IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

136 <strong>IMMOEAST</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>/<strong>07</strong><br />

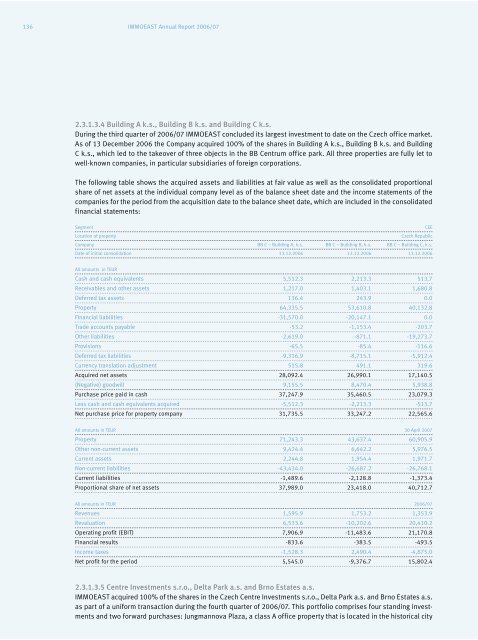

2.3.1.3.4 Building A k.s., Building B k.s. and Building C k.s.<br />

During the third quarter of <strong>2006</strong>/<strong>07</strong> <strong>IMMOEAST</strong> concluded its largest investment to date on the Czech office market.<br />

As of 13 December <strong>2006</strong> the Company acquired 100% of the shares in Building A k.s., Building B k.s. and Building<br />

C k.s., which led to the takeover of three objects in the BB Centrum office park. All three properties are fully let to<br />

well-known companies, in particular subsidiaries of foreign corporations.<br />

The following table shows the acquired assets and liabilities at fair value as well as the consolidated proportional<br />

share of net assets at the individual company level as of the balance sheet date and the income statements of the<br />

companies for the period from the acquisition date to the balance sheet date, which are included in the consolidated<br />

financial statements:<br />

Segment CEE<br />

Location of property Czech Republic<br />

Company BB C – Building A, k.s. BB C – Building B, k.s. BB C – Building C, k.s.<br />

Date of initial consolidation 13.12.<strong>2006</strong> 13.12.<strong>2006</strong> 13.12.<strong>2006</strong><br />

All amounts in TEUR<br />

Cash and cash equivalents 5,512.3 2,213.3 513.7<br />

Receivables and other assets 1,217.0 1,403.1 1,680.8<br />

Deferred tax assets 136.4 243.9 0.0<br />

Property 64,335.5 53,610.8 40,132.8<br />

Financial liabilities -31,570.0 -20,147.1 0.0<br />

Trade accounts payable -53.2 -1,153.4 -203.7<br />

Other liabilities -2,619.0 -871.1 -19,273.7<br />

Provisions -65.5 -85.4 -116.6<br />

Deferred tax liabilities -9,316.9 -8,715.1 -5,912.4<br />

Currency translation adjustment 515.8 491.1 319.6<br />

Acquired net assets 28,092.4 26,990.1 17,140.5<br />

(Negative) goodwill 9,155.5 8,470.4 5,938.8<br />

Purchase price paid in cash 37,247.9 35,460.5 23,<strong>07</strong>9.3<br />

Less cash and cash equivalents acquired -5,512.3 -2,213.3 -513.7<br />

Net purchase price for property company 31,735.5 33,247.2 22,565.6<br />

All amounts in TEUR 30 April 20<strong>07</strong><br />

Property 71,243.3 43,637.4 60,905.9<br />

Other non-current assets 9,424.4 6,642.2 5,976.5<br />

Current assets 2,244.8 1,954.4 1,971.7<br />

Non-current liabilities -43,434.0 -26,687.2 -26,768.1<br />

Current liabilities -1,489.6 -2,128.8 -1,373.4<br />

Proportional share of net assets 37,989.0 23,418.0 40,712.7<br />

All amounts in TEUR <strong>2006</strong>/<strong>07</strong><br />

Revenues 1,595.9 1,753.2 1,353.9<br />

Revaluation 6,533.6 -10,202.6 20,410.2<br />

Operating profit (EBIT) 7,906.9 -11,483.6 21,170.8<br />

Financial results -833.6 -383.5 -493.5<br />

Income taxes -1,528.3 2,490.4 -4,875.0<br />

Net profit for the period 5,545.0 -9,376.7 15,802.4<br />

2.3.1.3.5 Centre Investments s.r.o., Delta Park a.s. and Brno Estates a.s.<br />

<strong>IMMOEAST</strong> acquired 100% of the shares in the Czech Centre Investments s.r.o., Delta Park a.s. and Brno Estates a.s.<br />

as part of a uniform transaction during the fourth quarter of <strong>2006</strong>/<strong>07</strong>. This portfolio comprises four standing investments<br />

and two forward purchases: Jungmannova Plaza, a class A office property that is located in the historical city