IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

92 <strong>IMMOEAST</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>/<strong>07</strong><br />

Strong improvement in<br />

revenues and earnings<br />

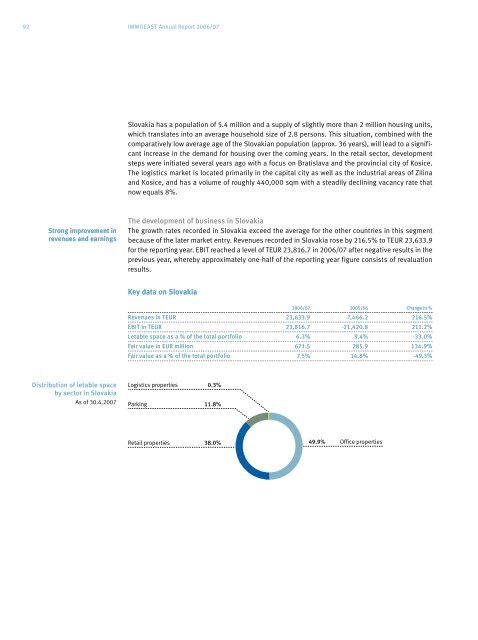

Distribution of letable space<br />

by sector in Slovakia<br />

As of 30.4.20<strong>07</strong><br />

Slovakia has a population of 5.4 million and a supply of slightly more than 2 million housing units,<br />

which translates into an average household size of 2.8 persons. This situation, combined with the<br />

comparatively low average age of the Slovakian population (approx. 36 years), will lead to a significant<br />

increase in the demand for housing over the coming years. In the retail sector, development<br />

steps were initiated several years ago with a focus on Bratislava and the provincial city of Kosice.<br />

The logistics market is located primarily in the capital city as well as the industrial areas of Zilina<br />

and Kosice, and has a volume of roughly 440,000 sqm with a steadily declining vacancy rate that<br />

now equals 8%.<br />

The development of business in Slovakia<br />

The growth rates recorded in Slovakia exceed the average for the other countries in this segment<br />

because of the later market entry. Revenues recorded in Slovakia rose by 216.5% to TEUR 23,633.9<br />

for the reporting year. EBIT reached a level of TEUR 23,816.7 in <strong>2006</strong>/<strong>07</strong> after negative results in the<br />

previous year, whereby approximately one-half of the reporting year figure consists of revaluation<br />

results.<br />

Key data on Slovakia<br />

<strong>2006</strong>/<strong>07</strong> 2005/06 Change in %<br />

Revenues in TEUR 23,633.9 7,466.2 216.5%<br />

EBIT in TEUR 23,816.7 -21,420.8 211.2%<br />

Letable space as a % of the total portfolio 6.3% 9.4% -33.0%<br />

Fair value in EUR million 671.5 285.9 134.9%<br />

Fair value as a % of the total portfolio 7.5% 14.8% -49.3%<br />

Logistics properties 0.3%<br />

Parking 11.8%<br />

Retail properties 38.0% 49.9% Office properties