IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

252 <strong>IMMOEAST</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>/<strong>07</strong><br />

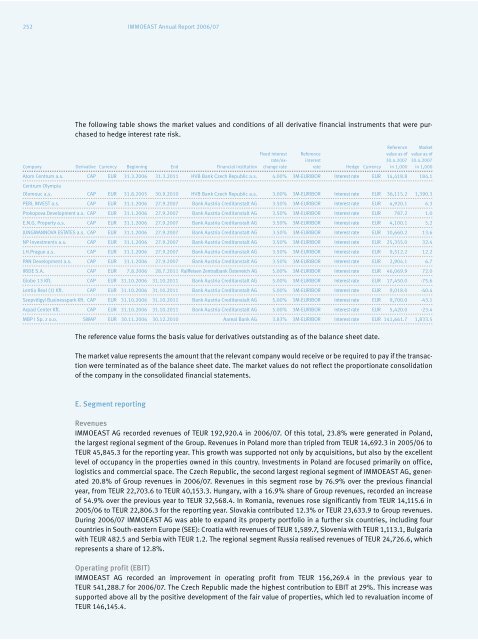

The following table shows the market values and conditions of all derivative financial instruments that were purchased<br />

to hedge interest rate risk.<br />

Reference Market<br />

Fixed interest Reference value as of value as of<br />

rate/ex- interest 30.4.20<strong>07</strong> 30.4.20<strong>07</strong><br />

Company Derivative Currency Beginning End Financial institution change rate rate Hedge Currency in 1,000 in 1,000<br />

Atom Centrum a.s.<br />

Centrum Olympia<br />

CAP EUR 31.3.<strong>2006</strong> 31.3.2011 HVB Bank Czech Republic a.s. 4.00% 3M-EURIBOR Interest rate EUR 14,418.8 184.1<br />

Olomouc a.s. CAP EUR 31.8.2005 30.9.2010 HVB Bank Czech Republic a.s. 3.00% 3M-EURIBOR Interest rate EUR 36,115.2 1,390.3<br />

PERL INVEST a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 4,920.1 6.3<br />

Prokopova Development a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 787.2 1.0<br />

E.N.G. Property a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 4,100.1 5.2<br />

JUNGMANNOVA ESTATES a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 10,660.2 13.6<br />

NP Investments a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 25,355.0 32.4<br />

J.H.Prague a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 9,512.2 12.2<br />

PAN Development a.s. CAP EUR 31.1.<strong>2006</strong> 27.9.20<strong>07</strong> Bank Austria Creditanstalt AG 3.50% 3M-EURIBOR Interest rate EUR 2,904.1 6.7<br />

IRIDE S.A. CAP EUR 7.8.<strong>2006</strong> 28.7.2011 Raiffeisen Zentralbank Österreich AG 5.00% 3M-EURIBOR Interest rate EUR 46,069.9 72.0<br />

Globe 13 Kft. CAP EUR 31.10.<strong>2006</strong> 31.10.2011 Bank Austria Creditanstalt AG 5.00% 3M-EURIBOR Interest rate EUR 17,450.0 -75.6<br />

Lentia Real (1) Kft. CAP EUR 31.10.<strong>2006</strong> 31.10.2011 Bank Austria Creditanstalt AG 5.00% 3M-EURIBOR Interest rate EUR 9,018.0 -40.4<br />

Szepvölgyi Businesspark Kft. CAP EUR 31.10.<strong>2006</strong> 31.10.2011 Bank Austria Creditanstalt AG 5.00% 3M-EURIBOR Interest rate EUR 9,700.0 -43.1<br />

Arpad Center Kft. CAP EUR 31.10.<strong>2006</strong> 31.10.2011 Bank Austria Creditanstalt AG 5.00% 3M-EURIBOR Interest rate EUR 5,420.0 -23.4<br />

MBP I Sp. z o.o. SWAP EUR 30.11.<strong>2006</strong> 30.12.2010 Aareal Bank AG 3.83% 3M-EURIBOR Interest rate EUR 141,661.7 1,833.5<br />

The reference value forms the basis value for derivatives outstanding as of the balance sheet date.<br />

The market value represents the amount that the relevant company would receive or be required to pay if the transaction<br />

were terminated as of the balance sheet date. The market values do not reflect the proportionate consolidation<br />

of the company in the consolidated financial statements.<br />

E. Segment reporting<br />

Revenues<br />

<strong>IMMOEAST</strong> AG recorded revenues of TEUR 192,920.4 in <strong>2006</strong>/<strong>07</strong>. Of this total, 23.8% were generated in Poland,<br />

the largest regional segment of the Group. Revenues in Poland more than tripled from TEUR 14,692.3 in 2005/06 to<br />

TEUR 45,845.3 for the reporting year. This growth was supported not only by acquisitions, but also by the excellent<br />

level of occupancy in the properties owned in this country. Investments in Poland are focused primarily on office,<br />

logistics and commercial space. The Czech Republic, the second largest regional segment of <strong>IMMOEAST</strong> AG, generated<br />

20.8% of Group revenues in <strong>2006</strong>/<strong>07</strong>. Revenues in this segment rose by 76.9% over the previous financial<br />

year, from TEUR 22,703.6 to TEUR 40,153.3. Hungary, with a 16.9% share of Group revenues, recorded an increase<br />

of 54.9% over the previous year to TEUR 32,568.4. In Romania, revenues rose significantly from TEUR 14,115.6 in<br />

2005/06 to TEUR 22,806.3 for the reporting year. Slovakia contributed 12.3% or TEUR 23,633.9 to Group revenues.<br />

During <strong>2006</strong>/<strong>07</strong> <strong>IMMOEAST</strong> AG was able to expand its property portfolio in a further six countries, including four<br />

countries in South-eastern Europe (SEE): Croatia with revenues of TEUR 1,589.7, Slovenia with TEUR 1,113.1, Bulgaria<br />

with TEUR 482.5 and Serbia with TEUR 1.2. The regional segment Russia realised revenues of TEUR 24,726.6, which<br />

represents a share of 12.8%.<br />

Operating profit (EBIT)<br />

<strong>IMMOEAST</strong> AG recorded an improvement in operating profit from TEUR 156,269.4 in the previous year to<br />

TEUR 541,288.7 for <strong>2006</strong>/<strong>07</strong>. The Czech Republic made the highest contribution to EBIT at 29%. This increase was<br />

supported above all by the positive development of the fair value of properties, which led to revaluation income of<br />

TEUR 146,145.4.