IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

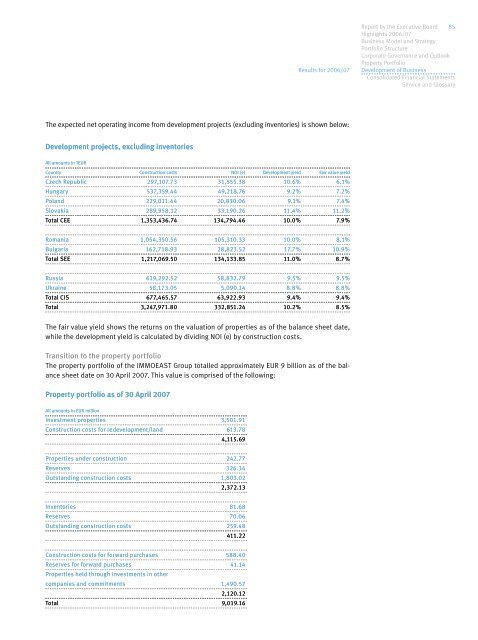

The expected net operating income from development projects (excluding inventories) is shown below:<br />

Development projects, excluding inventories<br />

All amounts in TEUR<br />

Country Construction costs NOI (e) Development yield Fair value yield<br />

Czech Republic 297,1<strong>07</strong>.73 31,555.38 10.6% 6.1%<br />

Hungary 537,359.44 49,218.76 9.2% 7.2%<br />

Poland 229,011.44 20,830.06 9.1% 7.4%<br />

Slovakia 289,958.12 33,190.26 11.4% 11.2%<br />

Total CEE 1,353,436.74 134,794.46 10.0% 7.9%<br />

Romania 1,054,350.56 105,310.33 10.0% 8.1%<br />

Bulgaria 162,718.93 28,823.52 17.7% 10.9%<br />

Total SEE 1,217,069.50 134,133.85 11.0% 8.7%<br />

Russia 619,292.52 58,832.79 9.5% 9.5%<br />

Ukraine 58,173.05 5,090.14 8.8% 8.8%<br />

Total CIS 677,465.57 63,922.93 9.4% 9.4%<br />

Total 3,247,971.80 332,851.24 10.2% 8.5%<br />

The fair value yield shows the returns on the valuation of properties as of the balance sheet date,<br />

while the development yield is calculated by dividing NOI (e) by construction costs.<br />

Transition to the property portfolio<br />

The property portfolio of the <strong>IMMOEAST</strong> Group totalled approximately EUR 9 billion as of the balance<br />

sheet date on 30 April 20<strong>07</strong>. This value is comprised of the following:<br />

Property portfolio as of 30 April 20<strong>07</strong><br />

All amounts in EUR million<br />

Investment properties 3,501.91<br />

Construction costs for redevelopment/land 613.78<br />

4,115.69<br />

Properties under construction 242.77<br />

Reserves 326.34<br />

Outstanding construction costs 1,803.02<br />

2,372.13<br />

Inventories 81.68<br />

Reserves 70.06<br />

Outstanding construction costs 259.48<br />

411.22<br />

Construction costs for forward purchases 588.40<br />

Reserves for forward purchases<br />

Properties held through investments in other<br />

41.14<br />

companies and commitments 1,490.57<br />

2,120.12<br />

Total 9,019.16<br />

Results for <strong>2006</strong>/<strong>07</strong><br />

<strong>Report</strong> by the Executive Board 85<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary