IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

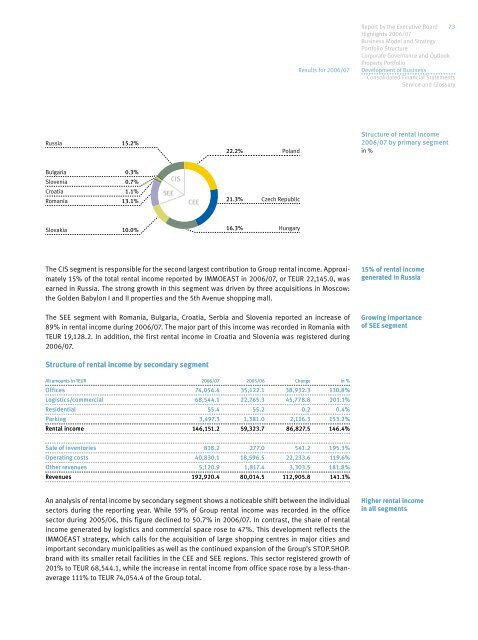

Russia 15.2%<br />

Bulgaria 0.3%<br />

Slovenia 0.7%<br />

Croatia 1.1%<br />

Romania 13.1%<br />

Slovakia 10.0%<br />

SEE<br />

CIS<br />

CEE<br />

The CIS segment is responsible for the second largest contribution to Group rental income. Approximately<br />

15% of the total rental income reported by <strong>IMMOEAST</strong> in <strong>2006</strong>/<strong>07</strong>, or TEUR 22,145.0, was<br />

earned in Russia. The strong growth in this segment was driven by three acquisitions in Moscow:<br />

the Golden Babylon I and II properties and the 5th Avenue shopping mall.<br />

The SEE segment with Romania, Bulgaria, Croatia, Serbia and Slovenia reported an increase of<br />

89% in rental income during <strong>2006</strong>/<strong>07</strong>. The major part of this income was recorded in Romania with<br />

TEUR 19,128.2. In addition, the first rental income in Croatia and Slovenia was registered during<br />

<strong>2006</strong>/<strong>07</strong>.<br />

Structure of rental income by secondary segment<br />

22.2% Poland<br />

21.3% Czech Republic<br />

16.3% Hungary<br />

Results for <strong>2006</strong>/<strong>07</strong><br />

All amounts in TEUR <strong>2006</strong>/<strong>07</strong> 2005/06 Change in %<br />

Offices 74,054.4 35,122.1 38,932.3 110.8%<br />

Logistics/commercial 68,544.1 22,765.3 45,778.8 201.1%<br />

Residential 55.4 55.2 0.2 0.4%<br />

Parking 3,497.3 1,381.0 2,116.3 153.2%<br />

Rental income 146,151.2 59,323.7 86,827.5 146.4%<br />

Sale of inventories 818.2 277.0 541.2 195.3%<br />

Operating costs 40,830.1 18,596.5 22,233.6 119.6%<br />

Other revenues 5,120.9 1,817.4 3,303.5 181.8%<br />

Revenues 192,920.4 80,014.5 112,905.8 141.1%<br />

An analysis of rental income by secondary segment shows a noticeable shift between the individual<br />

sectors during the reporting year. While 59% of Group rental income was recorded in the office<br />

sector during 2005/06, this figure declined to 50.7% in <strong>2006</strong>/<strong>07</strong>. In contrast, the share of rental<br />

income generated by logistics and commercial space rose to 47%. This development reflects the<br />

<strong>IMMOEAST</strong> strategy, which calls for the acquisition of large shopping centres in major cities and<br />

important secondary municipalities as well as the continued expansion of the Group’s STOP.SHOP.<br />

brand with its smaller retail facilities in the CEE and SEE regions. This sector registered growth of<br />

201% to TEUR 68,544.1, while the increase in rental income from office space rose by a less-thanaverage<br />

111% to TEUR 74,054.4 of the Group total.<br />

<strong>Report</strong> by the Executive Board 73<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary<br />

Structure of rental income<br />

<strong>2006</strong>/<strong>07</strong> by primary segment<br />

in %<br />

15% of rental income<br />

generated in Russia<br />

Growing importance<br />

of SEE segment<br />

Higher rental income<br />

in all segments