IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

188 <strong>IMMOEAST</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>/<strong>07</strong><br />

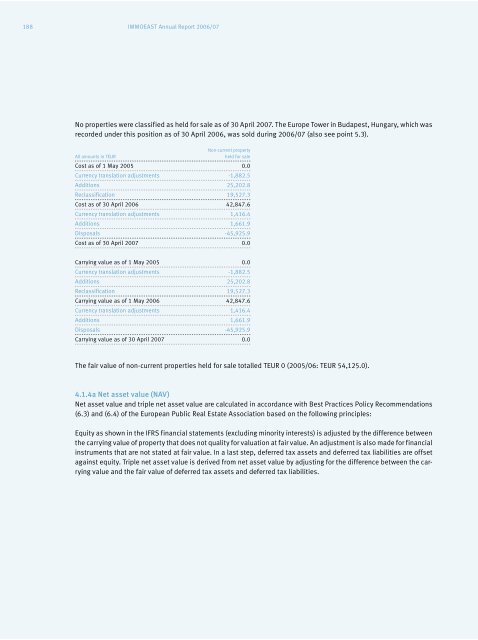

No properties were classified as held for sale as of 30 April 20<strong>07</strong>. The Europe Tower in Budapest, Hungary, which was<br />

recorded under this position as of 30 April <strong>2006</strong>, was sold during <strong>2006</strong>/<strong>07</strong> (also see point 5.3).<br />

All amounts in TEUR<br />

Non-current property<br />

held for sale<br />

Cost as of 1 May 2005 0.0<br />

Currency translation adjustments -1,882.5<br />

Additions 25,202.8<br />

Reclassification 19,527.3<br />

Cost as of 30 April <strong>2006</strong> 42,847.6<br />

Currency translation adjustments 1,416.4<br />

Additions 1,661.9<br />

Disposals -45,925.9<br />

Cost as of 30 April 20<strong>07</strong> 0.0<br />

Carrying value as of 1 May 2005 0.0<br />

Currency translation adjustments -1,882.5<br />

Additions 25,202.8<br />

Reclassification 19,527.3<br />

Carrying value as of 1 May <strong>2006</strong> 42,847.6<br />

Currency translation adjustments 1,416.4<br />

Additions 1,661.9<br />

Disposals -45,925.9<br />

Carrying value as of 30 April 20<strong>07</strong> 0.0<br />

The fair value of non-current properties held for sale totalled TEUR 0 (2005/06: TEUR 54,125.0).<br />

4.1.4a Net asset value (NAV)<br />

Net asset value and triple net asset value are calculated in accordance with Best Practices Policy Recommendations<br />

(6.3) and (6.4) of the European Public Real Estate Association based on the following principles:<br />

Equity as shown in the IFRS financial statements (excluding minority interests) is adjusted by the difference between<br />

the carrying value of property that does not quality for valuation at fair value. An adjustment is also made for financial<br />

instruments that are not stated at fair value. In a last step, deferred tax assets and deferred tax liabilities are offset<br />

against equity. Triple net asset value is derived from net asset value by adjusting for the difference between the carrying<br />

value and the fair value of deferred tax assets and deferred tax liabilities.