IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>IMMOEAST</strong> is a property company that invests exclusively in properties located on markets in Eastern Europe. The<br />

core market of <strong>IMMOEAST</strong> AG covers three regions: Central and Eastern Europe (CEE) with investments in the Czech<br />

Republic, Poland, Slovakia, Hungary and Estonia; South-eastern Europe (SEE) with investments in Croatia, Romania,<br />

Bulgaria, Slovenia and Serbia; as well as the Community of Independent States (CIS) with investments in Russia<br />

and Ukraine. The identification of segments by <strong>IMMOEAST</strong> AG follows the internal reporting structure and meets<br />

the materiality criteria defined in IFRS 8.13 (see following table). The property portfolio of <strong>IMMOEAST</strong> is diversified<br />

through two types of segments: regional segments (primary segments) Central and Eastern Europe (CEE: subdivided<br />

into Hungary, the Czech Republic, Poland and Slovakia), South-eastern Europe (SEE: subdivided into Romania, Slovenia,<br />

Serbia, Bulgaria and Croatia) and the Community of Independent States (CIS: Russia and Ukraine) as well as<br />

sector segments that reflect the type of property (secondary segments) such as office, logistics, commercial, hotel<br />

and residential. The activities of the Group are concentrated primarily on the purchase and rental of properties as<br />

well as the widely diversified investment in properties with various types of use – ranging from apartments, offices,<br />

hotels, logistics and commercial space up to garages in Central and South-eastern Europe. According to IFRS 8.13,<br />

an operating segment qualified as reportable if it generates at least 10% of the combined segment revenue, segment<br />

profit or segment assets.<br />

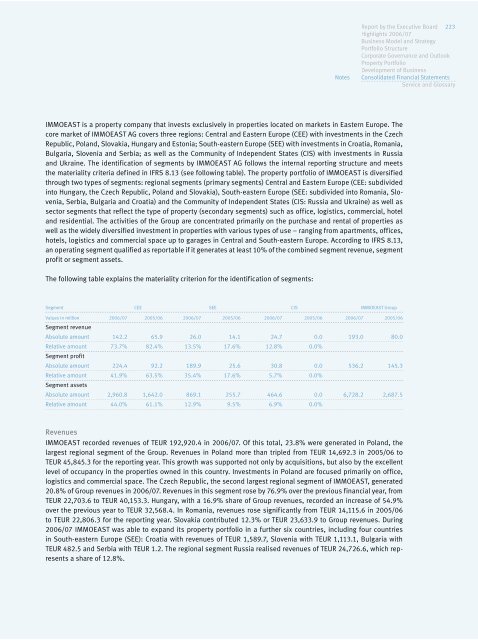

The following table explains the materiality criterion for the identification of segments:<br />

Segment CEE SEE CIS <strong>IMMOEAST</strong> Group<br />

Values in million<br />

Segment revenue<br />

<strong>2006</strong>/<strong>07</strong> 2005/06 <strong>2006</strong>/<strong>07</strong> 2005/06 <strong>2006</strong>/<strong>07</strong> 2005/06 <strong>2006</strong>/<strong>07</strong> 2005/06<br />

Absolute amount 142.2 65.9 26.0 14.1 24.7 0.0 193.0 80.0<br />

Relative amount<br />

Segment profit<br />

73.7% 82.4% 13.5% 17.6% 12.8% 0.0%<br />

Absolute amount 224.4 92.2 189.9 25.6 30.8 0.0 536.2 145.3<br />

Relative amount<br />

Segment assets<br />

41.9% 63.5% 35.4% 17.6% 5.7% 0.0%<br />

Absolute amount 2,960.8 1,642.0 869.1 255.7 464.6 0.0 6,728.2 2,687.5<br />

Relative amount 44.0% 61.1% 12.9% 9.5% 6.9% 0.0%<br />

Revenues<br />

<strong>IMMOEAST</strong> recorded revenues of TEUR 192,920.4 in <strong>2006</strong>/<strong>07</strong>. Of this total, 23.8% were generated in Poland, the<br />

largest regional segment of the Group. Revenues in Poland more than tripled from TEUR 14,692.3 in 2005/06 to<br />

TEUR 45,845.3 for the reporting year. This growth was supported not only by acquisitions, but also by the excellent<br />

level of occupancy in the properties owned in this country. Investments in Poland are focused primarily on office,<br />

logistics and commercial space. The Czech Republic, the second largest regional segment of <strong>IMMOEAST</strong>, generated<br />

20.8% of Group revenues in <strong>2006</strong>/<strong>07</strong>. Revenues in this segment rose by 76.9% over the previous financial year, from<br />

TEUR 22,703.6 to TEUR 40,153.3. Hungary, with a 16.9% share of Group revenues, recorded an increase of 54.9%<br />

over the previous year to TEUR 32,568.4. In Romania, revenues rose significantly from TEUR 14,115.6 in 2005/06<br />

to TEUR 22,806.3 for the reporting year. Slovakia contributed 12.3% or TEUR 23,633.9 to Group revenues. During<br />

<strong>2006</strong>/<strong>07</strong> <strong>IMMOEAST</strong> was able to expand its property portfolio in a further six countries, including four countries<br />

in South-eastern Europe (SEE): Croatia with revenues of TEUR 1,589.7, Slovenia with TEUR 1,113.1, Bulgaria with<br />

TEUR 482.5 and Serbia with TEUR 1.2. The regional segment Russia realised revenues of TEUR 24,726.6, which represents<br />

a share of 12.8%.<br />

Notes<br />

<strong>Report</strong> by the Executive Board 223<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary