IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

IMMOEAST Annual Report 2006/07

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

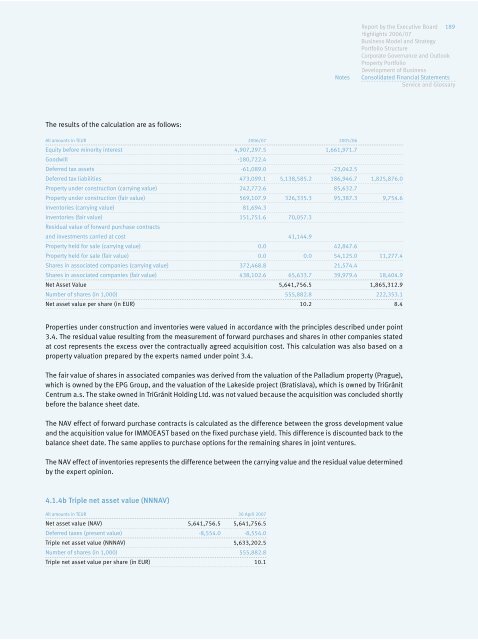

The results of the calculation are as follows:<br />

All amounts in TEUR <strong>2006</strong>/<strong>07</strong> 2005/06<br />

Equity before minority interest 4,9<strong>07</strong>,297.5 1,661,971.7<br />

Goodwill -180,722.4<br />

Deferred tax assets -61,089.0 -23,042.5<br />

Deferred tax liabilities 473,099.1 5,138,585.2 186,946.7 1,825,876.0<br />

Property under construction (carrying value) 242,772.6 85,632.7<br />

Property under construction (fair value) 569,1<strong>07</strong>.9 326,335.3 95,387.3 9,754.6<br />

Inventories (carrying value) 81,694.3<br />

Inventories (fair value)<br />

Residual value of forward purchase contracts<br />

151,751.6 70,057.3<br />

and investments carried at cost 41,144.9<br />

Property held for sale (carrying value) 0.0 42,847.6<br />

Property held for sale (fair value) 0.0 0.0 54,125.0 11,277.4<br />

Shares in associated companies (carrying value) 372,468.8 21,574.4<br />

Shares in associated companies (fair value) 438,102.6 65,633.7 39,979.4 18,404.9<br />

Net Asset Value 5,641,756.5 1,865,312.9<br />

Number of shares (in 1,000) 555,882.8 222,353.1<br />

Net asset value per share (in EUR) 10.2 8.4<br />

Properties under construction and inventories were valued in accordance with the principles described under point<br />

3.4. The residual value resulting from the measurement of forward purchases and shares in other companies stated<br />

at cost represents the excess over the contractually agreed acquisition cost. This calculation was also based on a<br />

property valuation prepared by the experts named under point 3.4.<br />

The fair value of shares in associated companies was derived from the valuation of the Palladium property (Prague),<br />

which is owned by the EPG Group, and the valuation of the Lakeside project (Bratislava), which is owned by TriGránit<br />

Centrum a.s. The stake owned in TriGránit Holding Ltd. was not valued because the acquisition was concluded shortly<br />

before the balance sheet date.<br />

The NAV effect of forward purchase contracts is calculated as the difference between the gross development value<br />

and the acquisition value for <strong>IMMOEAST</strong> based on the fixed purchase yield. This difference is discounted back to the<br />

balance sheet date. The same applies to purchase options for the remaining shares in joint ventures.<br />

The NAV effect of inventories represents the difference between the carrying value and the residual value determined<br />

by the expert opinion.<br />

4.1.4b Triple net asset value (NNNAV)<br />

All amounts in TEUR 30 April 20<strong>07</strong><br />

Net asset value (NAV) 5,641,756.5 5,641,756.5<br />

Deferred taxes (present value) -8,554.0 -8,554.0<br />

Triple net asset value (NNNAV) 5,633,202.5<br />

Number of shares (in 1,000) 555,882.8<br />

Triple net asset value per share (in EUR) 10.1<br />

Notes<br />

<strong>Report</strong> by the Executive Board 189<br />

Highlights <strong>2006</strong>/<strong>07</strong><br />

Business Model and Strategy<br />

Portfolio Structure<br />

Corporate Governance and Outlook<br />

Property Portfolio<br />

Development of Business<br />

Consolidated Financial Statements<br />

Service and Glossary