total amount. This significant increase was the result of two<br />

main factors: on the one hand, the yield compression in Central and Eastern Europe intensified significantly<br />

in relation to 2005/06 –Hungary was the only country to report a different development.<br />

On the other hand, <strong>IMMOEAST</strong> was able to acquire a number of interesting sites for future project<br />

development, which were revalued during <strong>2006</strong>/<strong>07</strong>. Also included here are properties that did not<br />

exceed their acquisition cost in revaluations carried out during earlier years. Revaluation results<br />

include TEUR 163,541.0 from the revaluation of property sites in <strong>2006</strong>/<strong>07</strong>, which represent 33% of<br />

total revaluation results.<br />

A strong rise in the Polish Zloty, Romanian Leu, Hungarian Forint and Slovakian Krone had a substantial<br />

negative impact on revaluation results for the year. This effect was particularly significant<br />

in Slovakia, where a 9.8% increase in the value of the Krone over the prior year level had an equal<br />

impact on revaluation results. The Hungarian Forint gained 6.4% in relation to the Euro, a development<br />

that was also reflected in revaluation results.<br />

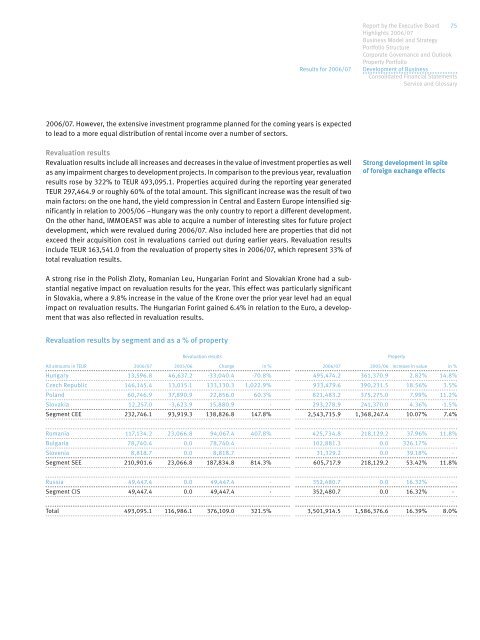

Revaluation results by segment and as a % of property<br />

Results for <strong>2006</strong>/<strong>07</strong><br />

Revaluation results Property<br />

<strong>Report</strong> by the Executive Board 75<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary<br />

Strong development in spite<br />

of foreign exchange effects<br />

All amounts in TEUR <strong>2006</strong>/<strong>07</strong> 2005/06 Change in % <strong>2006</strong>/<strong>07</strong> 2005/06 Increase in value in %<br />

Hungary 13,596.8 46,637.2 -33,040.4 -70.8% 495,474.2 361,370.9 2.82% 14.8%<br />

Czech Republic 146,145.4 13,015.1 133,130.3 1,022.9% 933,479.6 390,231.5 18.56% 3.5%<br />

Poland 60,746.9 37,890.9 22,856.0 60.3% 821,483.2 375,275.0 7.99% 11.2%<br />

Slovakia 12,257.0 -3,623.9 15,880.9 - 293,278.9 241,370.0 4.36% -1.5%<br />

Segment CEE 232,746.1 93,919.3 138,826.8 147.8% 2,543,715.9 1,368,247.4 10.<strong>07</strong>% 7.4%<br />

Romania 117,134.2 23,066.8 94,067.4 4<strong>07</strong>.8% 425,734.8 218,129.2 37.96% 11.8%<br />

Bulgaria 78,740.4 0.0 78,740.4 - 102,881.3 0.0 326.17% -<br />

Slovenia 8,818.7 0.0 8,818.7 - 31,329.2 0.0 39.18% -<br />

Segment SEE 210,901.6 23,066.8 187,834.8 814.3% 605,717.9 218,129.2 53.42% 11.8%<br />

Russia 49,447.4 0.0 49,447.4 - 352,480.7 0.0 16.32% -<br />

Segment CIS 49,447.4 0.0 49,447.4 - 352,480.7 0.0 16.32% -<br />

Total 493,095.1 116,986.1 376,109.0 321.5% 3,501,914.5 1,586,376.6 16.39% 8.0%<br />

-